Buying a property in Spain is usually a big step in fulfilling your dream of living in a sunny Mediterranean climate and enjoying the seaside.

The whole process might be (and should be) an enjoyable experience. You simply need to know how Spain's property market works and all the possible pitfalls that you need to avoid when buying your dream home in the sun.

In this guide to buying a property in Spain, you'll find everything you need to know about the process, starting with the planning and research stage and going right through to completion and receiving your title deeds.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Spain property market

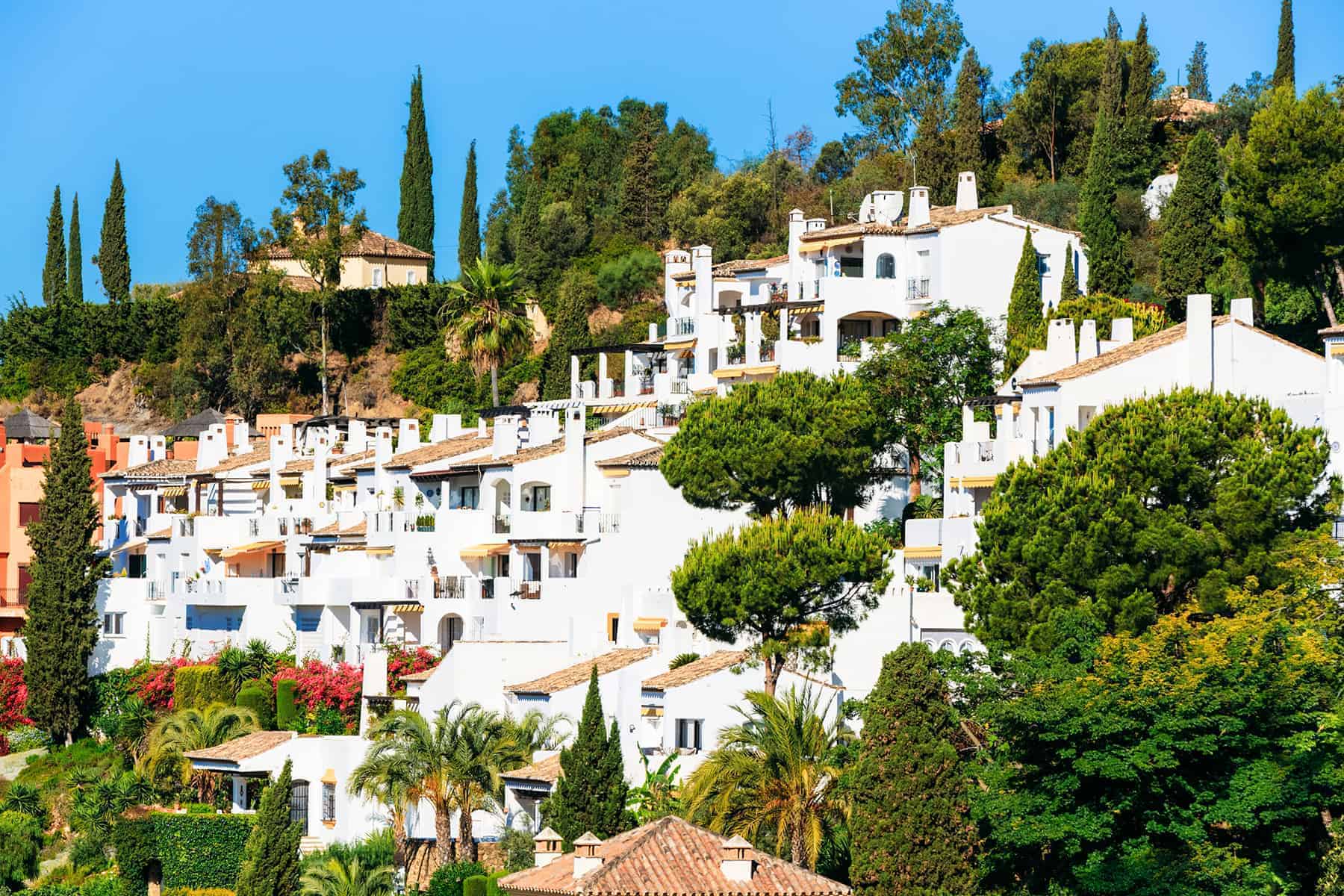

Spain is one of the favorites of foreign property buyers, especially Europeans.

The country is so stunning, so diverse, and has such a great climate – what’s not to love?

