Moving to Spain can be complex, filled with legalities, cultural differences, and other challenges. This guide will walk you through everything you need to know about setting up a life as an expat in Spain, ensuring your transition is as smooth as possible.

In this guide:

- The legalities of moving to Spain: Visas and residency options, registration on a Pardon, NIE, opening a bank account, and other paperwork.

- Costs and expenses associated with moving to and living in Spain.

- Healthcare and health insurance: Your options and costs.

- Travel, public transport, infrastructure.

- Housing and accommodation: Available real estate, renting, and buying.

- Education and schools.

- Where to live in Spain: Overview of the most popular expat destination.

Spain highlights

High quality of life: Spain consistently ranks high in the quality of life index, boasting a pleasant climate, rich culture, and world-class healthcare system. It ranks 14th globally in the 2021 Human Development Index.

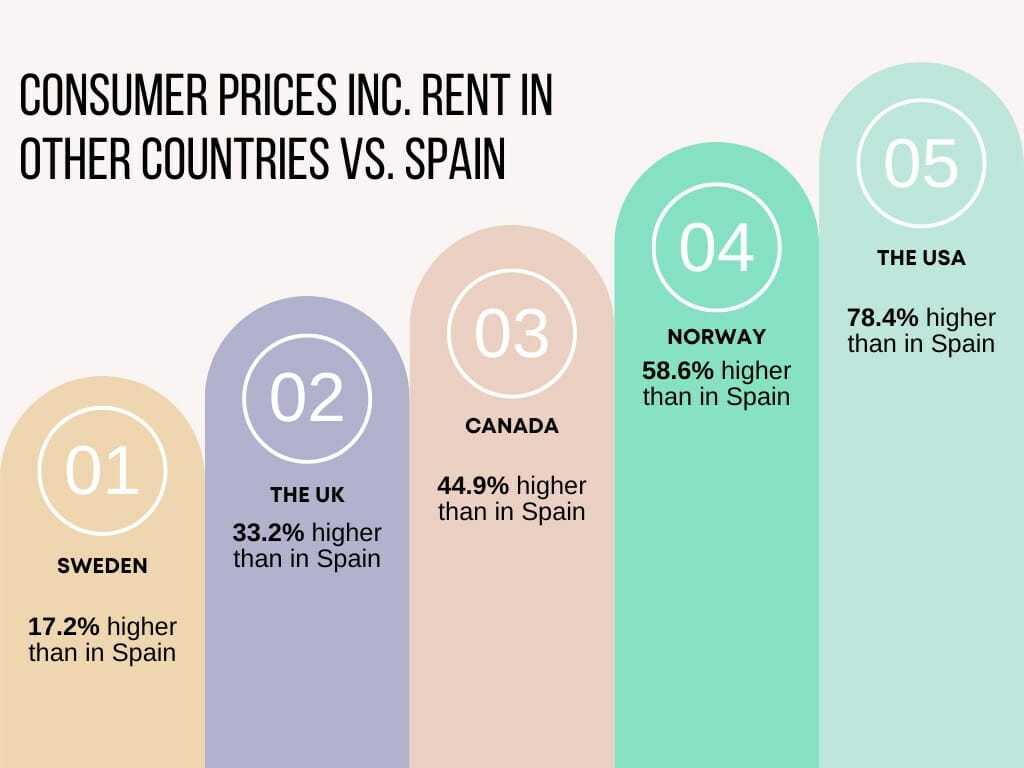

Affordable cost of living: The cost of living in Spain is relatively inexpensive compared to many Western European and North American countries.

Quality healthcare: Spain has a highly regarded healthcare system offering universal healthcare to all its legal residents.

Cultural richness: Spain is renowned for its rich history, diverse culture, vibrant festivals, and world-class cuisine. It has 49 UNESCO World Heritage Sites, showcasing its cultural and historical importance.

Great for retirement: Spain is a popular retirement destination ranking high among the best countries for retirement, especially for European expats. Its sunny climate, affordable healthcare, and relaxed lifestyle are attractive factors.

Ease of residency: There are various residency options for non-EU citizens, including retirees, investors, and digital nomads.

Well-developed infrastructure: Reliable internet connectivity, extensive road networks, and efficient train system.

Things to keep in mind

Bureaucracy: Red tape can be extensive when dealing with administrative tasks.

Language barrier: If you don’t speak Spanish, you may struggle to integrate or deal with official matters.

