Cyprus’ sunny weather and lenient fiscal policy towards expats and businesses make it a very attractive destination to move to.

This guide will give you better insight into what it’s like living in Cyprus as an expat; we take a look at the various aspects of moving to the Republic of Cyprus so that you can decide if this beautiful island is the right place for you.

In this guide:

- Cyprus highlights: a general overview of Cyprus as an expat destination.

- Cyprus residency options for non-EU citizens: how to get a long-term residency.

- The cost of living in Cyprus: how much money you need to have a comfortable life in Cyprus.

- Cyprus as a retirement destination.

- Travel connections and infrastructure.

- Property: what's available and average costs.

- Healthcare and education: your options and costs.

- Taxes: how expats can save money with Cyprus Non-Dom program.

- Where to live: best areas to live for expats.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Cyprus' highlights

Cyprus is a great place to live, both for families and retirees. The island is renowned for its fabulous beaches, but it also draws people from all over the world with its stunning mountains and little valleys full of vineyards, orange orchards, and olive groves.

Living in Cyprus can bring many lifestyle and financial advantages. Life, in general, is more relaxed, and there are more opportunities to spend time outdoors.

The cost of living in Cyprus is generally lower, taxes are more lenient, and property prices are generally more affordable than in the USA, Northern Europe, and the UK.

The lifestyle is typically Mediterranean with its slow, laidback pace and “enjoy the moment” attitude. Fruit, veg, fish, and various seafood can be bought fresh all year round. Colorful and inexpensive fruit and veg markets are dotted everywhere.

The island enjoys the warmest climate in the European Union, with some 320 days of sunshine per year.

English is widely spoken across the island.

The Republic is an officially recognized state and a member of the EU.

It has a more dynamic economy, more sophisticated facilities, and multiple double taxation treaties with a wide range of countries across the globe (including the UK, the USA, Canada, etc.). All of this makes tax matters much simpler for private persons and businesses and makes Cyprus one of the best retirement destinations in the world.

Residency in Cyprus for non-EU citizens

The Republic of Cyprus is an EU member state, so all EU nationals have a right to come and live in Cyprus without too much paperwork.

As a non-EU citizen, you do not have automatic rights to settle down in Cyprus.

You can stay in South Cyprus without a visa for 90 days. After that, if you want to live there, you will need to go through a residency application process, which is the same for all non-EU citizens.

As the process can be quite complex, consider consulting a reputable immigration lawyer.

Non-EU citizens planning to spend more than 90 days every 180 days in a year in Cyprus should be looking at applying for Cypriot temporary residence, known as Pink Slip.

Temporary Residence Permit

A Pink Slip, also known as a Temporary Residence Permit, allows you to live in Cyprus for one year with the option to renew. This opens doors to:

- Visa-free travel and return to Cyprus

- Residency for your family

- School enrollment for your children

Requirements:

- Sufficient income to cover living expenses (around €24,000 - €30,000 annually for a family of 3)

- Proof of accommodation (rental agreement or property ownership)

- Health insurance

- Medical exams (first permit only)

- Bank guarantee (varies by nationality)

Application Process:

- Gather Documents:

- Application form

- Proof of accommodation

- Bank statements showing income transfers from abroad

- Health insurance

- Medical exam results (first permit only)

- Proof of income

- Passport copy

- Family certificates (if applicable)

- Criminal background check

- Submit Application: Apply to the Immigration Unit closest to you. The Immigration Units are in Nicosia, Limassol, Larnaka, Paphos, and Famaguatsa.

- Processing Time: Expect a decision within 3 months. You can stay legally while your application is processed.

Annual renewal:

Renewing your Pink Slip is similar to the initial application but without medical exams or updated criminal records.

Tips:

- Transferring money from abroad to a Cypriot bank account strengthens your renewal application.

- Use a credit card or visa for everyday expenses instead of cash.

Cyprus Government Fees:

- Application: €70 per person

- Registration: €70 per person (first time only)

Permanent residency may be applied for after five years.

