This comprehensive guide on living in Portugal as an expat aims to provide essential information and insights into various aspects of moving to and settling down in Portugal, including residency, healthcare, cost of living, cultural experiences, and more.

In this guide:

- The legalities of moving to Portugal: visas and residency options for non-EU nationals.

- The cost of living: daily expenses, rentals, and real estate.

- Infrastructure: travel connections, public transport, internet.

- Healthcare and education.

- Taxes and bank accounts.

- Where to live in Portugal - an overview of the most popular expat locations.

- Culture, leisure, and socializing.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Portugal's highlights

There are some good reasons – beyond the weather and excellent golf amenities – why Portugal is highly regarded as an ideal place to live. Its beautiful coastline, healthy lifestyle, and affordability make the country stand out among other popular southern European destinations.

Here's what makes Portugal such an attractive destination:

- Mild climate: Enjoy a Mediterranean climate with mild winters and sunny summers in most regions, making outdoor activities a year-round pleasure.

- Affordable cost of living: Portugal offers a relatively lower cost of living compared to other Western European and Northern American countries, especially in housing, groceries, and dining out.

- Stunning coastline: The country features beautiful beaches, cliffs, and picturesque seaside towns, ideal for leisure and relaxation.

- Rich history and culture: Portugal offers a rich history, beautiful architecture, and a diverse cultural environment to satisfy even the most demanding culture aficionados.

- Quality healthcare: Benefit from a high standard of healthcare services, including a well-established public healthcare system and access to private healthcare facilities.

- Safe and peaceful environment: The country has a low crime rate and a welcoming, friendly local population.

- Easy travel within Europe: Portugal's convenient location provides easy access to other European countries for leisure or business.

- Diverse expat communities: Portugal is a truly global country where you can meet people and make friends from all over the world.

Portugal residency for non-EU citizens

Citizens of countries with visa agreements with the EU can travel to Portugal and stay there for up to 90 days as tourists without a visa. This includes citizens of the UK, USA, Canada, Australia and other countries.

To live and work in Portugal, you must apply for a visa and go through the immigration procedures set for all non-EU citizens, including Americans and British. The most common visas are the D7 and Portugal Golden Visa.

UK citizens can find more details in our Living In Portugal After Brexit guide.

Portugal's Golden Visa route

A quicker option is Portugal's Golden Visa route, where you invest a minimum of €500,000 in arts, R&D, or businesses in Portugal and gain a residency permit for a family, including dependent children.

Alternatively, you can invest in qualifying Portuguese funds, set up a business that creates jobs, contributes to R&D projects, or donate to national heritage projects.

A capital transfer of a minimum of €1,500,000 to a Portuguese bank can qualify you for a Golden Visa.

This program, among other benefits, could give you the right to apply for permanent residence and Portuguese citizenship.

If you have questions or need more information, please see our Guide to EU Golden Visa Programs or contact us via our page on Residency and Citizenship. We will be happy to help.

Portugal D7 residency visa

This is the best route to residency in Portugal for retirees and people with stable investment incomes.

You need to have sufficient passive income to qualify for this visa. The income can be received from pensions, property rentals, investments, dividends, etc.

You have to apply to the Portuguese consulate in your home country.

To qualify, you need to:

- Be a non-EU citizen.

- Have enough funds to support yourself during your stay in Portugal. Official figures say your income should at least be equal to the annual minimum wage in Portugal (which is currently €886.7) for the principal applicant and 50% of the minimum wage for a spouse. However, that might not be enough to get your application approved. Aim at a minimum of €12,000 annually to be on the safe side.

- Have a clean criminal record.

- Show a residence address in Portugal.

- Have valid health insurance.

The visa itself is permission to enter Portugal. With the visa, you can enter Portugal two times and remain there for a period of 4 months in total.

You must apply for a residence permit in Portugal during the four months. The first permit is granted for one year. After that, it can be renewed for two years.

After five years of residing in Portugal, you can convert it into a permanent residence permit.