Stagnant job market: Unemployment rates can be high in Spain, particularly for young people.

Relatively high taxes: Generally, there is no special tax regime for expats in Spain, except in some cases falling under Beckham Law (details in the Taxes section). Spain’s taxation system might appear quite heavy depending on where you’re moving from.

Spain as a retirement destination

According to the Expatra Global Retirement Survey, Spain consistently appears in the top ten best countries to retire worldwide.

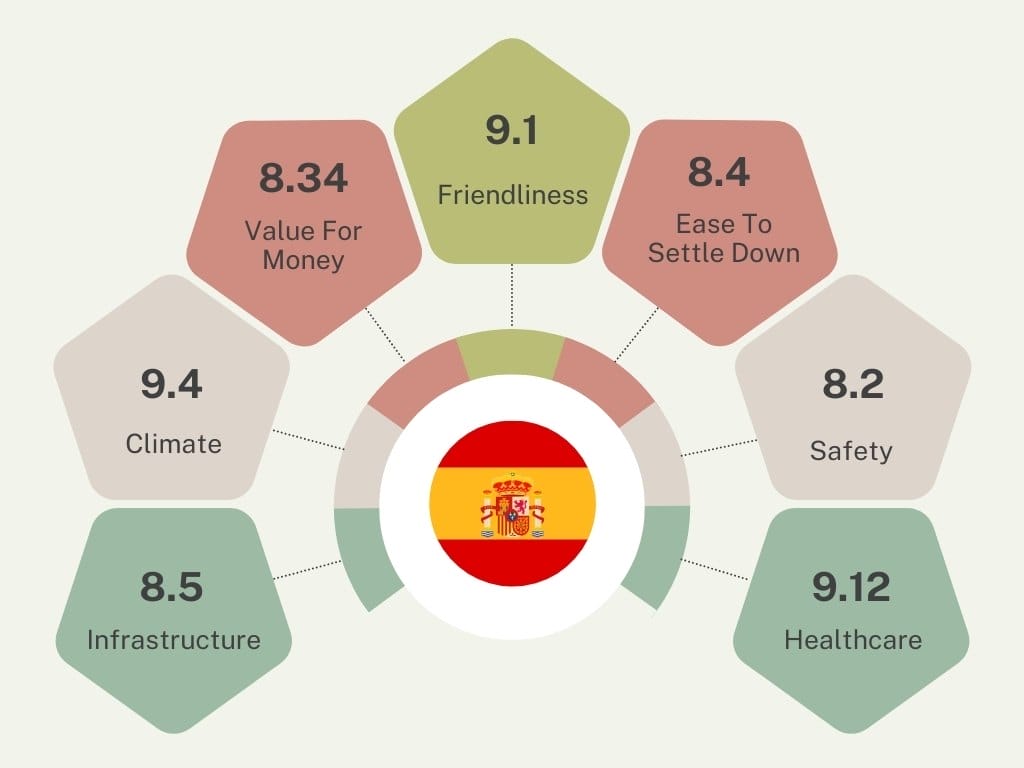

The survey asks international retirees to rate their retirement destination’s infrastructure, climate, ease of settling down, value for money, friendliness, and other aspects of life in Spain. Here’s how Spain scores:

Visas and residency options for non-EU citizens

If you are non-EU national planning to move to Spain independently (not being relocated by your employer), you have several options when it comes to visas and residency:

Non-Lucrative Visa – for retirees and people with passive incomes:

- Ideal for individuals who wish to reside in Spain without engaging in any work or professional activities.

- Requires proof of sufficient financial means to support oneself and any dependents.

Golden Visa – for investors:

- Designed for investors and entrepreneurs willing to make a significant investment in Spain.

- Requires a minimum investment in real estate, business projects, public debt, or bank deposits.

- Grants residency and, eventually, the opportunity to apply for permanent residency or citizenship.

Digital Nomad Visa – for remote workers and digital nomads:

- Specifically for remote workers or freelancers who can work online and are not tied to a physical location.

- Allows individuals to live and work in Spain while employed by a foreign company or self-employed.

Entrepreneur Visa – for people wanting to start a business in Spain:

- Targets entrepreneurs intending to start a business in Spain or undertake a self-employed activity.

- Requires a viable business plan, sufficient financial resources, and the creation of jobs or economic impact in Spain.