Residency in Cyprus through buying a property

A simpler route is the Cyprus Residency by Investment Program. Under this program, you can obtain a Cypriot permanent residence permit (PRP) in just two months through a property purchase starting from €300,000 (plus VAT).

The cost of living in South Cyprus

You will find that the cost of living in Cyprus is generally on par with other South European countries and is cheaper than in the UK, Northern Europe, and North America.

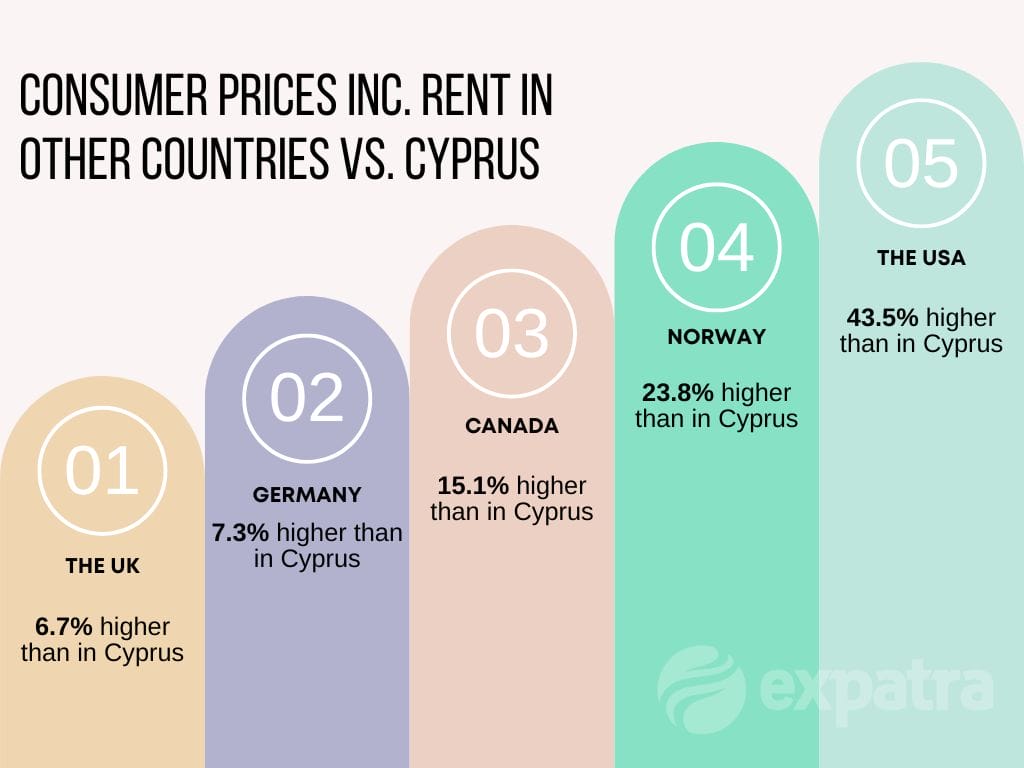

Here's how Cyprus' cost of living, including rent, compares to some Northern European and North American countries:

It's worth noting that rent is the highest expense. If you take rent out of the equation, the cost of living is quite low. As a homeowner in Cyprus, you will have much more spare cash than if you are renting.

Day-to-day shopping is much cheaper if you buy local produce, and you can still buy a beautiful coastal property for a good price.

When you have settled down and found lovely local cafes and restaurants catering for residents (as opposed to tourists), you will find that dining out is cheaper, too, and the food is great, as a rule.

Nicosia, as the capital, might feel like the most expensive city, and this is one of the reasons expats prefer to live in other locations. If, however, you want all the sophistication of urban living and not too huge tourist crowds in summer, it’s worth paying a bit more to live in Nicosia.

The most considerable savings when you move to Cyprus come from a great taxation regime for retirees and the Cyprus Non-Dom Program.

Housing and accommodation

Housing costs vary significantly based on location and type of accommodation.

In urban centers like Nicosia and Limassol, rental prices for apartments can be higher compared to more rural areas.

On average, monthly rents for a one-bedroom apartment range from €800 to €1,100, while larger apartments may cost around €900 to €1,900, and even higher for more luxurious options.