Portugal Digital Nomad visa

The official name of the visa is “residence visa for the exercise of professional activity provided remotely outside the national territory”. This visa is designed for working professionals.

To qualify, you must:

- Come from a non-EU and non-EEA country.

- Be self-employed or employed by a company based outside Portugal

- Earn at least four times the Portuguese minimum wage per month - roughly €2,800.

The weather and various climate areas in Portugal

The weather and climate in Portugal are very diverse, so you can actually choose an area that suits your taste.

As you head further south, you’ll find hotter summers and more temperate winters. The Algarve is dry and sunny almost all year round.

If you like it seriously hot, head away from the Atlantic coastline towards the country’s beautiful interior. You’ll find the summers are baking hot!

Tip: Portugal experiences its highest temperatures inland. Amareleja, for example, in the Alentejo region, is the hottest places in Europe during the summer, having recorded 47.4°C (117.3 °F). Besides its extreme heat, Amareleja is renowned for its robust red wines and is even home to a prominent outdoor thermometer at the local Farmácia.

Here's a brief overview of the areas with various climates:

| Area | Locations | Climate |

|---|---|---|

| Southern Coastal Region | Algarve | Mediterranean, mild winters, hot summers |

| Lisbon Metropolitan Area | Lisbon, Cascais | Mediterranean, mild winters, warm summers |

| Central Interior Region | Coimbra, Tomar | Continental, cold winters, hot summers |

| Northern Mountainous Region | Porto, Braga | Maritime, mild winters, mild summers |

Safety and crime

Portugal ranks as the 17th safest country in the world and second among the safest countries in the European Union. Violent crime is rare, and petty crime is largely limited to street crime during the busy tourist season.

Like in any country, there are areas with higher crime rates. Central parts of Porto and Lisbon and other urban centers tend to have higher reported crime rates compared to rural areas. This includes cities like Coimbra, Braga, Faro, and others.

The cost of living in Portugal

The cost of living is among the lowest in Western Europe.

Here is how Portugal's cost of living, including rent, compares to some of the Northern European and North American countries:

How much money do you need to live comfortably in Portugal?

If you are going to rent (which, initially, is a good idea), two people can live comfortably in Portugal starting from about $2,000 a month, depending on the location.

The nearer to Lisbon you want to live, the bigger your budget should be.

For example, a couple can live relatively comfortably in the Algarve for $2,200 a month, including rent, occasional meals out, gym membership, and other moderate luxuries.

The same lifestyle in Cascais can cost closer to $3,100, including rent.

Housing costs

When it comes to buying a property in Portugal, the average cost across the country is cheaper than in the UK, North America, and Northern Europe.

However, if you are looking at the favorite destinations for expats retiring to Portugal, which are mostly around Lisbon, Porto, and the Algarve, you will probably find that property prices are the highest there.

For example, an average two-bedroom apartment on the Algarve coast costs at least twice as much as in central Porto. Still, for $370,000, you can buy a three-bed villa in a gated community, with access to a swimming pool and a five-minute walk to the beach.

The price of property away from the resorts and coast will surprise you even more. You can bag bargains in some stunning inland towns and villages and still only be a short drive from major urban areas and beaches.

It will mean looking at more traditional properties rather than developed resort-style homes, but you can certainly find an affordable property if you hunt for it in Portugal.

Rental costs

Rental prices can vary significantly across different regions in Portugal. Here's a general overview:

Most expensive:

- Lisbon: The capital city, particularly areas like Chiado, Príncipe Real, and Avenida da Liberdade, tend to have higher rental prices due to high demand and a booming tourism industry.

- Porto: Porto, especially in the central and riverside districts, is known for relatively higher rental prices, although they may be slightly lower than in Lisbon.

- Cascais and Estoril: These affluent coastal areas near Lisbon are also known for higher rental prices, particularly for upscale properties and those with a sea view.

- Algarve: Certain popular tourist destinations in the Algarve region, such as Albufeira, Vilamoura, and Lagos, can have high rental prices, especially during the peak tourist season.