The most popular options for expats are the non-lucrative visa (NLV), Golden Visa (GV), and digital nomad visa (DNV).

Here’s how they compare:

| NLV | GV | DNV | |

| Sponsorship of family members | Yes | Yes | Yes |

| Financial requirements | An annual income of 400% of IPREM* plus 100% of IPREM* for each dependent. | Only proof of investments required. | A monthly income of 200% of the minimum wage plus 75% for the first dependent and 25% for each additional dependent.** |

| Validity | A one-year residence permit renewable for 2 years indefinitely. | A one-year residence permit (two if applied within Spain) renewable for 5 years indefinitely. | A 3-year residence permit renewable for further 2 years. |

| Permission to work | No | Yes | Remote work allowed |

| Permanent residency | After 5 years | After 5 years | After 5 years |

| Citizenship | After 10 years | After 10 years | Afer 10 years |

- *IPREM sets the minimum amount of an individual’s earnings. The IPREM for 2023 is €600 per month. You must show €2,400 as a regular guaranteed monthly income or a yearly income of €28,800.

- ** Spanish minimum wage is currently set at €1,050 a month.

EU Blue Card – for highly skilled professionals

- EU Blue Cards allow Spanish companies to hire highly qualified individuals from non-EU countries.

- Requires proof of a higher professional qualification or possessing at least five years of professional experience at a similar level.

- Requires a job offer from a Spanish employer for a paid position (self-employed individuals are ineligible).

- Applications for the EU Blue Card are submitted by the Spanish employer.

You can find the details and requirements for every visa type in our guide to Spain Visas And Residency Options.

The cost of living and moving expenses

When comparing the cost of living in Spain to Northern Europe and Northern America, on average:

- Housing: Approximately 30-40% lower in Spain.

- Groceries: About 7-25% lower in Spain.

- Dining Out: Roughly 10-20% cheaper in Spain.

- Transportation: Generally 25-40% less expensive in Spain.

These numbers may vary based on the specific region within Spain. However, they provide a good indication of the cost differences in these essential living expenses.

Let’s look at various costs more closely.

Legal costs

Legal help to sort out your visas and residency, including putting the right documents together plus necessary translations and legalization services (apostilles) and filling out the forms, can add up to the costs of your move.

It can cost between $2500 and $3500 for two people for Non-Lucrative Visa, for example.

Typical legal fees for Golden Visa applications are around $9,000 for an individual applicant, $11,500 for a family of four during the initial application and $3,000 for each subsequent renewal.

Moving household goods to Spain

Shipping household belongings is always a big bill. Here are a few examples of the shipping costs to Spain:

- From the USA: on average, from $2,500 to $10,500.

- From Canada: a 20-foot container – from $1,500, a 40-foot container – from £1,800.

- From the UK: a 20-foot container- from £800, a 40-foot container- average £1,500,

- From Sweden: a 20-foot container- from $2,400, a 40-foot container- from $2,600.

For more information, visit our guide, Planning And Organizing Removals To Spain.

Monthly expenses

Here’s a breakdown of some of the most common expenses you can expect:

| Expense | From |

|---|---|

| Groceries (for one person per month) | $150-$200 |

| Utilities (Electricity, Water, Garbage per month for an apartment) | $100-$150 |

| Internet (60 Mbps or more, unlimited data, cable/ADSL per month) | $55-$60 |

| Mobile (per minute on the prepaid mobile tariff without any discounts or plans) | $0.18-$0.20 |

| Public transport (Monthly ticket) | $40-$45 |

| Dining out for two (Three-course meal, moderate restaurant) | $35-$50 |

| Train ticket (single way) | $10-$20 |

| Car rent (Economy car, per day) | $20-$30 |

| McDonald’s meal (or equivalent combo meal) | $9-$11 |

Housing expenses

Rental prices vary significantly depending on where you want to live. Below is the average rent costs for a 1-bedroom apartment in a good area in the 10 most popular Spanish cities for expats.

| City | From |

|---|---|

| Madrid | $1,200 – $1,400 |

| Barcelona | $1,000 – $1,200 |

| Valencia | $750 – $900 |

| Seville | $700 – $900 |

| Malaga | $1,000 – $1,100 |

| Granada | $500 – $800 |

| Bilbao | $1,000 – $1,200 |

| Alicante | $700 – $800 |

| Cordoba | $600 – $700 |

| Palma de Mallorca | $1,100 – $1,300 |

To learn more about the Spanish rental process and how to protect yourself as a tenant, read our Renting In Spain guide.