Many see the current situation in Spain as the opportunity that they’ve been waiting for for years. Vendors and developers are so keen to sell in this stagnant market that there are bargains to be bagged.

What’s more, these downturns in the market are part of a cyclical process. As long as you’re not buying a property in Spain hoping to turn it around and make a fast buck, you’re probably buying a very solid investment for the long term.

The very first piece of the property buying process puzzle is deciding why you want to buy a property in Spain. Your decision will guide many elements in the rest of the process.

So, are you buying for investment purposes? If so, do you want rental income, or is capital appreciation more important to you? Are you buying for family holidays, for you to live in and work from, or as a retirement property?

With a decision clear in your mind, you can look at any property with this fundamental conclusion guiding your choice. If you’re buying an apartment in Spain to let to the tourism market, you will surely then look at each property with your potential tenant’s tastes and desires in mind rather than your own.

However, if you are moving to Spain to live there as a permanent resident, that's a totally different situation to consider. It's all about your plans, your tastes, your future, and your preferences.

If you are retiring to Spain, you should choose your property very carefully. The right choice can help you make life in Spain a dream come true.

Spain's golden visa for property buyers

Property investors in Spain can qualify for residency if they meet certain conditions under the 'golden visa' program.

If you buy a Spanish property worth more than €500,000, you will be automatically eligible for a residency visa which you can turn into a permanent residency after five years, and Spanish citizenship - after ten years.

If you have questions or need more information about your Golden Visa options in Spain, contact us via our page on Residency and Citizenship. We will be happy to help.

Opening a bank account for property purchase in Spain

While you are looking for an ideal property in your favorite location in Spain, it may be wise to open a Spanish bank account.

You can transfer about 15 percent of your planned budget to it as working capital, with which you can make deposits and pay taxes and immediate charges when you’re ready to proceed.

Remember that you will never get the best exchange rate from your bank. Look at the currency specialists out there, speak to them about your euro transfers and how to get the best transfer and exchange deals.

House hunting in Spain

As soon as you begin meeting estate agents, developers or anyone with a property to sell, expect the ‘hard sell.’

You might be put under clever pressure from these people to buy. Even if you are made feel like if you don’t sign for that ideal property the minute you see it, you will lose your chance to buy it forever - it's not a reason for hurried actions.

In the end, there is always more than one ideal property, and if you really do want to make sure that you’re doing the right thing.

You should take all the time you need to get to know everything about Spain and property before you make any commitment at all. Take all you hear with a pinch of salt, and stay firm and true to the process!

Choosing a lawyer

With your dream home found, to proceed, you need to have a lawyer.

Wherever you wish to buy a home in Spain, always make sure that you have an independent and professional solicitor to advise you on your purchase.

Make sure that the local lawyer representing your interests is independent of the estate agent, developer or company showing you the properties.

If your Spanish is not very good, find an English-speaking lawyer. It is not as difficult in Spain and will ensure that you are explained all the details of the contract without ambiguities of translation, and make sure that the lawyer is specialized in Spanish land law (urbanismo).

Ask for your lawyer’s registration number and check that they are registered and practicing with the local bar association (Colegio de Abogados).

Your lawyer should also have professional indemnity insurance.

Legal process

The most important advice is - do not sign any papers or hand over any money until you have taken independent legal advice.

When you have found the property that ticks all your boxes, it’s time to make an offer.

Once an offer has been accepted, you sign a conditional purchase contract that protects you and your deposit in the event that your lawyer finds something untoward with the property, its deeds, or the vendor’s right to sell it.

You will usually pay a deposit of about 10% at this point. If you haven’t already, you will need to set up a bank account and have a Spanish NIE number in place – your lawyer or estate agent can help you with this.

Now you need to keep a very close eye on your chosen lawyer and ensure they get on with searches and checks in a timely manner to meet the conditions of the contract.

You can also have the property surveyed or valued by an independent surveyor, and it is strongly advisable, especially if you buy a resale property.

The results of the survey can give you a stronger negotiation position with the vendor and a better understanding of what you are really prepared to pay for the property.

When it’s done, and the agreement with the buyer is reached, your solicitor conducts necessary checks and does the due diligence. It usually involves reviewing the sale agreement, verifying titles, and carrying out other checks to ensure that your interests are protected.

The next step is signing a private contract with the vendor. At this point, you will also be required to put down a deposit as specified in the terms of the contract. Remember that changing your mind after signing the contract can cost you a fortune, so be absolutely sure of your decision before you sign.

You are then given time to get your money in place prior to signing the deeds before a Notary and taking possession of the property. The final step requires you to get your title inscribed in the property register, pay any relevant taxes and get utilities connected.