More affordable:

- Interior regions: Rural areas and smaller towns in the interior regions of Portugal, away from major cities and the coast, generally have more affordable rental options.

- Northern and Central Portugal: Cities like Braga, Coimbra, Aveiro, and smaller towns in the north and central parts of the country tend to offer more budget-friendly rental options than Lisbon and Porto.

- Alentejo: Rural areas and smaller towns in the Alentejo region can also provide more affordable rental rates than urban centers and coastal areas.

If you are unfamiliar with the rental process in Portugal, our guide to Renting In Portugal will provide all the necessary information on how it works and how to protect yourself as a tenant.

Retiring to Portugal

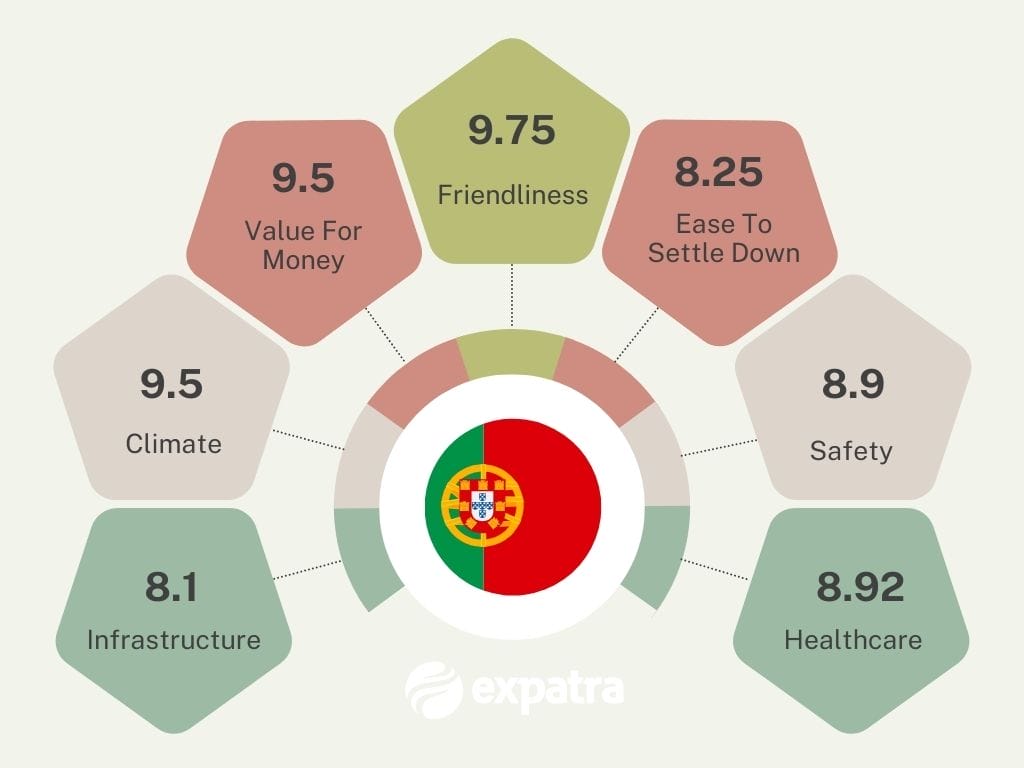

According to the Expatra Global Retirement Index, Portugal is in the top 20 countries for retiring abroad because of its climate, lifestyle, and the fact that it’s a great value-for-money destination.

The index is based on the Expatra Global Retirement Survey that asks international retirees to rate their retirement destination’s infrastructure, climate, ease of settling down, value for money, friendliness, and other aspects of life in their retirement destination.

Here's how Portugal scores:

Retirement visa

For non-EU nationals, a D7 visa or a Golden Visa are the best options. Both options can lead to permanent residence and, eventually, citizenship. The most significant difference is that a D7 visa is cheaper to process and requires a holder to reside in Portugal permanently.