Healthcare

Spain offers a sound healthcare system that ranks among the best in the world. There are good hospitals and clinics all over the country. All major expat destinations have both private and public health facilities.

If you are a non-EU national, before you become a resident (for example, while you are applying for residency), private health insurance is required by law.

When your residency is granted, you have several options to consider for your healthcare needs:

Public healthcare

Spain’s National Health System, Sistema Nacional de Salud, provides free basic healthcare services to all residents, including expats. This system is funded by social security contributions, meaning employed or self-employed individuals in Spain are eligible.

Eligibility: If you are a legal resident in Spain and make social security contributions, you are eligible for state-run healthcare. This also applies to retirees from EU/EEA countries and Switzerland.

Non-contributors who have lived in Spain for over 12 months can also opt-in by paying a monthly fee (Convenio Especial) which is generally lower than private insurance fees.

Please find more details in our guide, Health Insurance And Healthcare For Expats In Spain.

Local private health insurance

You may prefer to use private health insurance, which often provides quicker access to specialists and elective procedures and often includes coverage for dental care.

Numerous private insurance companies are available in Spain, so you should compare packages to find the one that best fits your needs.

International health insurance

International health insurance can provide coverage both in Spain, in your home country, and in other countries included in the policy.

This can be particularly useful if you often travel back and forth between Spain and your country of origin or want to ensure you can receive treatment in your home country if you need it.

International health insurance can be quite expensive. To make sure you get the best value for money, compare international health insurance options from various providers to find the best deal.

Internet and mobile connection

Mobile and internet services in Spain offer a competitive range of options with widespread coverage. Major telecommunication companies:

- Movistar

- Vodafone

- Orange

- Yoigo

For example, a basic mobile plan with around 5GB of data and unlimited calls and texts can cost approximately €30-€40 per month.

High-speed fiber-optic internet is prevalent in urban areas, with speeds ranging from 100 Mbps to 1 Gbps. For instance, Movistar offers a 600 Mbps fiber plan at around €70 per month.

Overall, Spain has good internet coverage, especially in cities and urban areas, with average internet speeds around 76 Mbps, ranking above the global average. Mobile coverage is generally excellent, extending to even remote regions.

Bank accounts in Spain

Opening a bank account in Spain as a resident is pretty straightforward. Below is a list of required documents:

- Passport or National Identity Card: Verify your identity with a valid and government-issued identification.

- Proof of employment, retirement, or student status: Expat residents will need to provide proof of employment or, for students, proof of enrollment at a Spanish institution to avoid financial stability inquiries.

- Spanish address proof: Your current Spanish address can be validated with a lease agreement or a utility bill.

- NIE Number: Número de Identificación de Extranjero, or Foreigner Identification Number, is a tax identification number in Spain.

- Financial statement: An up-to-date statement from your current bank may be required.

Non-resident bank accounts

There are cases when you need to open a bank account before you become a resident in Spain. Some high street banks, like Santander, offer non-resident bank accounts.

Just remember that non-resident accounts with a Spanish bank are mostly fee-paying.

Digital-only banks’ multicurrency accounts

Here are some digital-only banks that provide the convenience of international banking that you can use in Spain:

- Wise Borderless account: Acts like a bank account in multiple countries. It is favored by expats for its low-cost international money transfers.

- Revolut: Offers a variety of services, including a multi-currency account that can be beneficial for expats managing finances across different currencies.

To learn more, visit our Banking In Spain For Expats guide.

Taxes in Spain

When you become a tax resident in Spain, you must pay all the taxes applicable to residents. Spain is not a low-tax country, so the tax burden can seem significant.

Residents living in Spain are subject to the following taxes:

- Income Tax: Known as Impuesto Sobre la Renta de las Personas Físicas (IRPF), this tax is levied on individuals’ worldwide income, not just the income within Spain. The tax rates range from 19% to 47%.

- Wealth Tax: This is also known as Impuesto Sobre el Patrimonio. The tax applies to those whose worldwide assets are valued at more than €700,000. The rates range from 0.2% to 2.5%.

- VAT: Value Added Tax, or Impuesto Sobre el Valor Añadido (IVA), is levied on most goods and services in Spain. The standard VAT rate is 21%.