Here's an average rent in various locations:

Limassol:

- Average rent for a 1-bed apartment: €800-€1,000 per month

- Average rent for a 3-bed house: €1,300-€1,900 per month

Nicosia:

- Average rent for a 1-bed apartment: €700-€1,100 per month

- Average rent for a 3-bed house: €1,300-€2,000 per month

Paphos:

- Average rent for a 1-bed apartment: €700-€800 per month

- Average rent for a 3-bed house: €1,000-€1,400 per month

Larnaca:

- Average rent for a 1-bed apartment: €600-€850 per month

- Average rent for a 3-bed house: €1,000-€1,400 per month

Ayia Napa:

- Average rent for a 1-bed apartment: €500-€800 per month

- Average rent for a 3-bed house: €950-€1,300 per month

Food and dining

The cost of food in Cyprus can be reasonable, particularly if you opt for local markets and shops. A meal at a mid-range restaurant might cost around €35 to €45 per person, while purchasing groceries for a week could amount to approximately €60 to €80 per person.

Utilities and services

Basic utilities like electricity, water, and heating for a standard apartment typically amount to around €160 per month. Internet services are available at an average cost of about €40 to €60 per month.

Healthcare costs

Healthcare in Cyprus is of a high standard and relatively affordable. Expats may need to enroll in the National Health Scheme (Gesy) or consider private health insurance.

If you consider paying as you go, medical consultations might range from €40 to €80.

Cyprus as a retirement destination

According to the Expatra Global Retirement Index, Cyprus is in the top ten best places to retire in the world.

The index is based on the Expatra Global Retirement Survey that asks international retirees to rate their retirement destination’s infrastructure, climate, ease of settling down, value for money, friendliness, and other aspects of life in their retirement destination.

Here's how Cyprus scores:

Cyprus' main strong points as a retirement destination are the following:

- No tax on foreign retirement income

- Affordable residency-through-investment program

- Good healthcare provision

- Climate and lifestyle

Traveling to and from Cyprus

Air travel

Cyprus has two primary international airports - Larnaca International Airport (LCA) and Paphos International Airport (PFO).

It takes around five hours to fly to Larnaca or Paphos from most major airports in Northern Europe.

A number of airlines offer flights to Cyprus, including low-budget EasyJet, and the tickets are almost always reasonably priced (except during the school holidays, of course).

With over 250 direct routes, Cyprus can be accessed from major European capitals and other international hubs.

Sea travel

If you prefer maritime routes, Limassol Port and Larnaca Port provide ferry routes to and from Italy and Greece.

The Grimaldi Lines, an Italian ferry company, operates a route connecting Limassol in Cyprus to the port of Salerno in Italy.

There are seasonal routes between Greece and Cyprus traveling from June to September. The ferry journey between Piraeus (Greece) and Limassol takes around 30 hours.

Taxes in Cyprus

Personal income while living in Cyprus is taxed on a tiered basis, with quite a substantial tax-free allowance of €19,500.

The maximum income tax rate on personal income in Cyprus is presently set at 35% for income in excess of €60,000.

Business tax rates and intellectual property

There is a 2.5% tax on royalties received in connection with intellectual property rights held in Cyprus. The regular corporate tax is 12.5% on profits.

Taxes on retirement income while living in Cyprus

Pensioners retiring to Cyprus have two options:

- To pay a fixed tax rate of 5% a year on their pension income for amounts exceeding €3,420

- To opt for Cyprus’ tiered income tax system

Depending on your income, you can choose between the options to make sure you benefit fully from the taxation rules. You can find out which option can suit you better in our guide on Taxes In Cyprus For Residents.

Buying property

South Cyprus offers a variety of property types, from apartments to villas to commercial properties and land.

- Apartments: Apartments are common and come in various sizes and locations. Prices can range from €125,000 to €350,000 or more, depending on factors like proximity to the sea, size, and amenities.

- Villas: Villas offer more space and privacy and are available in a wide range of styles and locations. Prices for villas typically start from around €200,000 and can go up to several million euros for luxury properties in prime locations.

