Ireland continues to attract a record number of American expats in 2025, with visa applications up 23% year-over-year, according to the Irish Immigration Service. Whether you're drawn by EU citizenship opportunities, the thriving tech sector in Dublin, or the quality of life that earned Ireland #8 in our Expat Retirement Index, this guide provides everything you need to navigate Ireland's immigration system successfully.

This comprehensive resource covers visa pathways, realistic living costs in a challenging housing market, and the practical realities of establishing your new life on the Emerald Isle—based on official government sources, verified expat experiences, and quarterly-updated data from our research network.

Editor's Note: This guide is based on extensive research and interviews with American expats currently living in Ireland. We maintain strict editorial independence and verify all information through multiple sources per our Research Methodology.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Key Takeaways: Ireland Immigration for Americans 2025

- Employment permits now require €44,000 minimum salary (Critical Skills) as of January 2025

- Retirement visas demand €50,000 annual income per person, plus comprehensive health insurance

- Housing crisis continues with Dublin 2-bedroom rents averaging €2,400 monthly

- PPS number processing takes 6-8 weeks and requires physical presence in Ireland

- No driving license exchange agreement means Americans must take the full Irish driving test

- Foreign Birth Registration offers an EU citizenship route for those with Irish grandparents (9-month process)

- ETIAS exemption: Ireland remains outside Schengen, unaffected by the new EU travel system launching in 2025

Can Americans Legally Move to Ireland?

Yes, but understanding the framework is crucial. Americans enjoy visa-free travel to Ireland for 90 days, but cannot work, study long-term, or establish residence during tourist visits.

To legally relocate, you'll need:

- A long-stay "D visa" aligned with your purpose

- Proof of financial self-sufficiency (amounts vary by visa type)

- Private health insurance coverage

- Clean criminal background check (FBI with apostille)

Critical Update: Ireland remains outside the Schengen Area, maintaining independent immigration policies. The ETIAS system (launching for Schengen countries in 2025) won't affect Irish entries. Your Irish visa does not permit automatic Schengen travel.