Discover more in our guide on retiring to Portugal.

Travel connections

Portugal is well-connected with Europe and major destinations worldwide.

Air travel

Portugal has several major international airports, the busiest being Lisbon Airport (Humberto Delgado Airport), followed by Porto Airport (Francisco Sá Carneiro Airport) and Faro Airport (Aeroporto Internacional de Faro).

These airports have numerous direct flights from major cities across Europe, North America, South America, Africa, and Asia.

There are also connecting flights via major hub cities, including London, Amsterdam, Madrid, Frankfurt, and Dubai.

Sea travel

Portugal, with its extensive coastline and major ports like Lisbon, Porto, and Funchal (Madeira), is a popular stop for cruise ships in the Mediterranean and Atlantic routes.

Trains

High-speed trains, such as the Alfa Pendular and the Renfe-SNCF service, connect Portugal to Spain and further European destinations.

The renowned "Sud Express" provides an excellent link from Portugal to Central Europe. You can travel overnight from Lisbon to San Sebastian and Hendaye (France), where you can take the TGV to Paris.

Public transport

Major cities like Lisbon, Porto, and Coimbra have efficient and extensive public transportation systems, including metro, buses, trams, and suburban trains.

Rural areas, however, may have less frequent public transport options.

Trains are run by the national railway company CP (Comboios de Portugal). Alfa Pendular, a high-speed tilting train, offers a fast connection between the key cities.

Tickets and costs

Many urban areas have integrated ticketing systems, allowing passengers to use a single ticket for multiple modes of transport.

| Type of Public Transport | Description | Cost |

|---|---|---|

| Metro | Underground train system in Lisbon and Porto. | Tickets start at around €1.50 for a single journey. |

| Bus | Local and intercity buses. | Tickets usually start around €1.50 for a single journey within a city. Inter-city bus fares vary. |

| Tram | Trams are mainly found in cities like Lisbon, Porto and Sintra. | Tickets typically start around €2 for a single journey. |

| Train | Urban commuter trains and intercity trains. | Tickets start around €2 for short journeys within a city and can go up to €30 or more for long-distance trips between cities. |

Internet and mobile connection

Overall, you can expect a good internet experience, especially in urban areas and popular tourist destinations. Broadband or fiber optic is generally available almost everywhere and offers up to 1 Gb.

Depending on the package, it can cost you from €40 for 200 Mb to €100 for 10 Gb.

Almost everywhere in the country, you can get 4G or 4G+ service, with some cities offering 5G.

Major internet service and mobile providers are MEO, NOS, and Vodafone Portugal.

Taxes for expats in Portugal

If you spend more than 183 days in Portugal, you become a tax resident, and legally, you should now file a tax return and pay your taxes in Portugal.

To register as a tax resident in Portugal, you first must visit the town hall where you live and demonstrate that you have adequate financial means and social security to cover yourself. You then visit the local tax office and register as a tax resident.

The NHR has come to an end

One of the biggest benefits of living in Portugal as an expat, Portugal's low-tax regime for expats, has ended.

If you are planning to move to Portugal, keep in mind that the tax situation is changing, and you might have to pay Portugal's general rates.

Various taxes and rates:

- Personal Income Tax (IRS): Progressive rates range from 14.5% to 48%, depending on income level.

- Corporate Income Tax (IRC): Flat rate of 21% for most businesses.

- Value Added Tax (VAT): Standard rate of 23% for most goods and services, with reduced rates of 6% and 13% for specific items.

- Municipal Property Tax (IMI): Varies between 0.3% and 0.45% of the property's fiscal value.

- Stamp Duty: Varied rates depending on the type of transaction, typically ranging from 0.8% to 0.6%.

- Capital Gains Tax: Rates vary depending on the nature of the gains and the holding period, with rates ranging from 14.5% to 48%.

- Social Security Contributions: Rates range from 11% to 23.75%, depending on income and employment status.