- Property Tax: Known as Impuesto sobre Bienes Inmuebles (IBI), this is a municipal tax imposed on the owner of the property. The annual tax rate ranges from is 0.4% to 1.1% of the property’s cadastral valuation.

- Capital Gains Tax: It applies to the profit from the sale of property or investments and ranges from 19% to 26%.

- Inheritance and Gift Tax: Formally known as Impuesto sobre Sucesiones y Donaciones (ISD), this is levied on inheritance received or gifts given; rates range from 7.65% to 34%.

Remember that tax rates and allowances can change annually and may be influenced by your personal circumstances. It is important to seek advice from tax professionals to better understand the local tax system and your obligations.

Non-resident taxpayer regime in Spain

If you are an employee assigned to Spain by your company or employed by a Spanish company, or moving to Spain with a Digital Nomad Visa and meet all the criteria to become tax-resident in Spain, in certain cases, you can have the option to choose the non-resident taxpayer rules for taxation.

Under this tax regime, employment income up to €600,000 is taxed at a rate of 24%, while income exceeding this amount is taxed at 45%.

For more information, visit our guide to Taxes In Spain For Residents And Non-Residents.

Real estate in Spain: options and costs

Whether you prefer an apartment situated in a lively city center, a beautiful beachside villa, or a traditional Spanish house away from the city’s hustle and bustle, Spain has it all.

The average property price in Spain is around €2,000 per square meter.

Apartments in Madrid or Barcelona (the country’s most expensive areas) cost around €5,000 per square meter. While in Lugo and Murcia (the cheapest areas), the price per square meter is just above €1,100.

Here’s a breakdown of the popular real estate options for expats, along with the average price per square meter:

| Type of Property | Average Cost per Square Meter |

|---|---|

| Apartments | €2,000 – €3,500 |

| Villas | €2,500 – €6,000 |

| Traditional houses | €1,500 – €2,500 |

Please note that these are estimates, and the actual price can vary considerably based on location, property condition, proximity to amenities, and other factors.

When buying property in Spain, it’s recommended to enlist the services of a reputable real estate agent and a lawyer to navigate the process smoothly.

Below is a list of required documents you will need:

- Passport: the original and a copy.

- NIE Number (Número de Identificación de Extranjero): a Spanish tax identification number for foreigners.

- Bank account: you’ll need a Spanish bank account to pay for the property and associated expenses.

- Proof of funds: you need to provide proof of the source of your funds. This could be a bank statement or a pay slip.

- Private Purchase Contract (Contrato de Arras): This is a contract signed by you and the seller detailing the terms and conditions of the sale.

Buying real estate to qualify for the Spanish Golden Visa

Buying a property valued over €500,000 can qualify you for Spanish residency under the residency by investment program.

Here are the key requirements:

- Investment in real estate: A minimum investment of €500,000 in Spanish real estate is required. Your investment can be spread over several properties, and the total value should sum up to the required amount.

- Clean criminal record: You should possess a clean criminal record, not just in Spain but also in the countries where you’ve lived during the past five years.

- Health insurance: A private health insurance policy from a Spanish insurance company is obligatory.

Find more details in our guide to Spain Visas And Residency. To learn how the Spanish Golden Visa compares to other EU programs, visit our guide to European Golden Visa Programs.

Help with paperwork

Moving abroad can come with a daunting amount of paperwork, but fortunately for expats in Spain, there’s assistance available: gestors, or administrative professionals.

Gestors are experts in Spanish bureaucracy and can help with everything from applying for residence permits to opening a bank account. Here’s what they can help you with:

Gestors are not lawyers or accountants and cannot give you [professional advice. What they can do is manage the whole process for you, making sure the paperwork is done correctly, all the stamps are collected in the right order, all the necessary appointments are booked, and the language barrier is dealt with.

Seeking the assistance of a Gestor can ultimately save expats time, stress, and confusion when navigating the quite often complex Spanish administrative landscape.

You can find out more about how gestors can help you in our guide to Gestorias In Spain.

Spain public transport

Spain has an extensive public transport network, spanning from urban metros to cross-country trains. Here are the best forms of transportation available in Spain:

1. Trains

Spain’s national rail service, RENFE, operates high-speed AVE trains that link Madrid to all major cities in Spain and also travel to Lyon and Marseille.

2. Buses

Buses are the cheapest way to travel in Sain.

Local bus services are also available in most cities and towns. In major cities, buses typically complement the Metro or Tram services. In smaller cities, buses are the only form of public transportation.