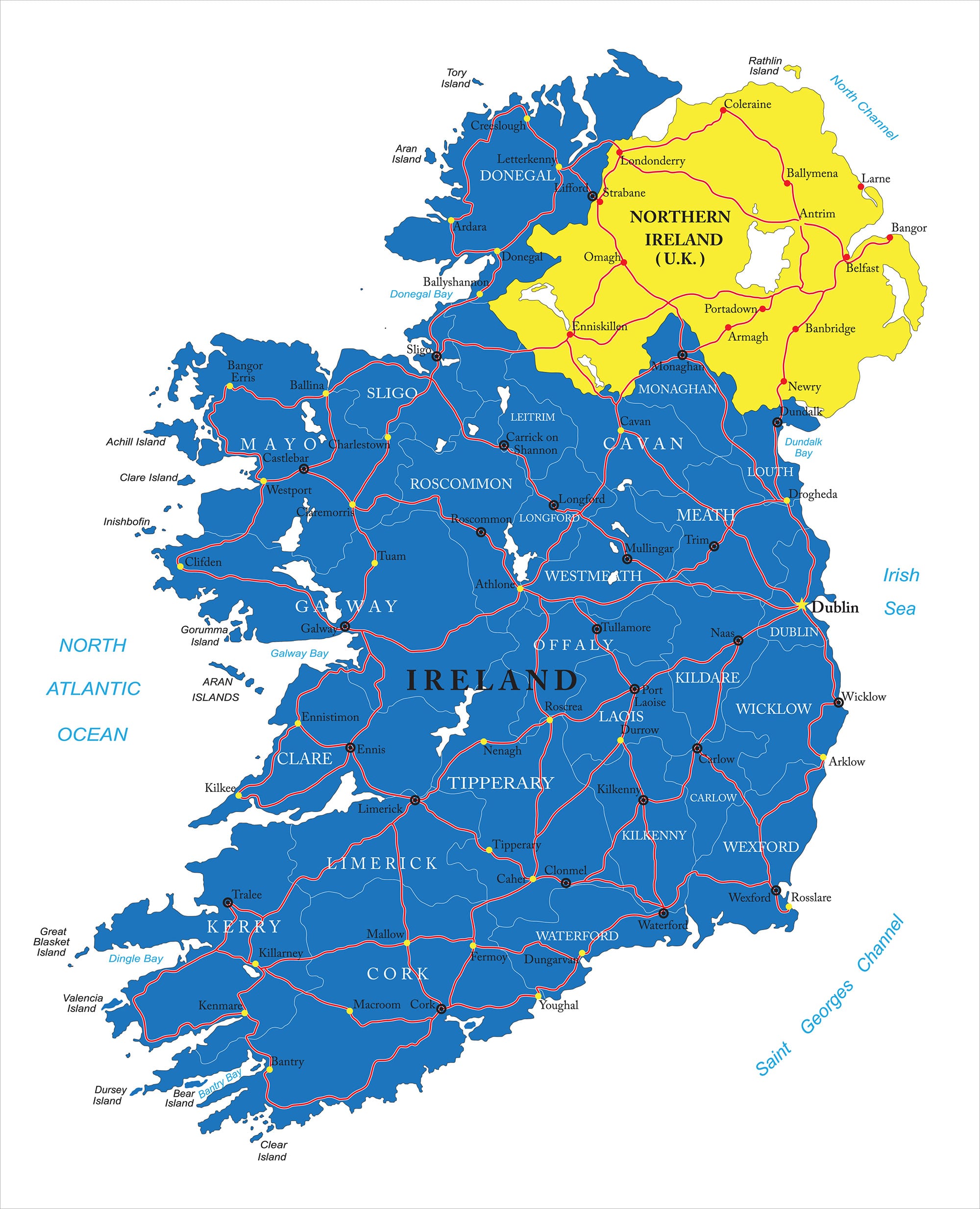

Republic of Ireland vs. Northern Ireland

This guide covers the Republic of Ireland exclusively. Northern Ireland, as part of the UK, requires different documentation—see our UK relocation guide for details.

Primary Visa Pathways: Comparison Table

| Visa Type | Minimum Income | Processing Time | Path to Residency | Work Rights | Best For |

|---|---|---|---|---|---|

| Critical Skills | €44,000/year* | 6-12 weeks | 21 months | Yes | Tech/Healthcare professionals |

| General Employment | €39,000/year* | 6-12 weeks | 5 years | Yes | Other skilled workers |

| Retirement (Stamp 0) | €50,000/year | 4 months | No automatic path | No | Retirees/Remote workers |

| Graduate (Stamp 1G) | N/A | 2-3 weeks | Via employment | Yes | Recent graduates |

| Investment | €500,000 min | 3-4 months | Immediate | Yes | High net worth individuals |

*Salary thresholds as of January 2025, subject to verification

1. Retirement Visa (Stamp 0) - Detailed Requirements

The retirement pathway suits financially independent Americans not seeking employment in Ireland.

Financial Requirements:

- €50,000 annual income (individual)

- €100,000 annual income (couples)

- Additional €25,000 per dependent

- Liquid savings: minimum €100,000

- Verification by an Irish accountancy firm is required

Additional Requirements:

- Comprehensive private health insurance with full hospital coverage

- Written commitment against seeking employment or public funds

- Clean FBI background check with apostille

- Processing time: 4 months average

- Initial permission: 1 year (renewable annually online)

Important Note: This visa doesn't lead to permanent residence but allows indefinite renewals if requirements are maintained.

2. Employment Permits

Ireland actively recruits experienced professionals, particularly in technology, healthcare, and financial services.

Critical Skills Employment Permit (Updated January 2025):

- Minimum salary: €44,000 (increased from €38,000)

- Eligible occupations on Critical Skills List

- Fast-track to permanent residence: 21 months

- Spouse receives automatic work authorization (Stamp 1G)

General Employment Permit:

- Minimum salary: €39,000 (increased from €34,000)

- Healthcare assistants qualify at €30,000

- Standard 5-year pathway to permanent residence

- Processing: 6-12 weeks

New for 2025: Job mobility restrictions reduced from 12 to 9 months. Labor market testing requirements eliminated for shortage occupations.

3. Irish Citizenship by Descent

Nearly 40 million Americans claim Irish ancestry, and many qualify for EU citizenship without residing in Ireland.

Automatic Citizenship:

- Born to Irish citizen parent(s)

- Born in Ireland before 2005 (restrictions apply after)

Foreign Birth Registration (FBR):

- Eligibility: Irish-born grandparent

- Processing: 9 months currently (down from 18 months in 2023)

- Cost: €278 adults, €153 minors

- Required: Original birth/marriage/death certificates tracing lineage

- Benefit: Children born after registration automatically qualify

Contact Department of Foreign Affairs to begin the FBR process.