- Townhouses: Townhouses are a popular choice, often found in residential complexes with shared amenities. Prices for townhouses generally range from €150,000 to €400,000.

- Traditional Stone Houses: These charming properties, often located in historic villages, can range from €120,000 to €500,000, depending on their size and condition.

- Land: If you prefer to build your own home, land is available for purchase. Prices for land can vary widely depending on location and size, ranging from €20,000 per 1,000 square meters to several hundred thousand euros for prime plots.

- Commercial Properties: Commercial properties like shops and offices are also available for investment purposes. Prices vary significantly based on location and size, with some retail spaces starting at €100,000 and larger commercial properties going into the millions.

For more information and details on the buying process, read our guide on buying property in South Cyprus.

Safety

Cyprus is one of the safest places in Europe. However, it is worth learning about local history to make sure you can avoid awkward situations and sensitive topics.

The island is split into the internationally unrecognized Turkish Republic of Northern Cyprus and the Greek-majority Republic of Cyprus.

These entities are separated by the Green Line, a buffer zone monitored by the United Nations. The division has long been a deeply sensitive issue for local residents.

Apart from the unresolved conflict, there are no significant threats to safety.

Crime

It maintains impressively low crime rates, with a reported crime rate of approximately 13.8 per 1,000 residents in recent years.

Compared to other European countries of similar size, there is less violent crime.

Crime targeting visitors in Cyprus is infrequent, yet it's wise to exercise caution. Keep your passports, money, and valuables secure at all times.

Of course, there are instances of non-violent and non-confrontational street crimes, and it’s better not to give petty criminals an opportunity. But on the whole, Cyprus is a safe and peaceful place to live.

Illegal drugs

Cyprus strictly forbids illegal drugs, including laughing gas. Possession can result in fines or imprisonment under their zero-tolerance policy.

Using cameras

Refrain from photographing secure zones, like military sites, to prevent potential arrest.

Water safety

Swimming is mostly safe, yet watch out for strong currents. Adhere to warnings and swim only in authorized beach areas.

Natural disasters

Wildfires

- Summers bring forest fires and wildfires due to dry conditions. These fires are hazardous and erratic. Exercise caution in woodlands, extinguish cigarette ends responsibly, and restrict barbecues to designated areas. Report fires to emergency services at 112 or 1407.

Earthquakes

- Earthquakes and tremors occur in Cyprus. Make sure you know the safety protocols and adhere to advice from local authorities to stay safe during such events.

Healthcare

Gesy is a universal healthcare system based on contributions from the residents, which is free to users (with small co-payments for certain services), subject to an annual cap.

Employees, pensioners, and income earners pay 2.65 percent of their income in the National Health Insurance System, employers pay 2.9 percent, and the self-employed 4 percent with tax capped on incomes above €180,000 (£161,440).

Healthcare benefits cover a standardized basket of medical services, including hospitalization, surgery, pharmaceuticals, general and specialist medical care, and laboratory services. Co-payments are capped at a maximum of €300 per year.

Many expats prefer to have private health insurance either from a local provider or an international one. To make sure you get the best value for money, compare international health insurance options from various providers to find the best deal.

Hospitals and clinics

Healthcare facilities are generally of high quality in Cyprus. Private clinics and hospitals have staff speaking various languages, with English being very common.

Hospitals:

- Nicosia General Hospital (Public)

- Limassol General Hospital (Public)

- Larnaca General Hospital (Public)

- Makarios Hospital in Nicosia (Pediatric)

- Mediterranean Hospital of Cyprus in Limassol (Private)

- American Medical Center in Nicosia (Private)

- Evangelismos Private Hospital in Paphos

- Andreas Syggros Hospital in Paphos (Public)

Clinics and Specialized Centers:

- Apollonion Private Hospital in Nicosia

- Ygia Polyclinic Private Hospital in Limassol

- Kyperounta Hospital for Rehabilitation

- Mediterranean Fertility Institute in Limassol

- Orthopedic and Rehabilitation Center in Nicosia

- Mediterranean Institute of Plastic Surgery in Nicosia

Pharmacies

Pharmacies, often identified by a Green Cross sign, are widespread across Cyprus, even in smaller towns and villages. They dispense both prescription and over-the-counter medications.