Extra costs

In most cases, the purchase price includes the estate agency fee (usually 5%), but do ask before signing a contract. It is common practice in Spain for Spanish vendors to inform the estate agent what net amount they want from the sale.

It is up to the agent then to charge as much on top of it as they can to increase their commission.

Foreign vendors are most likely to choose a traditional way and negotiate a fee as a percentage of the sale. Be aware of this when negotiating the purchase price.

As a rule, you will have to pay 10% of the purchase price as a transfer tax that goes to the Spanish Treasury.

Don’t forget to budget in notary fees and a land/property registration fee, which varies according to the purchase price of the property. Also, consider the solicitors fee, which can be 1 percent of the purchase price + VAT at 21 percent.

Buying property off-plan in Spain

If you intend to buy directly from a developer in Spain, which is not a rare case in the country where a big part of the construction market is specifically focused on foreign buyers, make sure you are dealing with a reputable company.

There are certain risks involved with buying a property that is not built yet.

Remember that the property market in Spain is abundant, so there is no real need to sign a Reservation Contract straight away under the agent’s pressure that the development is going to be sold off the next day and you will be left behind.

When you are sure that you want to proceed, try to negotiate a better deal with the developer.

There is always something you can negotiate to improve the deal for yourself: either a straightforward discount, fixtures, financial terms, or/and any conditions about the snagging period. It is even possible to negotiate a 5 percent price reservation on your side until the snagging period is over.

Spanish Reservation Contract when buying off-plan

After you and the developer have agreed on the terms, you will be required to sign the Reservation Contract (Documento de Reserva) and put down a deposit, usually specified by the developer.

Check that your Reservation Contract has a clause stating that the deposit is refundable in case you choose to withdraw. Such a clause is rare in this type of contract, so you might try to insist on it to protect yourself. Most reliable developers will agree to the clause.

Due diligence when buying off-plan

Before this, have your lawyer carry out appropriate due diligence.

Make sure your lawyer checks whether the land the building is on is registered under the developer’s name, whether the land is classified appropriately, and whether the development has been issued a building license by the local town hall and the planning permission has been obtained.

Do your own due diligence as well on surroundings, infrastructure, facilities, etc.

Make sure you have as detailed plans and specifications as possible, including the built area (superficie construida), useable area (superficie útil), total area including common areas (superficie total) and technical plans that show the functional installations.

And finally, make sure your developer has adequate insurance or a bank guarantee (aval bancario) which is required by law for developers receiving stage payments for off-plan properties. This guarantee aims to protect your funds should anything go wrong with the construction.

The developer should be able to present you with a certificate from the bank or an insurance company to prove that proper insurance has been taken out.

Down payment construction contract and Licence of First Occupation

Next, you will be required to sign a down payment contract or private contract (Contrato privado de compraventa).

When signing the down payment contract, make sure you receive a document from the guarantor which confirms that your stage payments are guaranteed. The document must bear your name on it.

At the signing of the contract, you will usually be required to put down the first payment.

The final payment is made when the property is completed, and the deeds are signed.

On completion, the development should be granted a Licence of First Occupation (or ‘Licencia de Primera Ocupación’ ). This licence is issued by a town hall and is a legal confirmation that a newly-built property fully complies with all planning and building regulations, and is ready to be used as a dwelling.

Buying a property in Spain to renovate

If you buy an older property in Spain and are planning to renovate it if you generally want to improve on a home you’ve already bought, you need to apply for permission from your local council.

You will find that you need permission for even the most insignificant building work.

Ask your fellow expats for recommendations for architects and builders. An architect can make the whole process of applying for permission much simpler for you by doing it on your behalf. Or you can use a gestor to help you with paperwork.

When you get a quote, make sure you find out whether VAT is included, and bear in mind that it is normal to have to pay about 50 percent upfront before building work commences.

Buying a property in Spain - summary

The process of buying a property in Spain is very straightforward when you know what it should be like. Getting the research right is the key to whether the whole purchase is a success.

So, take your time, don’t rush or be swayed by your estate agent’s veiled threats, and remember that this is one of the most important purchases you will ever make, so it is worth taking the time to make sure everything goes smoothly.

You might find useful:

- Living In Spain As An Expat – all you need to know to plan your move to Spain: the cost of living, housing, paperwork, visas and residency, healthcare, banking, taxes, etc.

- Best Places To Live In Spain – the best and most popular expat locations in Spain.

- Haven't found what you were looking for? Contact us or comment below with your question and we'll do our best to help.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.