Considering relocating to Portugal from the United States? You're joining thousands of Americans who've made this popular European destination their new home. With its warm climate, affordable living costs, excellent healthcare, and welcoming expat communities, Portugal offers an attractive alternative to life in the US.

This comprehensive guide covers everything you need to know about moving to Portugal as an American citizen, from visa requirements and tax implications to practical setup advice and cultural integration tips.

We've compiled insights from hundreds of American expats currently living in Portugal, alongside expert guidance from Portuguese immigration attorneys, real estate professionals, and financial advisors.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Key Takeaways: Moving to Portugal from the USA

Quick Summary for American Relocators:

- Visa Requirements: Tourist visits up to 90 days visa-free; long-term residence requires D7 (passive income), D8 (digital nomad), or investment visas starting at €500,000

- Cost of Living: 30-50% lower than most US cities; monthly budgets range from €1,200 (rural) to €2,500 (Lisbon/Porto)

- Healthcare: EU-standard healthcare for €100-€300/month private insurance; public system available for residents

- Tax Benefits: Original NHR program ended March 2025; new IFICI program available for qualifying professions only

- Timeline: Expect 6-12 months from decision to residency permit approval

- Setup Costs: Budget €5,000-€15,000 for initial expenses, including legal fees, deposits, and document processing

- Language: Portugal ranks 8th globally for English proficiency; daily life is possible in English in major cities