Wealth tax in Portugal

Portugal’s wealth tax is essentially an extension of Portugal’s Imposto sobre Imóveis (IMI), or property tax. You will normally pay 0.3% for your Portuguese property if it’s worth more than EUR 600,000. If you are married or in a civil partnership, you as a couple will be granted a combined threshold of €1.2m.

For more information, read our Taxes In Portugal guide.

Where to live in Portugal

Expats’ favorite locations in Portugal can be found in and around Lisbon.

Many expats are living in Lisbon itself, with others moving to Sintra or living in Cascais to take advantage of a more relaxed lifestyle.

If you want a smaller town with a lower cost of living but still close to the capital city, consider moving to Setúbal. This lovely coastal town has everything you could only dream of while conveniently close to Lisbon.

The Algarve is another favorite expat destination, of course, where there is a large community of British, Scandinavian, French, Brazilian, and other expats.

| Location | Description | Suitable for | Average property price (Approx.) | Further information |

|---|---|---|---|---|

| Lisbon | The capital city offers a vibrant cosmopolitan lifestyle. | Professionals, young couples, and digital nomads. | €400,000 - €600,000 | Living In Lisbon |

| Porto | Known for its charming atmosphere and rich cultural scene. | Professionals, artists, and those seeking a bohemian vibe. | €350,000 - €450,000 | Living In Porto |

| Cascais | A coastal town with beautiful beaches and a relaxed vibe. | Families, retirees, and beach lovers. | €450,000 - €650,000 | Living In Cascais |

| Algarve | Famous for its sunny climate and stunning coastline. | Retirees, expat communities, and golf enthusiasts. | €350,000 - €550,000 | Living In The Algarve |

| Sintra | Surrounded by lush nature and historic castles. | Nature lovers, artists, and history aficionados. | €300,000 - €450,000 | Living In Sintra |

| Madeira | A tranquil island paradise with a mild climate. | Retirees, nature enthusiasts, and outdoor adventurers. | €230,000 - €350,000 | Living In Madeira |

| Faro | Located in the Algarve, offering a mix of beach and city. | Professionals, retirees, and lovers of coastal living. | €250,000 - €400,000 | Living In The Algarve |

| Coimbra | Home to one of the oldest universities in the world. | Students, academics, and those seeking a cultural hub. | €220,000 - €350,000 | Living In Coimbra |

| Aveiro | Known as the "Venice of Portugal" for its canals. | Families, retirees, and lovers of a picturesque lifestyle. | €240,000 - €370,000 | Living In Aveiro |

| Braga | Rich in history and architectural treasures. | Young professionals, history buffs, and art enthusiasts. | €220,000 - €340,000 |

If you want to take the road less traveled, you might want to consider living in the Azores.

Island living is not for everyone, but if this is what you want, start with our guide on the best places to live in the Azores to find your perfect destination.

For more information on the most popular destinations, read our Best Places To Live In Portugal guide.

Schools and education in Portugal

If you are moving with children, schools are an essential subject. Depending on how long you are planning to stay and how old your children are, the following options are available:

Public schools

These are state-funded schools teaching the Portuguese curriculum in the Portuguese language.

State education is quite good in Portugal, but there are a few problems, including funding, insufficient teachers, and class sizes.

Private schools

Many are faith-based, have smaller class sizes, and have more options for various clubs and activities. The costs are between €400 and €550 a month, depending on location.

International schools

They are by far the most expensive option but the best if you need to ensure your child keeps up with the UK or USA curriculum.