4. Alternative Pathways

Digital Nomad Status:

- Not available: Ireland lacks a dedicated remote work visa

- Stamp 0 retirement visa is the only option for remote workers (no Irish employment allowed)

- Consider Portugal's D8 visa or Spain's Digital Nomad visa as EU alternatives

Real Cost of Living in Ireland 2025

Housing Costs by City (Q2 2025 Data)

Ireland faces its worst housing crisis in decades, with national vacancy rates at 0.3% and annual rent increases of 14%.

| City | 2-Bed Apartment (Monthly) | Annual Growth | Availability |

|---|---|---|---|

| Dublin City Center | €2,400-€2,700 | +15.2% | Extremely Limited |

| Dublin Suburbs | €1,750-€2,100 | +13.8% | Limited |

| Cork | €1,800-€2,200 | +13.6% | Very Limited |

| Galway | €1,700-€2,100 | +12.6% | Limited |

| Limerick | €1,400-€1,800 | +11.4% | Moderate |

Market Reality: Only 2,300 rental properties available nationwide (May 2025). Expect viewing queues of 20+ people and bidding wars.

Monthly Budget Breakdown (Couple in Dublin)

| Category | Essential (€) | Comfortable (€) |

|---|---|---|

| Rent (2-bed suburb) | €1,800 | €2,400 |

| Groceries | €600 | €800 |

| Utilities (including heating) | €250 | €300 |

| Transport | €200 | €300 |

| Dining/Entertainment | €300 | €600 |

| Health Insurance | €200 | €400 |

| Total | €3,350 | €4,800 |

Hidden Costs Often Overlooked

- Winter heating: €150-€200/month (poor insulation standard)

- Car insurance: €1,200-€2,500 annually (new drivers penalized)

- TV license: €160/year (mandatory, enforced)

- GP visits: €60-€70 (without medical card)

- Waste charges: €250-€400/year

- Initial setup costs: €5,000-€8,000 (deposits, furniture, connections)

Finding Housing: Strategies That Work

Rental Platforms & Approach

Primary Platforms:

Winning Strategies:

- Set up alerts and respond within 1 hour

- Prepare rental pack: references, employment letter, bank statements

- Offer 6 months upfront if possible (maximum legal is 2 months)

- Consider commuter towns on DART/Luas lines

- Use estate agents: Sherry FitzGerald, Savills, DNG

Recommended Areas for American Expats

Dublin (Connected & Expat-Friendly):

- Blackrock/Dun Laoghaire: Coastal, DART access, established expat community

- Rathmines/Ranelagh: Central but quieter, walkable to the city

- Malahide/Howth: Seaside villages, family-oriented, 30 mins to center

Cork (Rising Tech Hub):

- Douglas: Suburban convenience, shopping centers

- Blackrock: Village feel, close to city

- Cobh: Historic port town, more affordable

Best Value Alternatives:

- Waterford: €1,200-€1,500 rentals, 2.5 hours to Dublin

- Kilkenny: Medieval charm, €1,300-€1,600 rentals

- Westport: Coastal beauty, €1,100-€1,400 rentals

Healthcare System Navigation

Private Insurance (Mandatory for Visas)

Major Providers Compared:

| Provider | Basic Plan (Couple/Year) | Comprehensive (Couple/Year) | Waiting Periods |

|---|---|---|---|

| VHI Healthcare | €1,500-€2,000 | €3,500-€4,500 | 26-52 weeks |

| Laya Healthcare | €1,400-€1,900 | €3,200-€4,200 | 26-52 weeks |

| Irish Life Health | €1,600-€2,100 | €3,000-€4,000 | 26 weeks |

Public System (HSE) Access

- Free after establishing "ordinary residence" (typically 1 year)

- EU Health Insurance Card not valid for US citizens

- GP visits: €60-€70 without medical card

- Emergency department: €100 (without GP referral)

- Prescription cap: €80/month (Drugs Payment Scheme)

Banking & Financial Setup Timeline

Week 1-2: PPS Number Application

The Personal Public Service number is critical—nothing else proceeds without it.

