Quick Read Summary

Canada's best cities have shifted in 2025. Ottawa now ranks first, overtaking Toronto. Mid-sized cities like Halifax and Calgary offer better value. Remote work has changed everything. This guide covers costs, healthcare, safety, and lifestyle in Canada's top 10 cities.

Currency Note: All prices in this guide are shown in Canadian dollars (CAD) with conversions to British pounds (£) and US dollars (USD) for easy comparison. Exchange rates as of August 2025: CAD $1 = £0.58 GBP = $0.73 USD. View current rates

Important: USD refers to US dollars throughout this guide. When you see "$" alone in Canada, it always means CAD (Canadian dollars).

Table of Contents

- Why This Guide Matters Now

- Canada's Top 10 Cities Rankings

- Essential Decision Factors

- Working in Canada

- City-by-City Analysis

- Special Considerations by Group

- Immigration Pathways

- Financial Planning

- Healthcare Navigation

- Resources & Next Steps

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

Why This Guide Matters Now

Choosing where to live in Canada has never been more important or complex.

Housing costs have stabilised in most markets. Remote work has opened new possibilities. Some cities have emerged as surprise winners. Whether you're planning retirement, following career opportunities, or seeking a lifestyle change, this guide provides the clarity you need.

We've analysed 30 Canadian cities using Statistics Canada data, CMHC housing reports, and insights from Expatra's network of over 5,000 expats. Here's what actually matters in 2025.

Sources & Methodology: This guide combines official government data (updated quarterly), real estate market analysis from CREA, healthcare statistics from CIHI, and verified expat experiences.