While most pharmacies operate during regular business hours, some pharmacies, known as "24-hour pharmacies," provide services around the clock.

Pharmacy services

In addition to dispensing medications, pharmacies in Cyprus often offer a range of other services, including:

- Providing medical supplies and healthcare products.

- Administering vaccinations and flu shots.

- Offering health checks such as blood pressure measurements.

- Providing advice on nutrition, supplements, and wellness.

Schools and education options

If you are moving with children, you can choose whether to send them to international, private, or state schools, depending on your goals, budget, and preferences.

International schools

Cyprus hosts a variety of international schools that follow internationally recognized curricula such as the International Baccalaureate (IB) program, British National Curriculum, or American curriculum. There are about 13 private schools in the Limassol area, 7 - in Nicosia, and quite a few in the Paphos area.

Main international and private schools:

- American International School in Cyprus in Nicosia

- The International School Of Paphos

- The Heritage Private School - an English medium IGCSE school situated in the village of Palodia

- The International School of Nicosia

- The Falcon School in Nicosia

- Aspire Private British School in Paphos

- Silverline Private School near Limassol

Cost of schooling

Tuition fees in private and international schools range from €5,000 to €9,500 per annum, depending on the year. Full-time boarding fees can go as high as €26,000 a year.

Local state schools

If you want cultural immersion and integration, you might consider enrolling your children in local schools. While the language of instruction is typically Greek, many schools offer support for non-Greek-speaking students.

Enrolling in public schools can provide a unique opportunity for children to become proficient in Greek and experience the local culture.

Universities in Cyprus

Compared to many Western European countries, the cost of university education in Cyprus is relatively affordable. On average, the tuition fee for a Bachelor's degree can be around €3,400 to €8,000 per year. A Master's degree has a tuition fee of around €5,000 and €10,000 per year.

University of Cyprus (UCY) is one of the top public universities based in Nicosia. The Cyprus University of Technology and the Univerity of Nicosia are also very reputable establishments.

All three universities are in the top 1000 of the best universities in the world according to the Times Higher Education World University Rankings.

Internet

Internet connection is pretty good in major cities and towns but might be a bit inconsistent outside of urban centers.

The prices are higher than in mainland Europe, and there's not much competition.

Typically, all providers offer a range of ADSL, VDSL, and fiber-optic packages. The offered speeds range from 8 Mbps to 1 Gbps. Prices start at around €25 per month for an 8 Mbps connection with a 100 GB data allowance, going up to €80 per month for a 1 Gbps connection with unlimited data.

Where to live in Cyprus

Here are some of the most popular expat locations in South Cyprus:

1. Limassol: Limassol, located on the southern coast, is the country's second-largest city and a thriving business hub. Expats are drawn to its cosmopolitan lifestyle, beautiful beaches, and vibrant nightlife.

2. Paphos: Paphos, situated on the southwestern coast, offers a relaxed Mediterranean lifestyle. It's known for its rich history, archaeological sites, and pleasant climate. Many retirees choose Paphos for its serene atmosphere. You will find more information in our Living In Paphos guide.

3. Nicosia: As the capital city, Nicosia is the political and economic center of Cyprus. It has a mix of modern and historical attractions, along with a bustling city life. Discover more in our Living In Nicosia guide.

4. Larnaca: Larnaca, on the southeastern coast, is home to Cyprus' main international airport. It offers a mix of historical sites, beautiful beaches, and a lively promenade, making it a popular choice for expats.

5. Ayia Napa: Known for its vibrant nightlife and stunning beaches, Ayia Napa attracts younger expats and tourists. It's a hotspot for entertainment and watersports.

6. Protaras: Located near Ayia Napa, Protaras offers a more relaxed atmosphere with beautiful beaches and family-friendly amenities. It's popular among expat families and retirees.

7. Tala: Tala, a village in the hills near Paphos, provides a peaceful and picturesque setting. Expats often choose this area for its stunning views and proximity to amenities.