There are several thousand domestic intercity bus routes. All airports have low-cost buses linking to the nearest large city. All major cities have bus connections between each other and the capital.

Spain offers international bus routes connecting to various countries such as Portugal, France, Andorra, Italy, Germany, Switzerland, Belgium, and the Netherlands.

3. Metros

In larger cities such as Madrid and Barcelona, the metro systems are an efficient way to navigate through the city. They run regularly and offer reasonable prices. A single trip typically costs less than €2, with various types of tickets and plans available.

4. Taxis

Taxis in Spain are easily accessible, especially in urban areas. There’s a minimum charge, and the final cost depends on the distance traveled and the time of day. Services like Uber and Cabify operate in some Spanish cities.

5. Bicycle-sharing schemes

Several cities in Spain have bicycle-sharing schemes, which are an ecologically-friendly choice of transport. Madrid’s bike-sharing program, BiciMAD, is especially well-renowned.

Tip: Public transport systems in Spain often offer travel cards or passes that can significantly reduce your travel costs. Consider purchasing a travel card if you plan on using public transport frequently.

Driving in Spain

If you’re a non-EU national planning to drive in Spain, here’s what you need to know:

- 6-month window: you are allowed to drive in Spain using your existing foreign driver’s license for up to six months after you have registered for residency in Spain if your foreign driver’s license is in Spanish.

- International Driving Permit: If your driver’s license is not in Spanish, you’re required to obtain an International Driving Permit (IDP) in your home country before you leave. This document validates your driving license internationally.

- Spanish Translation: It is recommended to have a Spanish translation of your driving license. Some officials might ask for it during a road check.

- Getting a Spanish driver’s license: If you’re staying in Spain for more than six months, you must register with the local traffic authorities and may need to obtain a Spanish driving license.

Note: While driving, always carry your IDP, passport, and Spanish translation of your driving license. Not having these documents in your possession while driving can result in fines.

You can find more information in our guide to Buying A Car And Driving In Spain.

Schools and education

In Spain, education is compulsory from the ages of 6 to 16.

State-funded schools provide education free of charge, and all legal residents can send their children to s state-funded schools. The curriculum is taught in Spanish, and parents must pay for books and materials.

Church-run schools (concertadas), semi-private schools owned and operated by the church. They receive state funding and are open to all students offering basic education services free of charge.

Parents will still need to contribute toward costs such as books, extra-curricular activities, and, sometimes, a voluntary donation to the church.

Twenty-six percent of Spain’s schools are concertadas, and 76 percent of those are Catholic.

Private schools are funded by tuition fees. They provide a different learning environment, and some may follow alternative education theories, such as Montessori or Waldorf, or teach curriculum in a different language.

Costs vary, but expect to pay between 4,000€ and 8,000€ per school year.

International schools often run on a British, American, French, or German curriculum, making them an appealing option for expats looking to maintain continuity in their children’s education. Fees depend on the school’s reputation and location. Costs range from 6,000€ to 20,000€ per school year.

Here are some of the top international schools in Spain:

- Madrid’s International College Spain: This school offers an American-based curriculum and is known for its student-centered teaching methods.

- Barcelona’s American School: With an American curriculum, this school is esteemed for its teaching staff and diverse student body.

- British Council School in Madrid: This school offers a UK-based curriculum and is known for its focus on academic achievement.

- Kings College, Madrid: Renowned for its impressive student-teacher ratio, the school offers an enriched UK-based curriculum.

- Deutsche Schule Madrid: A German international school, it is recognized for its rich academic program and cultural immersion.

- Lycée Français de Madrid: This French international school is admired for its stimulating environment and strong academic record.

- American School of Valencia: Situated in Valencia, this school offers an American curriculum and a dynamic mix of local and international students.

- The British School of Alicante: A leading British international school located in Alicante. It is lauded for its focus on bolstering intellectual and social development.

- El Limonar International School, Murcia: A British school known for a well-rounded curriculum that includes a strong arts and sports program.

- English International College, Marbella: This British school in Marbella is distinguished for its high academic standards and a wide range of extracurricular activities.

- The American School of Bilbao: Located in the vibrant city of Bilbao, this American international school promotes a balanced education to help students excel in their chosen paths.

- Sotogrande International School: This British school, located in the south of Spain near Gibraltar, is particularly sought-after due to its innovative approach, offering the International Baccalaureate (IB) to all age groups.