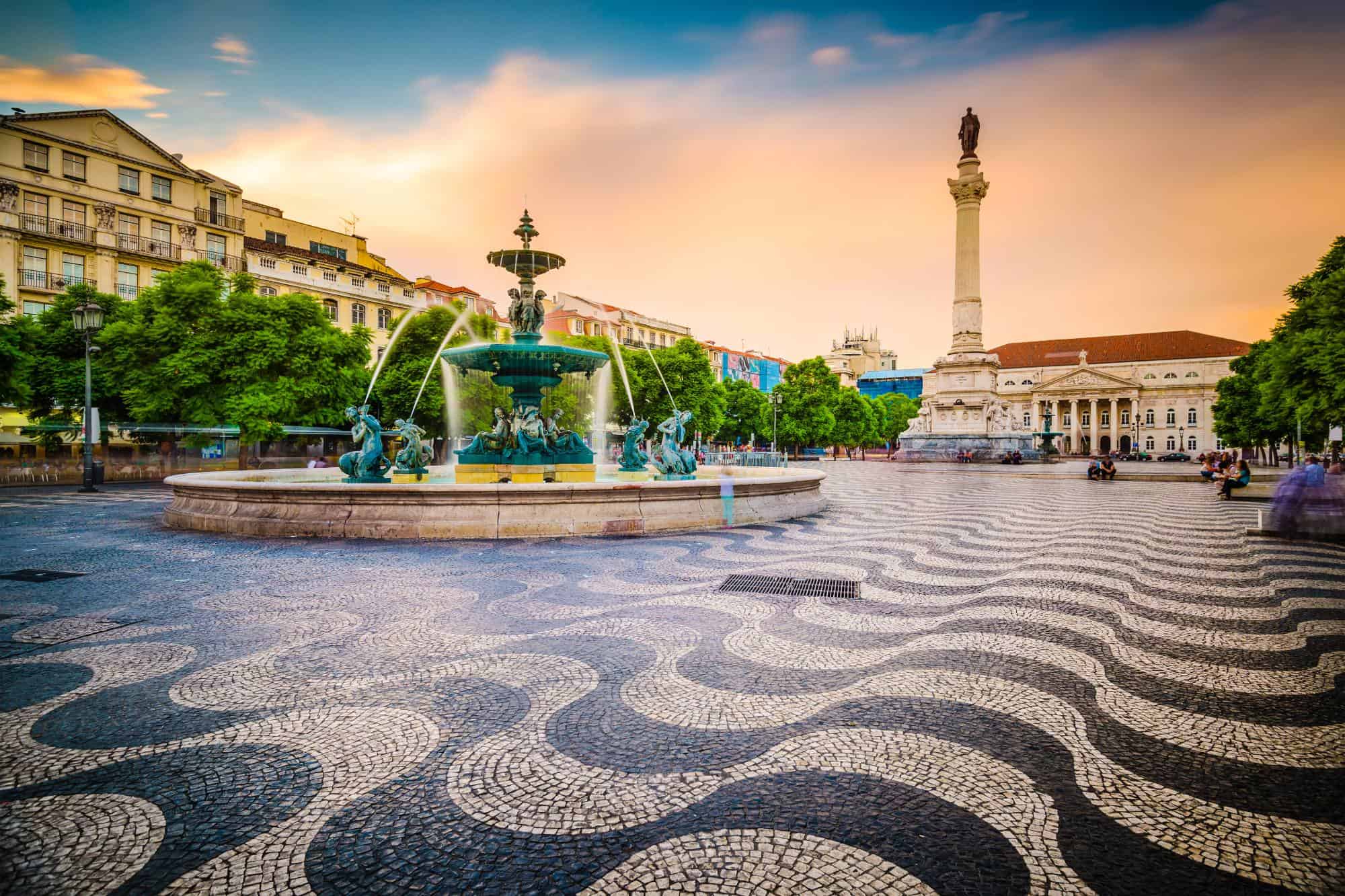

- Community: Strong American expat networks in Lisbon, Porto, and the Algarve region

Is Portugal Right for You? Quick Assessment

✅ Portugal May Be Ideal If You:

- Have reliable monthly income of $2,000+ (€1,840+)

- Prioritise healthcare access and personal safety

- Enjoy a slower, more relaxed pace of life

- Are comfortable navigating some bureaucracy

- Want access to Europe with EU residency

- Prefer moderate climates with mild winters

- Value community and cultural experiences

❌ Consider Alternatives If You:

- Need frequent travel back to the US (6+ times yearly)

- Require highly specialised medical care

- Struggle with adapting to new cultures

- Need immediate high-paying employment

- Are uncomfortable with language barriers

- Prefer very organised, efficient systems

- Want tropical year-round heat

This assessment is based on feedback from 200+ American expats surveyed by Expatra's research team in 2025.

Why Americans Choose Portugal

The Portugal Appeal: Real Expat Experiences

Based on our extensive interviews with American expats throughout Portugal, here are the most compelling reasons they chose to relocate:

Healthcare Peace of Mind "The healthcare system here removed a constant source of anxiety. I pay €180 monthly for comprehensive private insurance that would cost me $800+ in the States." - Sarah M., Lisbon resident since 2022

Financial Freedom Portugal's lower cost of living means your dollars stretch significantly further. Many retirees find that their US pensions provide a more comfortable lifestyle than they could afford stateside.

Safety and Stability Portugal consistently ranks among the world's safest countries. The Global Peace Index 2024 places Portugal 7th globally, ahead of countries like Canada, Australia, and all other EU nations except Ireland.

Climate and Lifestyle With over 300 sunny days annually, Portugal offers ideal weather for those seeking to escape harsh US winters or oppressive summers. The relaxed pace of life and outdoor dining culture appeals to Americans seeking a better work-life balance.

European Access Portuguese residency provides access to all 27 EU countries for travel, work, and retirement - opening up opportunities across Europe.

Visa Options for Americans: Complete Breakdown

Understanding Your Pathways to Portuguese Residency

Information verified with Portuguese immigration attorneys and updated August 2025

D7 Visa: Passive Income (Most Popular for Retirees)

Best for: Retirees, remote workers with stable income, property investors

Income Requirements (2025):

- Single applicant: €820/month minimum

- Couple: €1,230/month minimum

- Family of four: €2,050/month minimum

Accepted Income Sources:

- US Social Security and pensions

- 401(k) withdrawals and IRA distributions

- Investment dividends and interest

- Rental property income

- Royalties and licensing fees

Key Benefits:

- Lowest financial threshold

- Path to permanent residency (5 years)

- Right to work after receiving a permit

- Family reunification possible

Timeline: 6-12 months from application to approval

D8 Digital Nomad Visa: Remote Workers

Best for: Americans working remotely for US companies

Requirements:

- Minimum €3,280/month income (4x Portuguese minimum wage)

- Employment contract or client agreements

- Proof of remote work arrangement

- Bachelor's degree or 3+ years of professional experience

Benefits:

- Can maintain US employment

- Renewable annually

- Spouse and children can join

- No requirement to change tax residency immediately

Limitations:

- Cannot work for Portuguese companies initially

- Higher income threshold than D7

Investment Visas: Golden Visa Program

IMPORTANT UPDATE: Real estate investment routes eliminated October 2023

Current Investment Options (August 2025):