Current Process:

- Apply online via MyWelfare.ie (requires Irish address)

- Schedule an in-person appointment (2-3 week wait)

- Document verification at the appointment

- Card arrives by post: 3-4 weeks

- Total timeline: 6-8 weeks minimum

Week 3-4: Bank Account Opening

Requirements & Timeline by Bank:

| Bank | Account Type | Requirements | Timeline | Best For |

|---|---|---|---|---|

| Bank of Ireland | Expat Package | PPS + Address proof | 1-2 weeks | New arrivals |

| AIB | Standard Current | PPS + Employment | 2-3 weeks | Employed |

| Permanent TSB | Basic | PPS + Address | 1 week | Quick setup |

| Revolut/N26 | Digital | Passport only | Instant | Bridge solution |

US-Ireland Tax Treaty Considerations

Key Benefits:

- Prevents double taxation on employment income

- Social Security payments are taxed only in residence country

- Foreign Tax Credit available for remaining obligations

- Totalization agreement prevents dual social insurance

Reporting Requirements:

- FBAR: $10,000 threshold

- FATCA Form 8938: $200,000 (single abroad)

- Professional preparation recommended: €2,000-€5,000/year

For more information, read our guide on US taxes for US expats living abroad.

Retirement-Specific Considerations

Why Ireland Appeals to Retirees

- English-speaking with a familiar common law system

- EU base for travel (visa-free to 27 countries)

- Quality healthcare once established

- Active expat retiree communities

- No inheritance tax for US beneficiaries (under treaty)

Retirement Challenges to Consider

- High cost of living versus Portugal or Spain

- Weather: 225 rainy days annually

- No automatic path to permanent residence on Stamp 0

- Private health insurance costs increase with age

- Limited sunshine (compare Cyprus at 340 sunny days)

Pension & Investment Transfers

- US pensions remain US-taxable regardless of residence

- 401(k)/IRA distributions: Treaty prevents double taxation

- Consider a Qualifying Recognized Overseas Pension Scheme (QROPS)

- Irish investment taxation: 41% on gains (ETFs particularly affected)

- Consult cross-border tax specialist before transfers

Month-by-Month Settlement Checklist

Months 1-6 Before Arrival

- Determine visa pathway and begin documentation

- Check ancestry for citizenship eligibility

- Start job search (if employment route)

- Research housing markets and areas

- Get an FBI background check apostilled

- Arrange health insurance quotes

Months 3-1 Before Arrival

- Submit a visa application

- Book temporary accommodation (minimum 4 weeks)

- Open a Revolut/N26 account

- Join Facebook groups: "Americans in Ireland," "Dublin Expat Community"

- Schedule a PPS number appointment for the arrival week

- Arrange pet transport (if applicable)

Month 1 After Arrival

- Register with immigration (within 90 days)

- Attend the PPS number appointment

- Begin intensive housing search

- Register with GP

- Get an Irish SIM card (€20/month typical)

- Start the driver's license process

Months 2-3 After Arrival

- Open an Irish bank account (once PPS arrives)

- Complete employer registration

- Set up utilities accounts

- Apply for a medical card (if eligible)

- Join local clubs/activities

- Complete driving theory test

Months 4-6 After Arrival

- File first Irish tax return

- Review health insurance after waiting periods

- Complete driving lessons and test

- Establish ordinary residence for HSE access

- Plan first visa renewal

Ireland vs. Other EU Countries for Americans

| Factor | Ireland | Portugal | Spain | Germany |

|---|---|---|---|---|

| Language | English | Portuguese | Spanish | German |

| Min. Income (Retirement) | €50,000 | €9,120 | €28,800 | €45,000 |

| Path to Citizenship | 5 years | 5 years | 10 years | 8 years |

| Tax Rate (High Earners) | 40% | 28% (NHR) | 47% | 45% |

| Healthcare Ranking | Good | Very Good | Excellent | Excellent |

| Housing Availability | Crisis | Limited | Moderate | Moderate |

| Climate (Sunny Days) | 140 | 300 | 320 | 160 |

| EU Travel Rights | Yes | Yes | Yes | Yes |

What We Don't Know Yet: Changes to Watch

Potential 2025-2026 Developments

- Housing measures: Government emergency intervention pending

- Immigration processing: New digital system launching Q3 2025

- Employment permits: Further salary threshold reviews expected

- Healthcare: Sláintecare reforms may affect private insurance requirements

- EU relations: Post-Brexit arrangements still evolving

- Tax changes: Potential reforms to expatriate taxation under review

We update this guide quarterly. Check back for the latest developments.

Expert Assessment: Is Ireland Right for You?