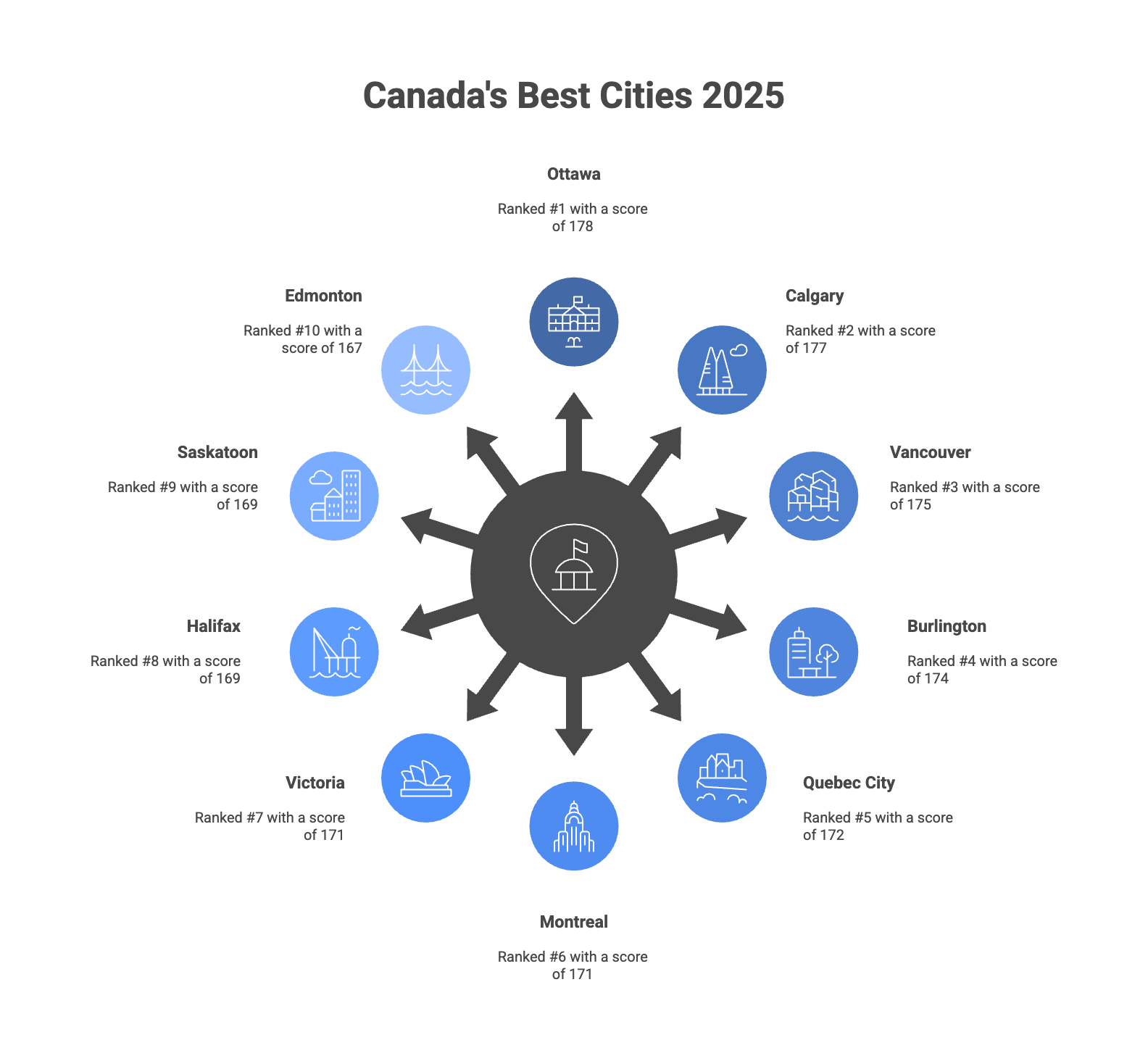

Canada's Top 10 Cities: The 2025 Rankings

At a Glance

Based on our analysis of affordability, safety, healthcare access, job market, and quality of life:

| Rank | City | Province | Score | Best For |

|---|---|---|---|---|

| 1 | Ottawa | Ontario | 178/200 | Government workers, families |

| 2 | Calgary | Alberta | 177/200 | Young professionals, outdoor enthusiasts |

| 3 | Vancouver | British Columbia | 175/200 | Tech workers, mild climate seekers |

| 4 | Burlington | Ontario | 174/200 | Families, safety-conscious |

| 5 | Quebec City | Quebec | 172/200 | Budget-conscious, culture lovers |

| 6 | Montreal | Quebec | 171/200 | Young professionals, artists |

| 7 | Victoria | British Columbia | 171/200 | Retirees, government workers |

| 8 | Halifax | Nova Scotia | 169/200 | Remote workers, first-time buyers |

| 9 | Saskatoon | Saskatchewan | 169/200 | Families, value seekers |

| 10 | Edmonton | Alberta | 167/200 | Festival lovers, families |

What Changed Since 2024?

Winners:

- Ottawa jumped 3 spots (improved housing affordability)

- Halifax entered the top 10 (tech boom, remote work hub)

- Calgary climbed 2 spots (economic diversification beyond oil)

Notable Changes:

- Toronto dropped to #11 (housing costs, congestion)

- Smaller cities gained ground (remote work impact)