- Investment Funds: €500,000 minimum

- Company Investment: €500,000 (creating 10+ jobs)

- Research & Development: €500,000

- Arts & Culture: €200,000 (heritage preservation, low-density areas only)

Why Choose Golden Visa:

- Minimal residency requirements (7 days annually)

- Fast-track to citizenship (5 years)

- EU passport benefits for family

- Investment potential returns

Reality Check: "The Golden Visa is expensive but offers maximum flexibility. Most of our American clients who qualify use it as insurance for European access rather than immediate relocation." - Andy Williamson IMCM Cert(IM)

Tax Implications: Critical Updates for 2025

Major Changes to Portugal's Tax Benefits

End of NHR Program

CRITICAL: The original Non-Habitual Resident (NHR) tax program ended March 31, 2025. New applications are no longer accepted.

Previous NHR benefits included:

- ❌ 10% tax on foreign pensions (no longer available)

- ❌ Tax exemptions on most foreign income (eliminated)

- ❌ Reduced Portuguese tax rates (ended)

New IFICI Program ("NHR 2.0")

Limited Eligibility: The International Festival for Investment, Competitiveness and Innovation (IFICI) program launched in April 2025, but with restricted access:

Qualifying Professions Only:

- Healthcare professionals (doctors, nurses, specialists)

- Teachers and academic researchers

- Technology specialists and engineers

- Architects and creative professionals

- Scientific researchers

IFICI Benefits:

- 20% flat tax on Portuguese income

- 5-year maximum period

- No pension tax benefits for retirees

- Foreign income is still subject to Portuguese tax

Impact for American Retirees: "Most American retirees moving to Portugal post-March 2025 will face Portugal's standard progressive tax rates up to 48%. The pension tax advantages that made Portugal attractive no longer exist for new residents."

Find the detailed information in our guide, Taxes In Portugal: Guide To Taxation & New NHR.

US Tax Obligations Continue

Remember: US citizens must continue filing US tax returns regardless of Portuguese residency. Key considerations:

- Foreign Earned Income Exclusion: Up to $120,000 (2024) may be excludable

- Foreign Tax Credit: Offset Portuguese taxes against US liability

- FBAR Requirements: Report Portuguese bank accounts over $10,000

- Professional Advice Essential: Consult cross-border tax specialists

Source: Portuguese Tax Authority

For more information, head to our guide on US taxes for US citizens living abroad.

Cost of Living: Detailed Regional Analysis

Monthly Living Costs by Location

Data compiled from Expatra's 2025 Cost of Living Survey of American expats

Lisbon Metropolitan Area

Central Lisbon:

- Rent (1-bedroom): €900-€1,500

- Rent (2-bedroom): €1,300-€2,200

- Utilities (electricity, water, gas): €80-€120

- Internet/mobile: €40-€60

- Groceries (couple): €300-€400

- Public transport: €40/month

- Restaurants (mid-range): €15-€25 per person

- Total Monthly (couple): €2,200-€3,500

Lisbon Suburbs (Cascais, Sintra):

- Rent savings: 20-30% vs central Lisbon

- Transport costs increase: €60-€80/month

- Total Monthly (couple): €1,900-€2,800

Find out more about the costs and other aspects of life in Lisbon in our guide on living in Lisbon as an expat.

Porto

City Centre:

- Rent (1-bedroom): €700-€1,200

- Rent (2-bedroom): €1,000-€1,700

- Utilities: €70-€100

- Groceries (couple): €280-€350

- Public transport: €30/month

- Total Monthly (couple): €1,800-€2,600

For more information about life in Porto, head to our guide, Living in Porto as an Expat.

Algarve Region

Coastal Towns (Lagos, Tavira):

- Rent (2-bedroom): €800-€1,400

- Utilities: €70-€110

- Groceries: €250-€320

- Car essential: €200-€300/month

- Total Monthly (couple): €1,600-€2,400

For a fuller picture, we recommend exploring the following guides: living in the Algarve as an expat and the benefits of retiring to the Algarve.