Most private and international schools are located in mainland Portugal in and around Porto, Lisbon, and the Algarve.

| International School | Curriculum | Annual Fees (Approx.) | Location |

|---|---|---|---|

| International School of Lisbon | International Baccalaureate (IB) | €12,000 - €18,000 | Lisbon |

| Carlucci American International School of Lisbon | American (AP) and International Baccalaureate (IB) | €15,000 - €20,000 | Lisbon |

| Oeiras International School | International Baccalaureate (IB) | €10,000 - €15,000 | Oeiras, Lisbon |

| St. Julian's School | International Baccalaureate (IB) and British Curriculum (IGCSE and A-Levels) | €15,000 - €20,000 | Carcavelos, Cascais |

| The British School of Lisbon | British Curriculum (IGCSE and A-Levels) | €10,000 - €15,000 | Linda-a-Velha, Lisbon |

| International Preparatory School | American (AP) | €10,000 - €15,000 | Porto |

| Nobel International School Algarve | British Curriculum (IGCSE and A-Levels) | €11,000 - €15,000 | Armação de Pêra, Algarve |

| The English College in Portugal | British Curriculum (IGCSE and A-Levels) | €8,000 - €12,000 | Quinta do Lago, Algarve |

| Vale Verde International School | International Baccalaureate (IB) | €8,000 - €12,000 | Loulé, Algarve |

| Vilamoura International School | British Curriculum (IGCSE and A-Levels) | €10,000 - €15,000 | Vilamoura, Algarve |

Healthcare in Portugal

Portugal is famous for its fantastic state-funded healthcare system, which is called the Serviço Nacional de Saude, or SNS for short.

This scheme is open to all permanent legal residents in Portugal and those with temporary residency who are either working and actively making social security contributions or from a country that shares a reciprocal healthcare agreement.

New arrivals in Portugal must live as temporary residents for five years before qualifying for permanent residency—so some retirees may need health insurance to bridge the gap.

Happily, private health insurance is far more affordable in Portugal than in most other countries too!

EU citizens arriving with a valid European Health Insurance Card (EHIC) or equivalent can use the Portuguese healthcare system for free for 90 days—allowing them time to get their Segurança Social registration in order.

Once eligible to enter the SNS system, expats will need to register at their local Centro de Saude, or health center, to receive a Numero de Utente and be assigned a family doctor.

Once you have your SNS patient number in hand, healthcare in Portugal is almost entirely free.

There are no costs for emergency healthcare—including trips to the emergency room and even a ride in an ambulance.

Non-essential healthcare can be accessed via small administrative charges called ‘taxas moderadoras’, which are so affordable that you'll only need to pull €4.50 from your wallet to visit your family doctor!

Family dependents of those who qualify will also be able to register.

Health insurance

Private health insurance is quite popular in Portugal—in fact, many Portuguese citizens supplement their SNS healthcare to enjoy access to private services and potentially shorter wait times.

Health insurance in Portugal can begin from as little as €30 per month, making it an accessible option for most expats. However, do keep in mind that insurance will be subject to an initial health assessment, and costs can be higher for those with pre-existing conditions.

Also, if you are 65 and over, you will find that most insurers will be unwilling to provide you with a health plan. If this is the case, you should look at international health insurance. To ensure you get the best value for money, compare international health insurance options from various providers to find the best deal.

Because of the popularity of private services, private clinics can be found all over the country, and expats can choose to visit a private doctor without health insurance for as little as €40.

Wherever you go, either practice your Portuguese or get a translator ready on your smartphone. Not all doctors speak English, and, particularly in rural areas, it's safe to assume that most won't!

Hospital care and specialist services in Portugal

Unless it's an emergency, treatment at a hospital requires a referral from a family doctor.

Referrals can also be provided for cheaper access to specialist services such as physiotherapy or mental healthcare.

The SNS system does not cover dental, except for those considered high-risk.

If opening a policy, your health insurance provider can include dental upon request.

However, once again, dental care is refreshingly affordable. With no coverage, a filling in Portugal costs only around €40, which should be cheap enough to keep you smiling.

Personal banking and bank accounts in Portugal for expats

You might want to open a bank account in Portugal before you move there. It can help you save money on charges for transactions abroad from your bank.

Opening a resident account in Portugal

Personal bank accounts in Portugal are not always free. Many current accounts have an admin charge of about €5 per month. You will also have to pay small fees to replace debit cards or counter withdrawals.

For that, you will get an assigned manager and have a direct line and mobile number. Whenever something happens that requires help, you can talk to them on the phone or go into your local branch and talk to them in person.