- Prairie cities showed strong economic growth

Essential Factors to Consider

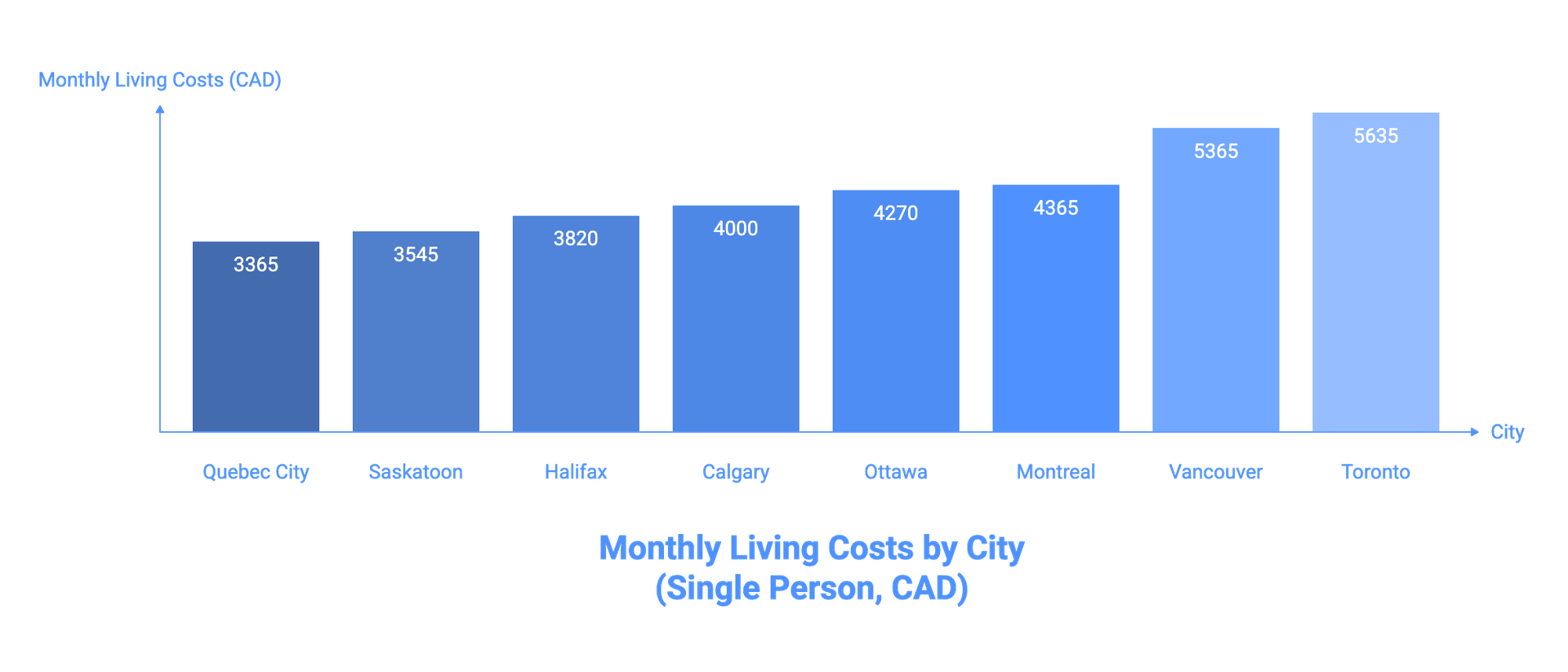

1. Real Cost of Living (August 2025 Data)

Understanding true costs helps you plan better. Here's what you'll actually spend:

Monthly Living Costs (Single Person): All amounts shown: CAD (Canadian) / £ GBP / $ USD

| City | Monthly Cost | What's Included |

|---|---|---|

| Quebec City | CAD $3,365 / £1,952 / $2,456 | Rent (1-bed), groceries, transport, utilities, internet, entertainment |