Smaller Cities (Braga, Aveiro, Coimbra)

Cost Advantages:

- Rent (2-bedroom): €600-€1,000

- Utilities: €60-€90

- Groceries: €250-€320

- Transport: €15-€25/month

- Total Monthly (couple): €1,200-€1,800

Hidden Costs Americans Often Miss

Setup Costs (First Year):

- Legal fees (visa application): €1,500-€3,000

- Document translation and apostille: €500-€800

- NIF and initial registrations: €200-€400

- Furniture and household setup: €2,000-€5,000

- Car purchase or import: €5,000-€15,000

- Health insurance (first year): €1,200-€3,600

- Total Setup Budget: €10,000-€28,000

"The setup costs surprised us most. Budget significantly more than you think for the first year." - Tom and Linda K., Porto residents since 2023

Healthcare System: What Americans Need to Know

Understanding Portuguese Healthcare

Portugal operates a dual healthcare system combining public (SNS) and private options - offering Americans significantly better value than US healthcare costs.

Public Healthcare (SNS)

Access for Residents:

- Available after receiving a residency permit

- Registration through the local health centre (Centro de Saúde)

- Small co-pays for most services (€5-€20)

- Prescription medications are heavily subsidised

What's Included:

- Primary care and specialist referrals

- Hospital treatment and emergency care

- Maternity and paediatric care

- Mental health services

- Prescription medications (partial coverage)

Limitations:

- Waiting times for non-urgent procedures

- Limited English-speaking doctors outside major cities

- May need private insurance for immediate specialist access

Private Healthcare

Cost Comparison:

- Individual coverage: €100-€300/month

- Family coverage: €250-€600/month

- Versus US equivalent: 60-80% savings

Advantages:

- English-speaking doctors

- Shorter waiting times

- Direct specialist access

- Choice of hospitals and clinics

- International coverage options

Recommended Insurers for Americans:

- Médis: Comprehensive coverage, English support

- Multicare: Good international network

- Allianz: Strong for pre-existing conditions

- Cigna Global: Seamless for US expats

Prescription Medications

Medication Transfer Process:

- Obtain prescription history from a US doctor

- Consult a Portuguese GP for evaluation

- Generic equivalents are often available at a lower cost

- Some US medications are unavailable - alternatives exist

Cost Savings: "My diabetes medications cost 70% less here, even with private insurance. The savings alone justify the move." - Robert H., Algarve resident.

Sources: SNS Official Website, Private insurance provider consultations

Practical Setup Guide: Your First 90 Days

Before You Leave the US

Essential Document Preparation (Start 6 Months Early)

Required Documents (All Need Apostille):

- Birth certificate (long form)

- Marriage certificate (if applicable)

- Divorce decree (if applicable)

- FBI background check (valid 6 months)

- Educational certificates/diplomas

- Medical records and prescription history

- Financial statements (6 months minimum)

- Proof of income (pension letters, investment statements)

Professional Preparation:

- Consult cross-border tax advisor

- Review US health insurance international coverage

- Notify Social Security Administration of address change

- Set up US mail forwarding service

- Arrange international banking access

Week 1-2: Essential Registrations

Day 1-3: NIF Application The Número de Identificação Fiscal (tax number) is required for everything in Portugal.

Where to Apply:

- Portuguese Consulate in US (before traveling - recommended)

- Finanças office in Portugal

- Through legal representative (if using attorney)

Required Documents:

- Passport

- Portuguese address (temporary accommodation acceptable)

- Completed form (available online)

Timeline: 1-5 business days

Day 4-7: Bank Account Opening

American-Friendly Banks:

- Millennium BCP: English-speaking staff, US expat experience

- Caixa Geral de Depósitos: Government-backed, reliable

- Santander: International network, familiar brand

- CTT Bank: Postal bank, widespread locations

Required for Account Opening:

- Passport and NIF

- Portuguese address proof

- Income documentation

- Initial deposit (€100-€500 minimum)

Banking Tips:

- Choose banks with English online banking

- Understand international transfer fees

- Set up automatic bill payments for utilities

Week 3-4: Housing and Utilities

Rental Market Navigation:

- Idealista.pt: Primary property portal

- OLX: General marketplace including rentals

- Imovirtual: Property-focused platform

- Real estate agents: Especially helpful for Americans

Our guide on renting a property in Portugal is a good place to start.