Documents needed to open a bank account in Portugal

To open a Portuguese bank account, you will need the following:

- your passport;

- your NIF (a Portuguese fiscal number which you can obtain at the local Financas);

- proof of income;

- proof of your Portuguese address;

- a mobile phone number with activated SMS.

Opening a non-resident bank account in Portugal

There might be circumstances when you need to have a Portuguese bank account before you apply for residency. This is what you can do to obtain a Portuguese bank account before you move to Portugal:

Some Portuguese banks offer this option. Banks such as ActivoBank and Banco CTT offer excellent services, which include no monthly fees and are free to use in the eurozone.

You have to be in the country to open a non-resident account, as it involves first obtaining a NIF (Número de Identificação Fiscal). You can get it from the nearest Finanças by providing your ID and proof of address (a recent bank statement that lists your non-Portuguese address will do perfectly well).

With your freshly obtained NIF, proof of address, and proof of income that states your profession or job title, you can apply for a non-resident bank account.

If you already have your NIF, both ActivoBank and Banco CTT (and several Portuguese banks) offer an online application that involves a video chat with a bank representative to confirm your identity.

How to open a bank account in Portugal online - a mobile-only bank account

You can opt for a mobile-only bank account. They are very easy to set up. The most popular mobile-only bank accounts are Borderless Account from TransferWise, DiPocket, Revolut, LeuPay, and N26.

With most of them, you can set up a bank account with a Portuguese IBAN on your mobile phone in minutes. You will need a smartphone and a valid ID, which will allow you to verify your identity either through a quick video call or with photos.

Cultural insights, leisure, and integration

Overall, Portugal is known for its welcoming and friendly culture, making it relatively easy for newcomers to integrate into the society.

However, it can be very helpful to familiarize yourself with certain aspects of Portuguese lifestyle and culture and, of course, make an effort to learn the language.

The language barrier

The most difficult thing about Portugal is the language. It is a very complicated and challenging language, and many people struggle to get further than the basics and everyday pleasantries.

If you live in the more urban and populated areas with many expats, international citizens, and professional Portuguese, you will find English is quite widely spoken. The Algarve, for example, is being anglicized rapidly thanks to international expats.

Step away from the major urban and tourist hubs, and you will be struggling with daily communications. So learning the language is highly beneficial and will help you integrate and make friends.

The major national holidays and festivals celebrated in Portugal

Besides traditional Christmas and New Year, here are some of the festivals you can enjoy in Portugal:

- Carnival (Carnaval): A lively celebration in February or March with colorful parades, costumes, and street parties before the start of Lent.

- Good Friday (Sexta-feira Santa): Observed during Holy Week on the Friday before Easter Sunday, commemorating the crucifixion of Jesus Christ.

- Easter Sunday (Páscoa): Celebrated in March or April, it marks the resurrection of Jesus Christ. Families gather for special meals and festivities.

- Freedom Day (Dia da Liberdade): Held on April 25th, commemorating the Carnation Revolution in 1974, signaling the end of the Estado Novo regime.

- Labour Day (Dia do Trabalhador): Celebrated on May 1st to honor workers and their contributions. It is marked by rallies, demonstrations, and cultural events.

- Portugal Day (Dia de Portugal): Celebrated on June 10th, it commemorates Portugal's national identity and its greatest literary figure, Luís de Camões.

- Feast of St. John (Festa de São João): Celebrated on the night of June 23rd, particularly in Porto, with lively festivities, music, dancing, and a traditional midnight bonfire.

- Assumption of Mary (Assunção de Nossa Senhora): Observed on August 15th, it marks the assumption of the Virgin Mary into heaven, a significant religious holiday.

- Republic Day (Implantação da República): Celebrated on October 5th, commemorating the establishment of the Portuguese Republic in 1910.

Things to do

Portugal is a brilliant country to be in if you are an active and outdoorsy type. The mild climate means various outdoor activities can be enjoyed all year round.