| Saskatoon | CAD $3,545 / £2,056 / $2,588 | Same basket of goods |

| Halifax | CAD $3,820 / £2,216 / $2,789 | Same basket of goods |

| Calgary | CAD $4,000 / £2,320 / $2,920 | Same basket of goods |

| Ottawa | CAD $4,270 / £2,477 / $3,117 | Same basket of goods |

| Montreal | CAD $4,365 / £2,532 / $3,186 | Same basket of goods |

| Vancouver | CAD $5,365 / £3,112 / $3,916 | Same basket of goods |

| Toronto | CAD $5,635 / £3,268 / $4,114 | Same basket of goods |

Source: Statistics Canada Consumer Price Index, August 2025

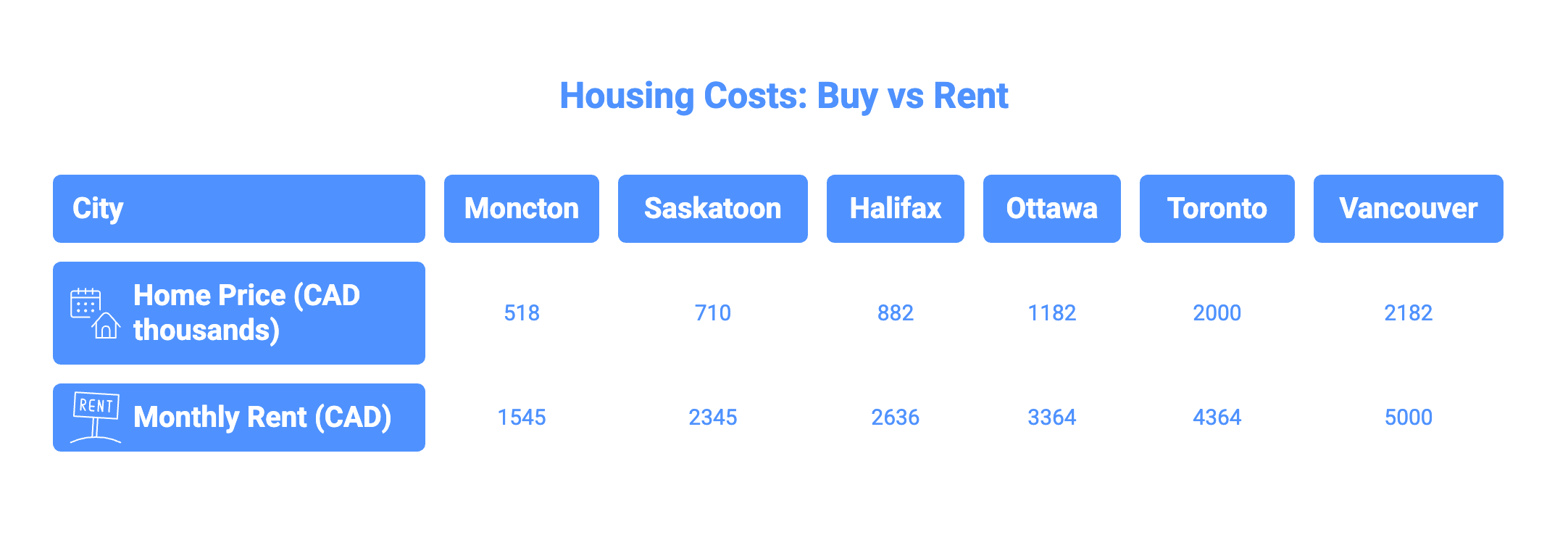

2. Housing: Buy or Rent?

Average Home Prices (August 2025): Source: Canadian Real Estate Association

| City | Average Home Price | 1-Bed Rental/Month |

|---|---|---|

| Moncton | CAD $518,000 / £300,440 / $378,140 | CAD $1,545 / £896 / $1,128 |

| Saskatoon | CAD $710,000 / £411,800 / $518,300 | CAD $2,345 / £1,360 / $1,712 |

| Halifax | CAD $882,000 / £511,560 / $643,860 | CAD $2,636 / £1,529 / $1,924 |

| Ottawa | CAD $1,182,000 / £685,560 / $862,860 | CAD $3,364 / £1,951 / $2,456 |

| Toronto | CAD $2,000,000 / £1,160,000 / $1,460,000 | CAD $4,364 / £2,531 / $3,186 |

| Vancouver | CAD $2,182,000 / £1,265,560 / $1,592,860 | CAD $5,000 / £2,900 / $3,650 |

Important: Housing prices are highly volatile. Verify current prices at CREA.ca for buying and Rentals.ca for renting before making decisions.

3. Healthcare Access: What Newcomers Need to Know

Coverage Timeline:

- 3-month waiting period in all provinces except BC (immediate coverage)

- Private insurance required during waiting period (CAD $150-300/month per person)

- Emergency care is always available regardless of coverage

Healthcare Accessibility by City: According to the Canadian Institute for Health Information, as of 2025:

- 4.6 million Canadians lack a family doctor

- Walk-in clinics are available in all major cities

- Virtual care options are expanding rapidly

Best Healthcare Access:

- Toronto: 45+ hospitals, shortest specialist wait times

- Montreal: Excellent hospitals, some French required

- Vancouver: Top-rated facilities, longer wait times

- Ottawa: Strong coverage, government employee benefits

- Calgary: Modern facilities, reasonable wait times

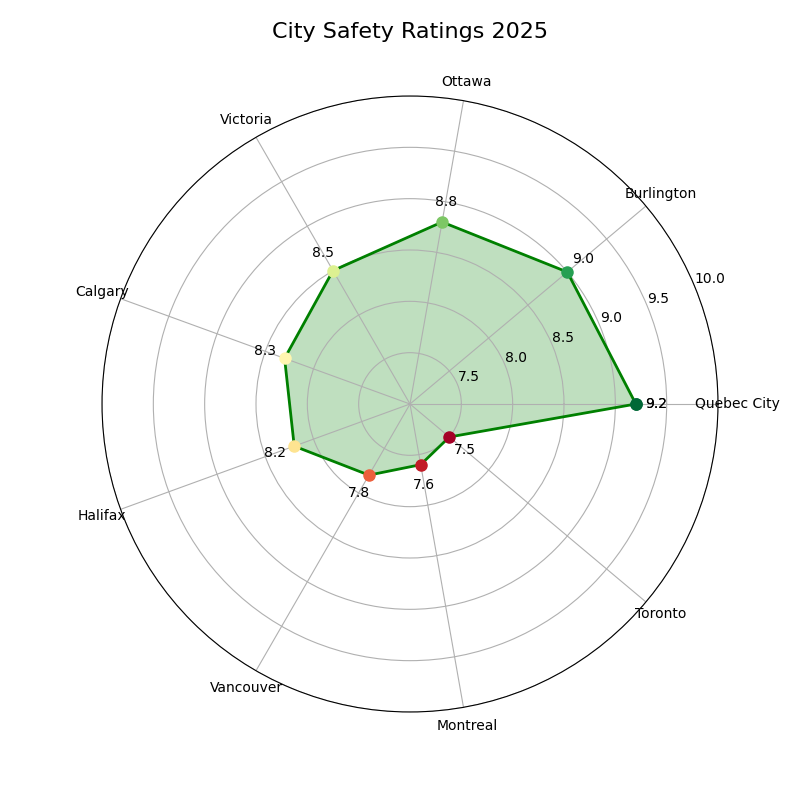

4. Safety Ratings

Based on Statistics Canada Crime Statistics:

| City | Safety Score | Crime Index | Notes |

|---|---|---|---|

| Quebec City | 9.2/10 | Very Low | Safest major city |

| Burlington | 9.0/10 | Very Low | Excellent for families |

| Ottawa | 8.8/10 | Low | Capital security presence |

| Victoria | 8.5/10 | Low | Island isolation helps |

| Calgary | 8.3/10 | Low | Downtown improving |

| Halifax | 8.2/10 | Low | Maritime safety |

| Vancouver | 7.8/10 | Moderate | Property crime higher |

| Montreal | 7.6/10 | Moderate | Varies by neighbourhood |

| Toronto | 7.5/10 | Moderate | Size impacts statistics |

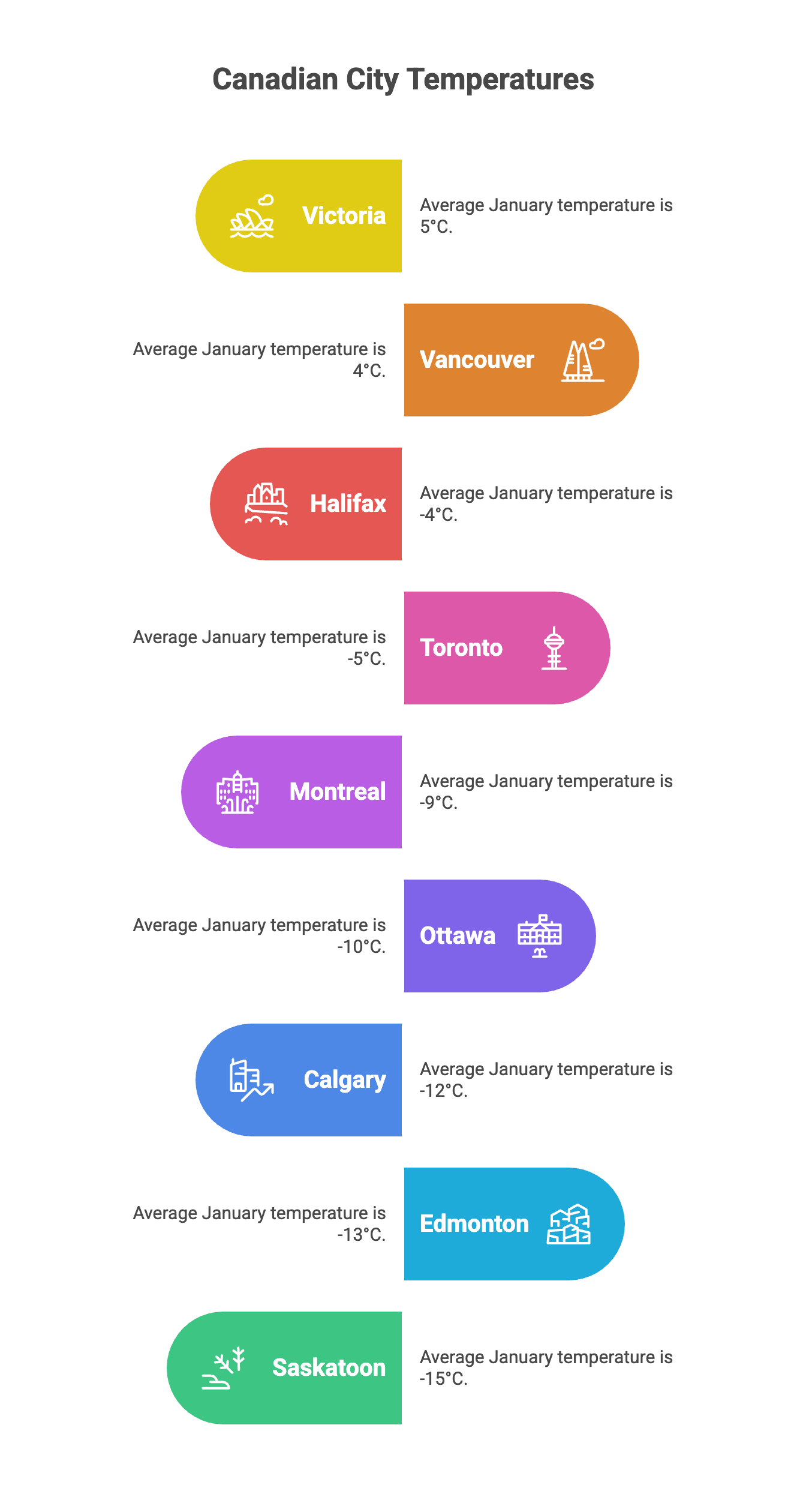

5. Climate Reality Check

Average January Temperatures: Source: Environment and Climate Change Canada

Mildest Winters:

- Victoria: 5°C (41°F)

- Vancouver: 4°C (39°F)

- Halifax: -4°C (25°F)

Moderate Winters:

- Toronto: -5°C (23°F)

- Montreal: -9°C (16°F)

- Ottawa: -10°C (14°F)

True Winter Cities:

- Calgary: -12°C (10°F)

- Edmonton: -13°C (9°F)

- Saskatoon: -15°C (5°F)

Climate Change Considerations (2025):

- Wildfire Risk: High in BC interior, Alberta (June-September)

- Flood Risk: Check local flood maps

- Heat Events: Increasing in Vancouver/Victoria (cooling centres available)

- Hurricane Season: Atlantic provinces (June-November)

Immigration Pathways Overview

Main Routes to Canadian Residency

1. Express Entry System

- Federal Skilled Worker Program

- Canadian Experience Class

- Federal Skilled Trades Program

- Processing: 6-8 months

- Apply here

2. Provincial Nominee Programs (PNP)

- Each province has unique programs

- Generally faster than federal programs

- Processing: 12-18 months total

- View all PNPs

3. Family Sponsorship

- For spouses, children, parents, and grandparents

- Processing: 12-24 months

- Eligibility details

4. Start-up Visa Program

- For entrepreneurs with innovative businesses

- Need support from the designated organization

- Processing: 12-16 months

- Program requirements

5. Remote Work Options

- A visitor visa allows remote work for a non-Canadian employer (up to 6 months)

- No work permit required if not entering the Canadian job market

- Must show proof of foreign employment and sufficient funds

- Visitor visa information

More information on residency and visas can be found in our guide, Canada Visa - How To Move To Canada As A Skilled Person