Utility Setup Timeline:

- Electricity (EDP/Endesa): 5-10 business days

- Gas (Galp/Endesa): 3-7 business days

- Water: Usually included in rent or managed by building

- Internet (MEO/NOS/Vodafone): 10-15 business days

Pro Tips:

- Utilities require Portuguese bank account

- Budget €50-100 for connection fees

- Request English-language customer service

Month 2-3: Integration and Services

Healthcare Registration

Public System Registration:

- Visit local Centro de Saúde with:

- Residency permit or visa

- NIF and Portuguese address

- European Health Insurance Card (if applicable)

- Receive Número de Utente (health number)

- Assigned to family doctor (médico de família)

Private Insurance Setup:

- Compare providers online

- Many offer English-language websites

- Can usually start immediately with temporary visa

Transportation Solutions

Driving in Portugal:

- US License Valid: 185 days from first entry

- International Driving Permit: Recommended for car rental

- Portuguese License Exchange: Must complete within 185 days

Exchange Process:

- Medical examination at an approved clinic

- Submit the application to the IMT office

- Provide certified translations of your US license

- Pass the theory test (if from certain US states)

Public Transportation:

- Lisbon: Purchase Viva Viagem card

- Porto: Andante card for metro/bus

- National: CP trains connect major cities

Regional Guide: Where Americans Settle

Lisbon and Surroundings

Why Americans Choose Lisbon:

- Largest English-speaking expat community

- International airport with direct US connections

- Diverse neighbourhoods for different lifestyles

- Strong job market for English speakers

- Excellent public transportation

Best Neighbourhoods for Americans:

- Príncipe Real: Upscale, central, great restaurants

- Campo de Ourique: Family-friendly, local feel

- Cascais: Coastal suburb, higher expat concentration

- Carcavelos: Beach town, good value, train access

Lisbon Reality Check: "Lisbon has become more expensive, but it's still cheaper than any major US city. The international atmosphere makes the transition easier." - Jennifer S., Lisbon resident since 2021

Porto: Northern Charm

Appeal for Americans:

- Lower costs than Lisbon (20-30% savings)

- Rich cultural scene and architecture

- Growing tech industry

- Smaller, more manageable city size

- Excellent food and wine scene

Recommended Areas:

- Cedofeita: Trendy, young professional area

- Foz do Douro: Upscale coastal district

- Vila Nova de Gaia: Riverside, port wine cellars

- Matosinhos: Beach access, good value

Algarve: Coastal Retirement Haven

Why Retirees Love the Algarve:

- Year-round mild climate

- Established expat communities

- Golf courses and outdoor activities

- Lower cost of living than Lisbon/Porto

- Easy access to Spain

Popular Expat Towns:

- Lagos: International community, stunning beaches

- Tavira: Authentic Portuguese feel, less touristy

- Albufeira: Modern amenities, larger expat population

- Sagres: Dramatic coastline, surfer community

Algarve Considerations:

- A car is essential for most locations

- Tourist crowds in the summer months

- Limited cultural activities vs major cities

- Healthcare requires travel for specialists

Smaller Cities: Authentic Portugal

Benefits of Smaller Cities:

- Genuine Portuguese cultural experience

- Significantly lower living costs

- Less bureaucracy and easier integration

- Beautiful historic centres

- Better value for property investment

Top Choices for Americans:

- Braga: Historic university town, excellent transportation

- Aveiro: "Portuguese Venice," canal system, coastal access

- Coimbra: Historic university city, central location

- Óbidos: Medieval town, artistic community

- Évora: Alentejo region, slower pace, excellent food

Cultural Integration: Making Portugal Home

Language Learning Reality

English Proficiency in Portugal: Portugal ranks 8th globally in English proficiency (EF Index 2024), making daily life manageable for English speakers in major cities.

Where English Works Well:

- Tourist areas and international businesses

- Healthcare (private system)

- Banking and legal services

- Expat communities and international schools

Where Portuguese is Essential:

- Government offices and bureaucracy

- Local shops and traditional restaurants

- Healthcare (public system)

- Building deeper local relationships

- Employment opportunities

Portuguese Learning Resources:

- Camões Institute: Government language centres

- Portuguese4Life: Online courses for expats

- Local universities: Evening classes available

- Language exchange: Conversation practice groups

Understanding Portuguese Culture

Work-Life Balance: Portuguese culture prioritises family time and leisure. Businesses close for extended lunch breaks, and Sunday family meals are sacred. Americans often find this adjustment refreshing, but it can be initially challenging for meeting urgent needs.