Homeschooling in Spain

In Spain, homeschooling isn’t officially acknowledged by law. Education for children aged six to 16, as per the law, must be obtained from registered schools.

Not enrolling your child in a recognized school may be deemed a violation of child rights by Spanish authorities.

Nonetheless, the situation isn’t entirely clear. Some families have successfully defended their homeschooling rights in court. Thus, the legal stance remains somewhat uncertain.

Higher education in Spain

Spain offers excellent educational opportunities. It hosts several reputable universities; the University of Barcelona and the Autonomous University of Madrid are ranked among the top 200 universities worldwide.

The top universities in Spain:

- University of Barcelona: Known for its research and a broad array of study programs.

- Autonomous University of Madrid: Renowned for its faculties in Law, Economics, and Psychology.

- Complutense University of Madrid: It is one of the oldest universities in the world and leads nationally in a number of academic fields.

- University of Navarra: Recognized particularly for its programs in Journalism, Business, and Medicine.

- Autonomous University of Barcelona: Renowned for its departments in Sociology, Geography, and History.

- Pompeu Fabra University: Recognized for its strong emphasis on research, particularly in the areas of Economics, Political Science, and Law.

- University of Valencia: Renowned for its Pharmacy, Medicine, and Nursing faculties.

Socializing and integrating into the community

Spain is greatly favored by expats, with areas where English is widely spoken, expat services are available, international restaurants abound, and the need to integrate into local life is minimal.

However, this is not necessarily what everyone wants.

You will find so much joy in understanding the real essence of Spanish culture and way of life. It’s why we move to a foreign country – to experience all the aspects of life and embrace the differences.

Cultural highlights

Life in Spain is traditionally slow-paced and laid-back, with a strong emphasis on family, food, and festivities.

Here are some traditional Spanish lifestyle quirks that might come across as different, unique, or surprising to expats:

- Diversity: Each Spanish region has its own customs, dialects, and traditions. Despite their differences, all Spaniards share a love for life, food, and family.

- Siesta time: Between 2 pm and 5 pm, many Spanish businesses close for siesta, a custom primarily followed in the smaller towns and cities. During these hours, locals usually eat lunch and take a short nap.

- Late dining: In Spain, people typically have dinner after 9 pm, much later than what might be standard in other countries. This late dining custom is largely due to the Spanish tradition of late-night socializing.

- Paseo culture: ‘Paseo’, or taking a slow, leisurely walk in the evenings, is a deeply entrenched Spanish tradition. Families and friends can often be found walking and socializing, usually after dinner.

- Fiestas: Spain is known for its colorful and vibrant festivals. They take their fiestas very seriously and it’s a part of their cultural identity.

- Strong family ties: Family and extended kin hold a crucial place in Spanish society. It is not uncommon to see the whole family, including grandparents, parents, and children, gather for meals and outings often.

Language barrier

Learning Spanish before moving to Spain is highly beneficial for everyday interactions and integration. While you can get by with English in major cities and tourist areas, Spanish is the primary language in most parts of the country.

It’s not a requirement, but speaking Spanish makes navigating daily life more comfortable.

In places like Madrid, Barcelona, and the Costa del Sol (Malaga, Marbella, Estepona, etc.), English is widely spoken due to international businesses and tourism.

However, in regions such as Galicia, Murcia, or Castile, a knowledge of Spanish will significantly enhance your experience. If you’re moving to Spain’s smaller towns or rural areas, learning Spanish is a necessity to get by.

Expat groups and meeting places

A great way to get involved in the community and meet fellow expats is through groups or clubs. Here are some of them:

- SpainExpat (Facebook): An online community for expats in Spain.

- Costa Women: A free community for women living in Spain, with events and meetings across the country.

- The Local.es: An online news portal with a dedicated section for expats in Spain.

- Meetup: An app that allows you to find and join local groups in Spain based on your interests.

- University of the Third Age groups: The U3A (University of the Third Age) organizes various activities like book clubs and art groups for English-speaking individuals over 50 all over Spain.

- Volunteering opportunities: You can volunteer to help other expats and local charities and meet like-minded people. The Spanish Red Cross, pet rescue centers, women’s associations, British charities like Help the Aged, Caritas, and local food banks always welcome volunteers. Check out the Support in Spain website for more options.