8. Kato Paphos: This is the lower part of Paphos, near the seafront and harbor. It's known for its historical sites, restaurants, and entertainment options.

For more information and insights, read our guide on the best places to live in South Cyprus.

South Cyprus and North Cyprus - differences and commonalities

The island is home to two countries – the Republic of Cyprus and the Turkish Republic of Northern Cyprus (TRNC). There is also a buffer zone, the so-called Green Line, between the two countries, which the UN created.

Both republics are stable countries with relatively low crime rates. Both the northern and southern areas welcome expats and have quite large expat communities.

The cost of living in North Cyprus is significantly lower. If you want a great value-for-money retirement destination in a beautiful Mediterranean setting, then North Cyprus can be a perfect choice. Forbes ranked North Cyprus as the top destination for the best beachfront buys in 2021.

However, the Southern economy is more stable, and regulations are more transparent and EU-compliant. Also, if you wish to set up a business or use the advantage of lenient tax policies in a white-listed reputable jurisdiction, the Republic of Cyprus is an optimal choice.

Foreigners can buy property in North and South Cyprus subject to permission (which is just a formality).

Traveling between North and South Cyprus

Anyone can cross the border between North and South Cyprus in both directions if they comply with the existing visa rules.

EU citizens are free to cross the border between the countries.

Non-EU citizens, including Britons, need to comply with visa requirements specified by the EU for their country of citizenship. The good news is that Brits can enter any EU country without a visa and stay there for up to 90 days.

So, the answer is yes, you can travel easily across the border in both directions, but only at designated points, with the most convenient ones being in Nicosia – the capital of both republics.

Crossing the border is not a big deal, although you might have to queue sometimes, especially if you do it by car.

If you are a resident of the Republic of Cyprus, when crossing to the TRNC, you will have to get entry clearance at the checkpoint and insure your car (if your car is registered in the Republic of Cyprus).

The clearance is free of charge and can be valid for up to 90 days; short-term car insurance is available on the spot as well.

Expats living in Cyprus on both sides frequently go to and fro and think nothing of it. Once you’ve done it, you’ll realize it’s very easy. Shopping and entertainment options are more abundant and sophisticated in the South, while nature, beaches, and major historical sites are more impressive in the North.

The pros and cons of living in Cyprus

Although the island is undeniably stunning and is a desirable location for many expats, moving to Cyprus has both advantages and disadvantages. It's good to become aware of both before you move.

The pros:

- There is fantastic weather and a lot of bright and long sunny days.

- There are many opportunities for an active outdoor lifestyle: great golf courses and stunning mountain hikes. You can do water sports and even go skiing in the Troodos Mountains in the winter months.

- There are plenty of beautiful beaches to choose from for a lazy day out by the sea.

- A lot of locals speak enough English, so learning Greek is not a must. However, if you make an effort, your local community will greatly appreciate it.

- Low taxes and a lower cost of living are a big relief for your bank account.

- There are great expat communities all over the island.

The cons:

- January and February can be quite dreadful as it rains often and can feel quite cold.

- July and August can feel unbearably hot, so air-con is necessary.

- The internet can be somewhat patchy and costly.

- Imported goods are expensive.

Living in Cyprus: final thoughts

Cyprus is a wonderful place. It’s sunny and friendly and represents a good retirement location. The tax rates and cost of living are softer on your bank account compared to major Northern European and North American countries.

However, just like with any other retirement destination, to find out whether Cyprus is a good fit for you, you need to try living there. So, rent a property and spend some time in the country in summer and in winter to see whether you can call it home.

You might find useful:

- Best Places To Live In The Republic Of Cyprus - a detailed overview of the best expat locations in South Cyprus.

- The Expat Guide To UK Pensions Abroad - find out what pension options are available to you when you move abroad.

- The Essential Guide To Cost-Effective International Removals - read about international removals options and how you can keep your costs down while getting a quality service.

Helpful external links:

- Government guidance for British citizens moving to or living in Cyprus.

- Find your country's embassy or consulate in Cyprus.

- Find information on temporary residence permits for non-EU citizens in the Republic of Cyprus on the Civil Registry and Migration Department site.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.