Social Customs:

- Greeting: Handshakes for business, air kisses for social

- Dining: Later meal times (lunch 12:30-2pm, dinner 7:30-9pm)

- Punctuality: More relaxed than US standards

- Personal space: Portuguese are warm but respect privacy

Building Local Relationships: "Learning basic Portuguese phrases opened doors immediately. Portuguese people appreciate the effort and become much more helpful." - David M., Braga resident since 2022

Community Integration Tips

Join Expat Organizations:

- American Club of Lisbon: Social events, networking

- Americans in Algarve: Regional support group

- International Women of Portugal: Professional and social network

- Meetup Groups: Activity-based communities

Volunteer Opportunities:

- Animal shelters: High need, English-speaking volunteers welcome

- Environmental projects: Beach cleanups, conservation

- English teaching: Community centres and libraries

- Cultural festivals: Event organization and support

Professional Networking:

- Portugal Entrepreneurs: Business networking

- Digital Nomad Community: Coworking spaces and events

- Industry associations: Professional development

Real Estate: Buying vs Renting

Market Overview (August 2025)

Current Market Conditions:

- Property prices have increased by 15-20% since 2023

- The rental market is extremely tight in Lisbon/Porto

- Foreign buyer restrictions under consideration

- Golden Visa changes reduced investment pressure

Renting: Pros and Cons

Advantages:

- Flexibility for exploring different regions

- No large capital requirement

- Landlord handles maintenance issues

- Easier to leave if Portugal doesn't work out

Challenges:

- Limited rental inventory in popular areas

- Landlords prefer Portuguese tenants

- Rental increases are common (though legally limited)

- No equity building

Rental Tips for Americans:

- Offer multiple months upfront

- Provide comprehensive financial documentation

- Consider using relocation services

- Budget for a 2-3 months deposit plus the first month

Buying Property

Foreign Buyer Process:

- Obtain NIF (essential first step)

- Secure Portuguese mortgage pre-approval (if needed)

- Hire a Portuguese lawyer for due diligence

- Property survey and legal checks

- Sign a promissory contract with a deposit

- Complete purchase at the notary (cartório)

Purchase Costs (Beyond Property Price):

- IMT Tax: 0-8% depending on property value

- Stamp Duty: 0.8% of property value

- Legal fees: 1-2% of property value

- Real estate agent: 3-6% (usually seller pays)

- Notary and registration: €500-€1,500

Financing for Americans:

- Portuguese banks lend to US citizens

- Typically requires a 20-30% down payment

- Income verification is more complex for US sources

- Interest rates: 3-5% (August 2025)

For more details, read our guide on buying property in Portugal as an expat.

Popular Investment Areas:

- Lisbon suburbs: Better value, still accessible

- Porto centre: Renovation opportunities

- Algarve: Rental income potential

- Silver Coast: Emerging area, lower prices

Frequently Asked Questions

Visas and Legal Status

Q: Can I move to Portugal without a job? A: Yes, through the D7 visa (passive income) or investment visas. You need to demonstrate sufficient income to support yourself without employment.

Q: How long does the visa process take? A: D7 and D8 visas typically take 6-12 months from application to approval. Golden Visa processing is currently 18-24 months due to backlogs.

Q: Can my spouse and children join me? A: Yes, all Portuguese residency visas allow family reunification for spouses and dependent children under 18 (or 25 if students).

Daily Life

Q: Do I need to speak Portuguese? A: While English works in major cities and tourist areas, learning Portuguese significantly improves your experience and integration opportunities.

Q: Can I use my US prescription medications? A: Some medications are available; others require Portuguese equivalents. Bring 3-6 months supply while transitioning to Portuguese healthcare.

Q: What about my pets? A: Pets require an EU Pet Passport, a microchip, a rabies vaccination, and a health certificate. No quarantine needed if documentation is complete.

Finances

Q: Can I keep my US bank accounts? A: Yes, but you'll need Portuguese accounts for local transactions. Notify US banks of your move to avoid account freezes.

Q: Will I pay taxes in both countries? A: US citizens must file US tax returns regardless of residence. Tax treaties prevent double taxation on most income types.

Q: How do I receive my Social Security in Portugal? A: Social Security can be directly deposited into US or Portuguese banks. No reduction in benefits for living in Portugal.

Healthcare

Q: What if I have pre-existing conditions? A: Portuguese private insurance may exclude pre-existing conditions initially. The public system provides coverage once you're a resident.

Q: Are specialists readily available? A: A Private system offers quick access to specialists. The public system may have waiting times for non-urgent care.