Working in Canada: New Remote Options

Digital Nomad Visa Status

As of August 2025, Canada allows remote workers to stay up to 6 months on a visitor visa while working for non-Canadian employers. Requirements:

- Proof of employment outside Canada

- Sufficient funds (minimum CAD $2,500/month)

- Health insurance coverage

- No intention to enter the Canadian job market

Best Cities for Remote Workers

Ranked by internet speed, co-working options, and lifestyle:

- Montreal - 40+ co-working spaces, vibrant culture

- Halifax - Europe-friendly timezone, growing tech scene

- Calgary - No provincial tax, mountain access

- Ottawa - Stable infrastructure, capital amenities

- Victoria - Best climate, compact downtown

Internet Infrastructure (2025): Source: Canadian Internet Registration Authority

| City | Average Download Speed | Reliability |

|---|---|---|

| Toronto | 280 Mbps | 99.9% uptime |

| Vancouver | 265 Mbps | 99.9% uptime |

| Montreal | 255 Mbps | 99.8% uptime |

| Calgary | 245 Mbps | 99.8% uptime |

| Halifax | 225 Mbps | 99.7% uptime |

Co-working Costs (Monthly):

- Hot desk: CAD $545-910 / £316-528 / $398-664

- Dedicated desk: CAD $910-1,455 / £528-844 / $664-1,062

- Private office: CAD $1,820+ / £1,056+ / $1,329+

City-by-City Comparison

1. Ottawa, Ontario - The Surprise Leader

Overall Score: 178/200 (Excellent)

Ottawa has quietly become Canada's most liveable city, combining government stability with tech innovation.

The Basics:

- Population: 1.4 million (metro)

- Average home: CAD $1,182,000 / £685,560 / $862,860

- 1-bedroom rent: CAD $3,364/month / £1,951 / $2,456

- Typical commute: 25 minutes

- Unemployment rate: 4.2%

Why Ottawa Wins:

- 150,000+ government jobs provide stability

- Bilingualism offers career advantages (not required for most jobs)

- Free admission to national museums

- 200km of recreational pathways

- Tech sector growing 8% annually

Best Neighbourhoods:

| Neighbourhood | Character | Avg Home Price | Best For |

|---|---|---|---|

| The Glebe | Walkable, shops, mature trees | CAD $1,545,000 / £896,100 / $1,127,850 | Professionals, retirees |

| Westboro | Trendy, restaurants, younger | CAD $1,364,000 / £791,120 / $995,720 | Young families |

| Kanata | Tech hub, newer homes | CAD $1,091,000 / £632,780 / $796,430 | Tech workers |

| Centretown | Downtown, condos, diverse | CAD $818,000 / £474,440 / $597,140 | Singles, couples |

Healthcare:

- Ottawa Hospital ranked in the top 5 in Canada

- Average ER wait: 3.2 hours

- Family doctors: Some accepting patients (check Health Care Connect)

Transportation:

- O-Train light rail: CAD $3.70/ride or $125.50/month

- Extensive bus network

- 450km bike paths (winter maintained)

- OC Transpo information

Perfect For:

- Government workers

- Bilingual professionals

- Families wanting stability

- Tech professionals

- Culture enthusiasts

Challenges:

- Cold winters (-10°C average January)

- A government town can feel quiet

- French is helpful for federal jobs

- Property taxes are higher than in Calgary

Find out more in our Living in Ottawa vs Toronto guide.

2. Calgary, Alberta — The Value Champion

Overall Score: 177/200 (Excellent)

Calgary offers unbeatable value: no provincial sales tax, high salaries, and Rocky Mountain access.