Ireland Suits Those Who Value

- English-speaking environment without language barriers

- EU citizenship and travel freedom

- Strong job market in tech/pharma/finance

- Walkable cities with good public transport

- Rich cultural heritage and vibrant arts scene

- Mild climate without extremes

- Established expat support networks

Consider Alternatives If You Prioritize

- Guaranteed sunshine: Consider Spain, Portugal, or Cyprus

- Low taxes: Look at Dubai or Portugal's NHR program

- Affordable housing: Eastern Europe or Latin America

- Easy visa process: Countries with digital nomad visas

- Lower cost of living: Southeast Asia or South America

- Driving convenience: EU countries with license exchange agreements

Common Challenges and Solutions

"Housing is impossible to find" Book 6-8 weeks temporary accommodation. Use this time for intensive searching. Consider suburbs first, then move closer once established. Engage an estate agent if the budget allows.

"The weather is depressing" Invest in quality rain gear, take vitamin D supplements (2000 IU daily recommended), and use bright therapy lights. Plan winter escapes to sunnier EU destinations; your Irish residence enables visa-free travel.

"Banking is complicated" Open Revolut before arrival for immediate functionality. Use this for 2-3 months while establishing traditional banking. Bank of Ireland's expat package streamlines the process.

"Healthcare seems complex" Purchase private insurance before arrival (visa requirement). Register with GP immediately. After one year, public system access significantly reduces costs. Keep US coverage if possible for the initial year.

"Making friends is difficult" Join the American Women's Club of Dublin,, local GAA clubs, or hobby groups. Irish people are friendly but social circles can be established. Pub culture helps. Find your local.

Next Steps and Action Items

- Assessment Visit: Book a 2-week reconnaissance trip to preferred cities

- Ancestry Check: Order grandparents' birth certificates for FBR eligibility

- Financial Planning: Budget €15,000-€20,000 for establishment costs

- Professional Consultation: Consider an immigration attorney for complex cases

- Network Building: Join "Americans in Ireland" and "Irish Immigration" Facebook groups

- Documentation: Start gathering required documents (allow 3 months)

Official Resources

- Irish Immigration Service - Visa applications and updates

- Citizens Information - Comprehensive living guides

- Department of Foreign Affairs - Citizenship queries

- Revenue.ie - Tax registration and information

- HSE.ie - Healthcare system navigation

- Enterprise Ireland - Employment permit lists

Frequently Asked Questions

Q: Can I work remotely for a US company from Ireland? A: Not on a tourist visa. You need either an employment permit (if the company establishes an Irish entity) or to qualify for a Stamp 0 retirement visa (which prohibits any employment). Consider Portugal's D8 visa or Spain's Digital Nomad visa as alternatives.

Q: How long until permanent residence? A: Critical Skills permit holders: 21 months. General permit: 5 years. Must maintain continuous legal residence. Stamp 0 (retirement) doesn't lead to permanent residence.

Q: Can I buy property without residency? A: Yes, Americans face no restrictions on property purchase, but ownership doesn't grant residency rights. Current stamp duty: 1% up to €1 million.

Q: What about my US driver's license? A: Valid for 12 months as a visitor only. No exchange agreement exists—you must take the full Irish driving test. Budget €500-€800 for lessons and tests.

Q: Will my US retirement income be taxed in Ireland? A: Under the tax treaty, government pensions (Social Security) are taxed only in the US. Private pensions may be taxable in Ireland. Consult a cross-border tax specialist.

Q: Is Ireland in the Schengen Zone? A: No, Ireland maintains independent immigration controls. Your Irish visa doesn't permit automatic Schengen travel, but Irish residence allows visa-free tourist visits to Schengen countries.

Q: How does Irish healthcare compare to the US? A: Quality is comparable to good US systems. Main differences: longer waits for non-urgent procedures, lower costs overall, no medical bankruptcies. Private insurance provides faster access.

Q: Can I bring my pets? A: Yes, from the US requires: microchip, rabies vaccination, tapeworm treatment, and a USDA health certificate. No quarantine needed. Budget $500-$4,500 depending on DIY vs. service.

Q: Can entrepreneurs benefit from Ireland's tax system? A: Ireland offers a 12.5% corporation tax rate, among Europe's lowest. However, personal tax rates remain high (40% top rate). Many US entrepreneurs establish Irish companies while maintaining non-resident status.

Q: What American community resources exist outside Dublin? A: Cork has an American Expats in Cork Facebook group (300+ members). Galway hosts monthly American meetups. Most counties have informal networks—check Facebook and Meetup.com for local groups.