Surfing and water sports

Portugal's extensive coastline provides excellent conditions for surfing, windsurfing, kitesurfing, and paddleboarding. Knowledgeable people say the country boasts 364 days of surf. Spots like Nazaré, Peniche, and Ericeira are renowned among surf enthusiasts.

Hiking and trekking

Explore the diverse landscapes of Portugal through its extensive network of hiking trails. The Douro Valley, Peneda-Gerês National Park, and Rota Vicentina offer stunning trekking opportunities.

Cycling and mountain biking

Discover Portugal's picturesque countryside and challenging mountain terrains on two wheels. The Algarve, Douro Valley, and Serra da Estrela are popular cycling destinations.

Golf

Portugal is a prime golf destination with world-class golf courses.

There are only 70 or so golf courses in the country, and the total number of golf club members is below 20,000. But despite (or maybe thanks to) these modest numbers, the quality of the courses is very high, and the country’s popularity as a top golfing destination has been steadily growing.

The Algarve, Lisbon, and Porto regions are particularly known for their exceptional golfing facilities and scenic courses.

Rock climbing

Adventure seekers can enjoy rock climbing in various regions, including Sintra, Cascais, and the Arrábida Natural Park, offering diverse climbing experiences for enthusiasts.

Sailing and yachting

Portugal's extensive coastline and marinas invite sailing and yachting enthusiasts. The Algarve, Lisbon, and Porto Santo are popular yachting destinations.

For all the yachting enthusiasts, here is the list of Portugal's most popular marinas and yacht clubs:

- Marina de Vilamoura

- Marina de Lagos

- Marina de Cascais

- Marina de Portimão

- Marina de Portimão

- Marina de Albufeira

- Marina de Faro

- Marina de Sines

- Marina de Peniche

- Marina de Ponta Delgada

These marinas and yacht clubs offer excellent facilities, stunning coastal views, and a wide range of services to satisfy your needs.

Bird watching

Portugal's diverse ecosystems provide rich birdwatching opportunities. Ria Formosa, Tejo Estuary, and Peneda-Gerês National Park are renowned birdwatching spots.

Dolphin and whale watching

Experience the thrill of observing dolphins and whales off the Portuguese coast. The Azores and Madeira are well-known for guided boat tours to witness these magnificent marine creatures.

Canoeing and kayaking

Enjoy paddling adventures in rivers, lakes, and coastal areas. The Douro River, Mondego River, and Aveiro Lagoon offer exciting canoeing and kayaking experiences.

Paragliding and skydiving

Adrenaline junkies can take to the skies for paragliding or skydiving experiences. Regions like Algarve, Madeira, and Porto offer thrilling opportunities for aerial adventures.

Final thoughts on living in Portugal

Portugal seems to have found the right recipe for becoming an attractive expat destination. It offers exactly what all expats are looking for when deciding to move: a good climate, great quality of life combined with a lower cost of living, and, a cherry on top of the cake, tax advantages.

This is exactly what you can get living in Portugal as an expat. Even if you cannot benefit from the tax advantages, all the other benefits are convincing enough to make Portugal a great destination to live in.

You might find helpful:

- Best Places To Live In Portugal – a detailed overview of Portugal’s most popular locations for expats.

- The Expat Guide To UK Pensions Abroad: Understand Your Options.

- The Essential Guide To Cost-Effective International Removals - read about international removals options and how you can keep your costs down while getting a quality service.

- Didn’t find what you were looking for or need further advice? Contact us or comment below with your question, and we will do our best to help.

Helpful external links:

- Online registration with a health center in Portugal - eportugal.gov.pt.

- Portugal public schools rating - observador.pt.

- Entering Portugal, the documents and travel information - eportugal.gov.pt.

- US citizen services in Portugal - pt.usembassy.gov.

- Portuguese public and private hospitals and their contact details - infarmed.pt.

- Online services for foreign nationals in Portugal - sef.pt.

- UK government guidance for British citizens moving to Portugal - www.gov.uk.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.