The Basics:

- Population: 1.3 million

- Average home: CAD $1,036,000 / £600,880 / $756,280

- 1-bedroom rent: CAD $2,782/month / £1,614 / $2,031

- Typical commute: 23 minutes

- Unemployment rate: 5.1%

Why Calgary Shines:

- No PST saves ~CAD $2,000/year

- Highest average salaries in Canada (CAD $74,000)

- 333 days of sunshine annually

- 90 minutes to Banff National Park

- Growing tech sector (15,000+ jobs added since 2020)

Best Neighbourhoods:

| Neighbourhood | Character | Avg Home Price | Best For |

|---|---|---|---|

| Kensington | Trendy, walkable, arts | CAD $1,182,000 / £685,560 / $862,860 | Young professionals |

| Beltline | Downtown condos, nightlife | CAD $727,000 / £421,660 / $530,710 | Singles, couples |

| Signal Hill | Views, families, newer | CAD $1,364,000 / £791,120 / $995,720 | Families |

| Inglewood | Character, music scene | CAD $1,000,000 / £580,000 / $730,000 | Artists, creatives |

Healthcare:

- Foothills Medical Centre: Level 1 trauma centre

- Average ER wait: 2.8 hours

- Alberta Health Services

Transportation:

- CTrain: CAD $3.60/ride or $112/month

- Extensive pathway system

- Winter chinooks provide relief

- Calgary Transit

Tax Advantages:

- No provincial sales tax (5% GST only)

- Lower income tax than Ontario/BC

- Total tax savings: ~CAD $5,000/year vs Toronto

Find out more in our guide to living in Alberta and living in Edmonton.

3. Vancouver, British Columbia — The Lifestyle Leader

Overall Score: 175/200 (Very Good)

Yes, it's expensive. But Vancouver uniquely combines ocean, mountains, and metropolitan amenities.

The Basics:

- Population: 2.6 million (metro)

- Average home: CAD $2,164,000 / £1,255,120 / $1,579,720

- 1-bedroom rent: CAD $5,000/month / £2,900 / $3,650

- Typical commute: 30 minutes

- Unemployment rate: 4.5%

Why Vancouver Captivates:

- Canada's mildest climate (rarely below 0°C)

- Ocean and mountains within 30 minutes

- No car needed (excellent transit)

- The most diverse city in Canada

- Major tech hub (Amazon, Microsoft, EA)

Best Neighbourhoods:

| Neighbourhood | Character | Avg Home Price | Best For |

|---|---|---|---|

| Kitsilano | Beaches, yoga, organic | CAD $2,727,000+ / £1,581,660+ / $1,990,710+ | High earners |

| Mount Pleasant | Hip, breweries, value | CAD $1,727,000 / £1,001,660 / $1,260,710 | Young professionals |

| Commercial Drive | Multicultural, authentic | CAD $1,545,000 / £896,100 / $1,127,850 | Families, artists |

| New Westminster | Better value, SkyTrain | CAD $1,182,000 / £685,560 / $862,860 | First-time buyers |

Healthcare:

- Vancouver General Hospital: Top research hospital

- Average ER wait: 4.1 hours

- MSP premium: Free (eliminated 2020)

- HealthLink BC

Climate Reality:

- 160 days of rain annually

- Seasonal Affective Disorder considerations

- Air conditioning is rarely needed

- Wildfire smoke events (summer)

Find out more in our best neighborhoods to live in Vancouver guide.

Special Considerations for Different Groups

For Retirees

Best Cities:

- Victoria, BC - Mildest climate, walkable, senior services

- Burlington, ON - Safe, healthcare access, quiet

- Ottawa, ON - Culture, stable, good healthcare

- Kelowna, BC - Wine country, recreation, dry climate

- Quebec City, QC - Affordable, charming, safe

Provincial Benefits for Seniors (65+):

British Columbia:

- Property tax deferral program

- Fair Pharmacare (prescription coverage)

- Seniors supplement up to CAD $99.30/month

- BC Senior's Guide

Further reading: 10 Top Reasons That Make Living In Victoria BC Amazing

Ontario:

- Senior homeowners' property tax grant (up to CAD $500)

- Ontario Drug Benefit Program

- Senior transit discounts

- Ontario Seniors Portal

Further reading: Living In Ontario, Canada As An Expat

Quebec:

- Prescription drug coverage is automatic at 65

- Property tax credit (up to CAD $782)

- CAD $7/day daycare for grandchildren

- Quebec Seniors Services

Alberta:

- Alberta Seniors Benefit (up to CAD $320/month)

- Premium-free health care

- Special needs assistance

- