Malta is all about history, long hot summers, being outdoors, stunning beaches, and low-tax living. You could call it a tax haven, and it wouldn't be too wrong. This is precisely why Malta is a popular destination for global expats and businesses.

In this guide, we will discuss all the important matters you need to consider when planning your move to Malta.

In this guide:

- Malta's highlights: main features that attract expats.

- The legalities of moving to Malta: visas and residency options.

- The cost of living: monthly expenses, including housing.

- Malta as a retirement destination.

- Infrastructure: travel connections, public transport, internet.

- Buying real estate.

- Healthcare and education.

- Where to live in Malta – an overview of the most popular expat locations.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Living in Malta - overview

Malta is tiny. It is made up of three islands, which, put together, make it the smallest EU member state. It’s also one of the most densely populated countries in the world.

Malta's highlights:

A stunning coastline and beautiful scenery: With its warm climate, numerous sandy beaches, and three UNESCO World Heritage Sites (including the ancient Megalithic Temples), Malta offers the perfect home to retire to the Mediterranean region.

Sizable expat community: Over 20% of the population of Malta are non-Maltese. The expat group is very and includes retirees from all over the world. The country ranks high on the Expatra Global Retirement Index and is rightfully featured among the best countries to retire abroad.

The main benefits: Expats cite Malta's beautiful climate, widespread English, relaxed lifestyle, and proximity to the continent. Plus, of course, a beneficial tax regime.

Malta's climate is splendid: the country boasts more than 3,100 hours of sunshine a year with an average temperature of 19C. Summers are hot and dry, autumns are warm and short, and winters are quite mild. Daytime temperatures rarely fall below 10ºC, and summer temperatures are usually above 30ºC.

English is widely spoken: Maltese and English are both official languages of the country, with Maltese being the national language. It is estimated that about 88 percent of the population can speak English.

Residency in Malta for non-EU nationals

Malta joined the EU in 2003, meaning it’s part of the Schengen visa area. For EU nationals, this translates to easier travel and permanent residency.

But, for third-country citizens, the process is a bit harder. Since Brexit, the UK now counts as a third country, meaning it must follow the same rules as other non-EU countries.

Malta long-stay visa

If your country has a visa-free travel arrangement with the EU, you can come and stay in Malta for up to 90 days in 180 days.

You need to obtain a long-stay "D"visa to stay longer.

If you are going to work in Malta, you have to get a work permit.

You should apply to the nearest Malta Embassy or Consulate in your country of residence.

The required documents:

- Completed Visa Application Form

- Two recent passport-sized color photos with white backgrounds in electronic format

- Your passport which should be valid for at least three months beyond the return date

- Confirmed flight booking or copy of actual flight ticket

- Proof of accommodation

- Health insurance acceptable in the Schengen Area (minimum coverage has to be 30,000 Euros) covering the period of validity of visa.

- Proof of civil status (marriage certificate, birth certificate of children, death certificate of spouse, etc.).

- A visa cover letter stating the purpose of the visit to Malta and itinerary,

- Proof of sufficient financial means for the period of stay in Malta (minimum 48€/day for the period of stay)

Temporary residence permit

The "D" visa is valid for a year. If you wish to stay longer, you must apply for a temporary residence permit after your arrival.

This is done in the nearest office of the Identity Malta Agency. The temporary residence permit is valid for one to five years, and you can renew it.

You must submit the following:

- Proof that you have no criminal record

- Proof of adequate health insurance

- Proof of income

Malta permanent residency

To obtain permanent residency status in Malta, you must live in the country legally for five years. After this point, you can apply to the Maltese immigration board for permanent status.

You must have the following:

- A copy of the passport used for your previous visa applications

- List of dates showing your entry and exit from Malta

- Proof of medical insurance

- Five years’ worth of tax declarations confirming you earned at least the national minimum wage or are self-sufficient

- Evidence of integration

- A cover letter explaining your history in the country

Evidence of integration comes from two sources. The first is the I Belong course, issued by the Maltese Directorate of Human Rights and Integration. It includes the history of Malta and other important information.

You must show 100 hours of attendance on the course and an overall pass mark of 75%.

You also have to complete a Level 2 MFQ Maltese language course. The pass mark for this is slightly lower: 65%. Finally, you must have proof of payment where relevant, although the I Belong course is free.

If your application is successful, you must get a few more documents. These are a CEA Form L, the application for residence, and Form ID 1A to register for an ID. This is the only cost involved, which is €137.50. However, you also have to pay a residence permit fee of around €24 a year.

Malta’s Retirement Program

If you wish to retire to Malta, you can receive special tax status through the Malta Retirement Programme, which will allow you to keep 85% of your pension income that you receive in Malta.

Applicants need to meet the following requirements:

- To purchase a property for a minimum of €275,000 or rent a property for a minimum of €9,600 per annum. If the property is situated in Gozo or the South of Malta, the minimum purchase value is €220,000, and the minimum rental value is €8,750 per year.

- To have adequate health insurance covering the EU territory

- To not spend more than 183 days in any one foreign jurisdiction in a year (i.e., to spend the majority of time in Malta).

- To satisfy a “fit and proper” test, which assesses the applicants’ integrity, competence, and solvency.

- Under this program, you will pay a flat 15% tax rate on foreign income remitted to Malta. The minimum annual tax under this program is €7,500, with an additional €500 per dependant. The Maltese Government levies a one-time registration fee of €2,500.

Applicants would need to apply for a residence card on the basis of their retirement in Malta.

You can only apply through an Authorised Registered Mandatory - a person or company registered with the Inland Revenue Department.

The Residence Scheme (residence via investment)

If you are not receiving a pension but have other sources of income instead, you can still retire to Malta under the Residence Scheme.

The Residence Scheme provides special tax status to EU/EEA/Swiss nationals wishing to gain residence in Malta under certain conditions:

- A governmental contribution of €68,000 with a property purchase from €300,000 in South Malta or Gozo or €350,000 in popular coastal resorts.

- Or a €98,000 donation, plus property rental of €10,000 in South Malta and Gozo, or €12,000 in the rest of the country.

- To receive stable and regular financial income

- To hold adequate health insurance covering the EU territory

- To pass the “fit and proper” test

- Not to spend more than 183 days outside Malta

The tax rate under this scheme is also 15% of foreign income remitted to Malta with a minimum annual tax of €15,000. The Malta Government levies a one-time registration fee amounting to €6,000.

When you receive special tax status, you can apply for a residence card.

You can only submit your application through an Authorised Registered Mandatory.

If you have questions or need more information about your residence via investment options in Malta, see our new EU Golden Visa Schemes Guide or contact us via our page on Residency and Citizenship. We will be happy to help.

The cost of living in Malta

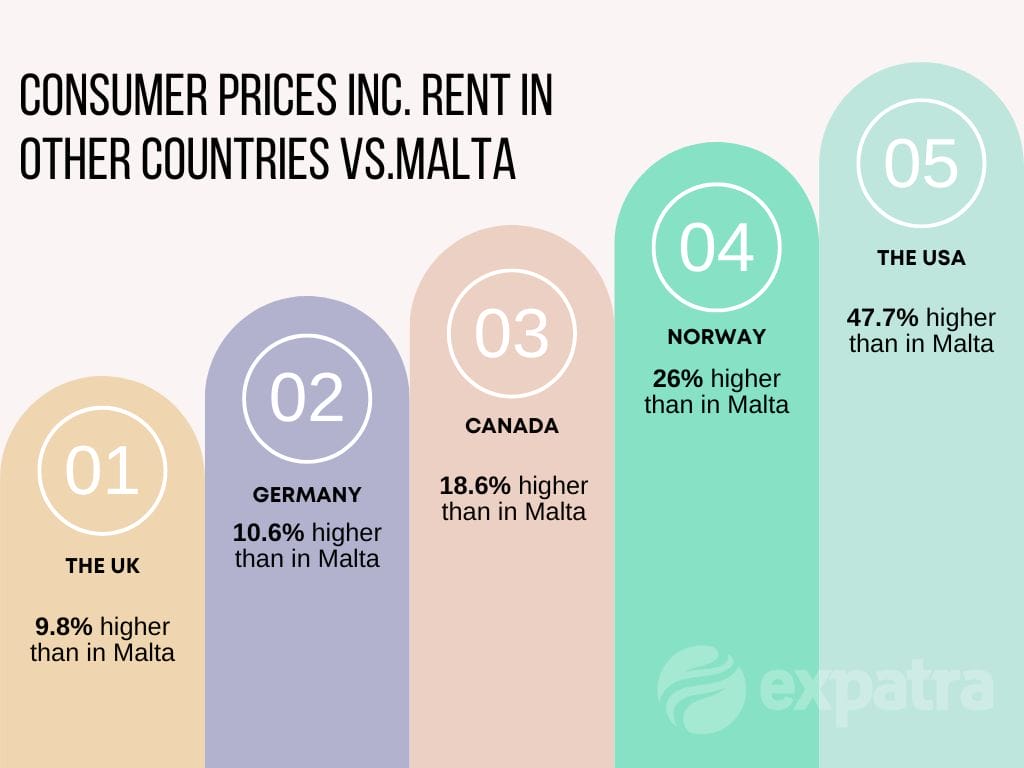

In general, it is less expensive to live in Malta compared to large cities in the north of Europe, North America, or the UK.

The cost of living in Malta is significantly lower than in European capitals like London or Berlin, but the average incomes are also lower.

So, if you are an expat in Malta drawing your income from abroad, that can work well for you.

Here's how the cost of living in Malta compares to some of the Northern European and North American countries:

Housing expenses

As usual, rental prices differ from area to area. A one-bedroom apartment in a new complex in a highly sought-after area of St. Julian's can cost you as high as €1,600 per month.

However, apartments in regular complexes aren’t too expensive if you don’t expect anything extremely luxurious.

There is a lot on offer for even lower prices if you look outside city centers or on Gozo.

Utility bills

The average bill for water, electricity, gas, and internet can be between €150 and €200, depending on your tariff and usage.

Groceries and household goods

The cheapest food shopping comes from buying local produce in supermarkets or from roadside markets or farmers’ markets.

Imported brands are slightly more expensive, as are the costs in the smaller grocery stores. Household and personal care items are more costly because they are all imported.

Eating out and entertainment

Eating out in Malta is not too expensive. Takeaways like pastizzi are very cheap, as are most snacks at regular, local cafes.

Entertainment in Malta is not expensive overall. If you love historic sites, which Malta has in abundance, it is worth getting a Heritage Malta Multipass.

Private heritage organization Fondajjoni Wirt Artna runs the saluting battery, Fort Rinella, the War Rooms, and other sites of interest and offers membership, which allows you to visit the sites regularly for a much lower price than the one-off entrance fee.

Cinema tickets are cheap. Theatre tickets or entry to various shows can be more expensive, and the choice is not always great.

Finally, Malta is, of course, blessed with countless beaches where you can spend your time at no cost at all.

Malta as a retirement destination

According to the Expatra Global Retirement Index, Malta is in the top 20 best places to retire worldwide.

The index is based on the Expatra Global Retirement Survey that asks international retirees to rate their retirement destination’s infrastructure, climate, ease of settling down, value for money, friendliness, and other aspects of life in their retirement destination.

Here's how Malta scores:

Main benefits:

- An affordable retirement program

- Low taxes on foreign pensions

- Lifestyle and climate

- Affordable properties

Traveling to and around Malta

There are direct flights to Malta from most European countries.

Malta is also well-connected to the Middle East and Africa. There are no direct flights from North America. However, layover flights are available. Flights are more frequent during the tourist season.

All international flights arrive at Malta International Airport. It’s the only airport in Malta and serves all of the Maltese Islands. The airport is located on the main island of Malta, between Luqa and Gudja.

Various dedicated bus services connect the airport to the main cities and towns of the island. Taxis and hire cars are also available from the arrivals terminal, which makes it generally easy to access the main locations of Malta.

Public transport

Public transport in Malta is cheap, and you can quickly get around the island using the bus service. It is sometimes up to 3 times cheaper than a taxi and is pretty efficient.

The island of Gozo can be accessed from the Circewwa Harbour, Malta’s most northern point, via a regular ferry. The trip takes just half an hour and is a pleasure in itself.

You can also get to Italy by ferry. The Valletta to Salerno ferry crossing operates once a week and takes about 7 hours.

Internet and mobile connectivity

Malta's average download speed is 30Mbps. Both broadband and mobile internet are available in Malta:

- Broadband speed: up to 1 Gbps; prices start from €30/month

- Mobile internet speed: up to 150 Mbps; prices start from €5/week

Epic, GO, Vodafone, and Melita are the top internet providers in Malta, providing mobile and TV services alongside their internet offerings.

4.5G and 5G are also available on the islands.

Banking & bank accounts for expats living in Malta

Banking services are offered in Maltese and English.

There is at least one bank in every village in Malta, with major banking centers in Sliema, Birkirkara, and Valletta.

The three main banks operating in Malta are HSBC, Bank Of Valletta (BOV), and APS Bank. There are branches of other foreign banks on the island, like Lombard, Banif, etc.

If you wish to open a bank account in Malta, use the bank's New Accounts department, which can be found in almost every branch.

You will generally have to provide details of your current home-based bank account so your new bank can contact them and ask for a bank reference.

After that, the bank has to do internationally required 'know your client' due diligence checks, and then your account will be operative.

It might also make sense to open an international bank account, depending on your circumstances.

- Banking, Saving, & Investments Abroad Guide - all the information you need to understand whether you can benefit from having an international bank account and how to open one.

Malta taxation

Malta generally offers expats favorable tax treatment. The country is trying to attract high-net-worth individuals with its Retirement Program and Residence Scheme. Under these schemes, expats pay just a flat rate of 15% tax on any income they remit to Malta.

Income in Malta is taxable only to the extent that it is remitted to the country, where the top tax rate at the highest margin is 35%, while the capital and overseas capital gains can be remitted tax-free.

There is no minimum income level required, so if you have capital, it is possible to live entirely off capital, tax-free. It is important to seek professional advice to be sure that you stay tax-compliant.

Conveniently for retirees and expats, Malta has neither wealth nor inheritance taxes nor annual property taxes.

When you de-register in your home country as a tax resident and become an expat, advice from an international financial advisor can sometimes make a difference to your financial affairs.

- The Expat Guide To UK Pensions Abroad - understand your pension options and how to maximize your retirement income when living abroad.

Property & housing in Malta

When you move to a new country, the standard advice is to rent a property for at least six months and get to know the country, the area, the property market, and how things work in your new country of residence.

Renting in Malta is a simple process. Foreigners can rent a property with no restrictions.

You will find that most properties in Malta are rented fully furnished. Don't be surprised to see your rented place equipped with dishes, cutlery, cookware, and even rubbish bins. TVs and electronics might also be included.

Short-term rentals (6 months or less) are usually more expensive than long-term rentals (6 months or more).

When you have found a property you like, ensure that your financial obligations, the landlord's financial responsibilities, and any future rent increase are clearly stated in the contract.

Here is a handy tip: utility rates in Malta depend on how many residents/non-residents are registered in the property and the registration type of the property.

Ask your landlord to verify the registration type of your property in writing. You don't want to live in a converted office with lower standards and higher utility rates.

You can also register the property's utilities in your name if possible. To register utilities in your name, you must have a Maltese ID card.

Once you've been through this, you will find how much more you understand about the local property market and how things work regarding housing. You will be more confident when the time comes to buy your own dream house.

- Buying A Property In Malta - everything you need to know to buy your dream house in Malta safely.

Schools and education

There are state, church, and independent schools in Malta. State schools are free for all residents. The core curriculum is taught in Maltese except for English lessons.

Church schools are run by the catholic church and do not charge fees. However, parents do contribute donations and pay for school supplies.

Independent schools include various private and international schools. The most significant advantage is that private schools teach in English.

Here's a list of some of the most popular international schools in Malta:

- St. Edward's College - Located in Cottonera, St. Edward's College is a renowned international school offering education from kindergarten to upper secondary level.

- Verdala International School - Situated in Pembroke, Verdala International School provides a well-rounded education for students aged 3 to 18.

- QSI International School of Malta - Situated in San Gwann, the QSI International School of Malta follows the American educational model and offers classes from preschool to secondary level.

- San Anton School - Located in Mosta, San Anton School is a well-established international school that caters to students from pre-kindergarten to upper secondary level.

- Malta Crown School - Located in St. Julian's , Malta Crown School provides primary and secondary education based on the English National Curriculum and the Russian State General Education Program.

Higher education

There are state-run and private universities in Malta. State universities are free for EU students and citizens of Malta. Non-EU students have to pay tuition fees.

Private universities charge fees and can be pretty expensive.

According to UniRank, the top state university is the University of Malta, while the American University of Malta is the best-ranking private one.

Healthcare in Malta

Malta is quite proud of its healthcare system. The quality of healthcare is generally good, and the insurance cost is much less than in many other parts of the world.

EU citizens staying in Malta for three months or less can use the European Health Insurance Card (EHIC) and receive medical attention from public clinics and hospitals at no cost.

Non-EU citizens must purchase insurance that covers medical treatments overseas and ensures that it also covers medical evacuations, as some policies do not.

Private healthcare

Private healthcare is popular with many Maltese citizens even though they qualify for free state healthcare. Those who can pay for private treatment do so because, as with anywhere else in the world, the private hospitals in Malta offer better services.

Public healthcare

Malta has one main public hospital, Mater Dei, located in Msida. It is a general teaching hospital offering hospital and specialist services.

There are eight public health centers in Malta and Gozo, which provide general practitioner and nursing services, as well as specialized health services such as immunization, speech and language therapy, antenatal and postnatal clinics, and wound clinics.

There are also several private hospitals and clinics which offer services by general practitioners, specialist doctors, and dentists.

UK citizens and an S1 (E121) form

If you reside in Malta and receive a state UK pension, you may be entitled to state healthcare paid for by the UK. You need to get an S1 (E121) form before moving to Malta.

You can apply for your S1 form via the International Pension Centre at 0191 218 7777.

When you arrive in Malta, register your S1 form with the Maltese Ministry of Health Entitlement Unit, which will issue you a certificate of entitlement. You must show this form when seeking treatment in public health facilities.

Private health insurance and pay-as-you-go

If you prefer to receive private treatment, as many expats do, you must consider buying health insurance or using the pay-as-you-go option (self-funding).

Self-funding, i.e., paying as you go, is only worth considering if you are sure that the risk of something bad happening to your health is minimal.

In such cases, self-funding is an excellent way to avoid paying for insurer profit, insurance taxes, and administrative costs.

Another solution may be to buy health insurance and have high excesses to be insured against the most expensive misfortunes only and pay out of your pocket for minor treatments.

In this case, your monthly insurance premiums can be pretty low, and you will have peace of mind knowing that you are covered in a critical emergency.

Taking out an international health policy has advantages: it covers you in as many countries as you wish to travel to, so you are free to travel without taking out new health cover for every country you want to visit.

To ensure you get the best value for money, compare international health insurance options from various providers to find the best deal.

How To Access Best Quality Affordable Healthcare When You Retire Abroad is a detailed guide to essential paperwork needed to access healthcare abroad, health insurance, tips on saving money on private health plans, and much more.

The biggest hospitals and clinics in Malta include:

- St. James Hospital in Sliema: Malta's largest private hospital offering various medical services and specialties.

- Mater Dei Private Hospital in Birkirkara

- St Thomas Hospital in Qormi

- St Luke's Hospital in Pietà

- Mount Carmel Hospital in Attard

- Gozo General Hospital in Gozo

Benefits of setting up a business in Malta

Setting up a business in Malta can have many benefits: Malta’s taxation policies guarantee up to 6/7 tax refunds to foreign shareholders (both residents and non-residents), full tax exemptions for holding companies, and no withholding taxes or stamp duties in case of profit repatriation.

Company formation and maintenance costs are pretty low, so it is no wonder that the number of foreign investors setting up companies in Malta is growing every year.

Setting up a business in Malta is generally straightforward and relatively fast.

For opening a private Limited Liability Company, €1,165 of share capital deposit is required. For a public company, the minimum share capital is approximately €46,600.

Both types of companies must have at least two shareholders.

Corporate tax

Malta rivals Cyprus as one of the best low-tax destinations for entrepreneurs and businesses inside the EU. These two sweet Mediterranean islands are competing hard with each other to attract more wealthy individuals and companies to their sunlit shores.

In such a case, you would imagine Malta’s corporate tax would be very low. Yet, it is not!

Companies registered in Malta are considered to be residents and domiciled in Malta; thus, they are subject to tax on their worldwide income at 35%.

At first glance, Malta’s corporate tax rate of 35% seems to be extortionate compared to Cyprus’ 12.5%.

However, it’s not that straightforward. Various deductions and refunds are available. Here lies the secret of Malta’s attractiveness for investors – in some instances, the refunds bring investors’ total tax liability to a mere 5% or sometimes even zero.

Tax refunds

Shareholders of a Maltese company receive dividends free of Maltese tax. Upon receiving dividends, the shareholders can claim a refund of all or part of the Malta tax paid by the company on the income distributed as dividends.

A shareholder of a Maltese company can claim 6/7ths of the tax paid by the company in respect of trading income and 5/7ths of the tax paid by the company on interest and royalties. The refund is reduced to 2/3rds, where the distributing company claims double taxation relief.

When they meet specific criteria, holding companies' income is exempt from tax.

Both resident and non-resident shareholders are entitled to claim tax refunds.

For example, a Maltese company declares profits of €100,000, on which it pays €35,000 of corporation tax and distributes the rest €65,000 as dividends. The shareholders then claim a tax refund of 6/7th of the €35,000 tax paid, which amounts to €30,000 being refunded. The total tax paid is €5,000 (5%).

Tax refunds are Malta tax-exempt and payable within a deadline of a few weeks.

Holding companies and participating exemption

Malta is fast becoming one of the best jurisdictions for forming a holding company.

There is a reason why a growing number of multinational groups opt to set up their holding company in Malta.

Malta offers participating exemption, which guarantees zero tax on dividends from such holdings and gains arising on the disposal of such holdings.

For a Maltese resident company to hold a “participating holding” in a company incorporated abroad, it must hold at least 10% of the equity shares in the non-resident company. If this condition is not met, there are several alternative tests to define whether the company is eligible for participating exemption.

The holding companies that satisfy all the conditions can enjoy 100% income tax relief on the dividends derived from a participating holding and on any capital gains earned on the sale of shares.

Income tax

For non-domiciled residents of Malta, income is taxable only to the extent that it is remitted to the country. The top tax rate at the highest margin is 35%, while the capital and overseas capital gains can be remitted tax-free. No minimum income level is required, so if you have capital, you can live entirely off capital tax-free.

It is essential to seek professional advice to be sure that you stay tax-compliant.

In Malta, the taxation of an individual's income remitted into the country is progressive; the rates are from 0% to 35%, depending on the income.

You can be taxed as a single person, a married couple, or a parent. Depending on your category, there is a tax allowance of €9,100, €12,700, and €10,500, respectively.

Above the tax allowance, the rates are 15%,25%, and 35%.

Conveniently for expats, Malta has neither wealth nor inheritance taxes nor annual property taxes.

Where to live in Malta

Malta offers a variety of attractive cities and towns to call home. Here's a list of the most popular locations:

Valletta: The capital city known for its rich history, architecture, and vibrant cultural scene. Apartments start from €300,000 onwards.

Sliema: A bustling coastal town with a lively atmosphere, popular among young professionals and expats. Apartments start from €350,000 onwards. Find out more in our Living in Sliema guide.

St. Julian's: A vibrant town renowned for its entertainment options, including restaurants, bars, and nightclubs. Apartments start from €350,000 onwards.

Mdina: The old capital city, also called the "Silent City," known for its medieval charm and narrow streets. Townhouses start from €500,000 onwards.

Birgu (Vittoriosa): A historic city with a picturesque waterfront, offering a tranquil and traditional lifestyle. Townhouses start from €400,000 onwards.

Rabat: Situated close to the ancient city of Mdina, Rabat is a peaceful town filled with historical sites and quaint streets. Apartments start from €250,000 onwards.

Marsaskala: A coastal town popular among families, known for its scenic bay, promenade, and relaxed atmosphere. Apartments start from €250,000 onwards.

Mosta: Home to the famous Rotunda of Mosta, this town offers a mix of modern amenities and a charming traditional core. Apartments start from €200,000 onwards.

Please find more information and insight in our guide to Malta's best places to live for expats.

Living in Malta - summary

Overall, Malta is a very beautiful place to retire to and has a lot to offer those who choose it as their home.

It has a lovely Mediterranean climate, a favorable tax regime, no language barrier, good travel links, a moderate cost of living, splendid beaches and historical sites, and very low crime rates. It is also relatively easy to acquire property in Malta.

The island offers a chance for a tranquil life, and if that's what you seek, it can be an ideal nation to consider.

You might find useful:

- The Best Places To Live In Malta For Expats - an overview of the most popular expat locations in Malta that can help you start your research into where in Malta you want to live;

- A Complete Guide To Buying A Property In Malta - understand the process and how to protect yourself when buying a property in Malta;

- Visit our Malta Country Guides page for more guides and information on Malta.

- Haven't found what you were looking for? Comment below with your question, and we'll do our best to help.

Helpful external links:

- Find the details about Malta's Retirement Program and how to apply on the government website.

- Malta Health Services website - information about services, hospitals, etc.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.