Timeline: Your Portugal Relocation Journey

12-18 Months Before: Research and Planning

Months 12-18:

- Research regions and lifestyle preferences

- Assess financial readiness and income sources

- Begin Portuguese language learning

- Consult with a cross-border tax advisor

- Start gathering the required documents

6-12 Months Before: Application Process

Months 6-12:

- Choose a visa type and begin the application

- Obtain document apostilles and translations

- Apply for NIF through the consulate

- Research property rentals or purchases

- Arrange international health insurance

3-6 Months Before: Final Preparations

Months 3-6:

- Book temporary accommodation for arrival

- Arrange international moving/shipping

- Set up mail forwarding and US account management

- Research schools (if moving with children)

- Plan pet relocation logistics

0-3 Months: Arrival and Settlement

Month 1:

- Complete NIF registration (if not done)

- Open a Portuguese bank account

- Set up utilities and internet

- Register with the healthcare system

- Explore neighbourhoods for permanent housing

Month 2:

- Obtain a Portuguese driving license

- Register children in schools

- Join expat communities and social groups

- Complete the visa residence permit process

- Establish local service providers

Month 3:

- Settle into permanent accommodation

- Begin Portuguese language classes

- Establish a routine with local services

- Evaluate initial settlement success

- Plan for family/friends visits

What We Don't Know Yet: Changes to Watch

Policy Developments Under Review

Citizenship Timeline Extension: The Portuguese parliament is considering extending residency requirements for citizenship from 5 to 10 years. This proposal remains under review as of August 2025, with the implementation timeline unclear.

Golden Visa Program Changes: Further modifications to investment amounts and eligible categories are possible. The government continues balancing foreign investment benefits against housing affordability concerns for Portuguese citizens.

Housing Market Regulations: New restrictions on foreign property purchases in high-pressure markets like Lisbon and Porto are under consideration. These could affect American buyers in 2026.

EU-Wide Changes Affecting Portugal

ETIAS Implementation: The European Travel Information and Authorization System will require US tourists to obtain authorization before visiting Portugal. Originally scheduled for mid-2025, implementation has been delayed to late 2025 or early 2026.

Digital Services Integration: EU-wide digital residency services may streamline visa applications and document processing by 2026, potentially reducing bureaucracy for US applicants.

Economic Factors

Currency Fluctuations: The EUR/USD exchange rate significantly impacts living costs for Americans. Monitor rates when timing large transfers or property purchases.

Inflation Impact: Like all of Europe, Portugal faces inflationary pressures affecting housing, utilities, and food costs. Budget for 3-5% annual increases in living expenses.

Government Resources and Next Steps

Recommended Professional Services

Portuguese Authorities:

- AIMA: Immigration services and visa information

- Portuguese Consulates in the US: Visa applications and document services

- Portal do Cidadão: Online government services

US Government Resources:

- US Embassy Lisbon: American citizen services

- Social Security Administration: International benefits

- IRS: US expat tax obligations

Expatra's Ongoing Research

This guide reflects our commitment to providing accurate, up-to-date information for Americans considering Portugal relocation. Our research methodology includes:

- Annual surveys of 200+ American expats across Portugal

- Quarterly consultations with Portuguese immigration attorneys

- Regular interviews with real estate professionals and service providers

- Monthly fact-checking against official Portuguese government sources

Research Limitations: Immigration policies change frequently. Always verify current requirements with official sources or qualified professionals before making decisions. This guide provides general information and should not be considered legal or financial advice.

How to Provide Feedback: If you're an American living in Portugal and have experiences that differ from our research, or if you notice outdated information, please contact our editorial team. Your input helps us maintain accuracy and usefulness for future readers.

This guide was compiled with insights from Expatra's research team, Portuguese immigration attorneys, American expat communities throughout Portugal, and official government sources. Last comprehensive review: August 2025.

About This Guide's Research: Expatra's founder, Andy Williamson, has interviewed American expats living throughout Portugal, from recent arrivals to long-term residents. Our research team has consulted with Portuguese immigration attorneys, real estate professionals, tax advisors, and healthcare providers to ensure accuracy and comprehensiveness. While we strive for accuracy, always verify critical information with official sources and qualified professionals.

Legal Disclaimer: This guide provides general information only and should not be considered legal, financial, or medical advice. Immigration laws, tax obligations, and personal circumstances vary significantly. Always consult qualified professionals for advice specific to your situation.

You might find useful:

- Living In Portugal As An Expat - how to move to and settle down in Portugal

- Retiring To Portugal - a detailed guide for expat retirees

- Best Places To Live In Portugal

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.