These groups will provide you with the opportunity to meet people who have had similar experiences and can provide useful tips and advice. They can make your transition to life in Spain much easier and more enjoyable.

Where to live in Spain

Spain offers diverse lifestyles and climates. Whether you prefer island living, the tranquility of the inland countryside, the temperate climate of the north, or the warm and sunny south, you’ll find it in Spain!

For urban facilities and infrastructure – the cities

If you are drawn to big city lifestyle and stunning natural sceneries, here are some of the most popular urban destinations:

- Barcelona: Known for its unique blend of Catalan culture, stunning Gaudi architecture, and beautiful beaches. Find out more in our Living In Barcelona guide.

- Madrid: The Spanish capital offers a bustling city life with its rich history, diverse cuisines, and high-quality life. More details are in our Living In Madrid guide.

- Valencia: Famous for its mix of old and new architecture, city beaches, and the birthplace of paella. Read more in our Living In Valencia guide.

- Seville: The heart of Andalusia is the home of flamenco, historical landmarks, and beautiful river views.

- Bilbao: Renowned for its modern architecture, like the Guggenheim Museum, delectable Basque cuisine, and green landscapes.

For beaches and all-year-round holiday feeling – the islands

The Balearic Islands in the Mediterranean Sea include Ibiza, Majorca, and Minorca, known for their stunning beaches, great nightlife, and relaxed way of life.

On the other hand, living in the Canary Islands in the Atlantic Ocean provides a tropical vibe with year-round warm weather and spectacular landscapes.

For temperate climate and outdoor activities – the North of Spain

The northern region of Spain, including cities like Bilbao, San Sebastian, and Gijón, is famous for its temperate climate.

The weather is generally milder, with warm summers and cool winters, making it an ideal place for those who enjoy outdoor activities. The region is also known for its lush landscapes and outstanding cuisine.

For coastal lifestyle – Spanish Costas

The Spanish Costas are the most attractive places in Spain for expats. The best news is that you can find a Costa that suits your climate preferences, lifestyle, and budget.

From the most expensive and glitzy Costa del Sol to a very affordable and equally stunning Murcia’s Costa Calida, you can find the coastal place to tick all your boxes.

Here are the highlights of the most famous Spanish Costas:

| Costa | Cost of an average 1-bed apartment | Climate |

|---|---|---|

| Costa del Sol | Most expensive | Hot-summer Mediterranean (hot summers, mild winters) |

| Costa Blanca | Medium range | Warm Mediterranean (mild dry winters and warm, dry summers) |

| Costa Brava | High-end | Hot-summer Mediterranean (hot, dry summers and moderately cold winters) |

| Costa Dorada | Medium range | Mild Mediterranean (a very warm and dry climate with long, hot summers and slightly more rainfall and cooler temperatures in winter) |

| Costa de la Luz | Medium to high-end | Hot-summer Mediterranean (hot dry summers and mild winters.) |

| Costa Calida | Affordable | Semi-arid Mediterranean (warm to hot all year round and very dry) |

For more details and information, visit our Spanish Costas guide.

To learn about the most popular expat spots in Spain, read our Best Places To Live In Spain guide.

Popular locations in Spain to check out:

- Living In Benidorm As An Expat

- All About Living On The Costa De La Luz

- Living In Malaga As An Expat

- Living In Granada

- Living On The Costa Blanca In The Province Of Alicante

Final thoughts on living in Spain

Spain offers a rich and inviting landscape for expats, with an attractive lifestyle and climate. The main benefits are:

- The cost of living that is, on average, 15-40% lower than in many Western European countries.

- The healthcare system ranks 8th globally, promising high-quality medical services.

- Spain’s rich cultural heritage is showcased through its 49 UNESCO World Heritage Sites. The country also ranks very high as one of the best retirement destinations in the world.

- Lastly, Spain’s Mediterranean climate provides over 2,900 hours of sunshine annually.

All these factors combine to make Spain an attractive location for expatriates seeking a balance between cost, culture, and quality of life.

You might find useful:

- Best Places To Live In Spain

- 10 Tips To Make Retiring To Spain An Absolute Success

- UK Pensions And Tax In Spain

- Living In Spain After Brexit – The Q&A For UK Citizens

Helpful external links:

- The map of Spanish consulates where you can make visa applications

- Support in Spain – non-profit organization for expats in Spain

- Train travel – tickets and schedules on the renfe site.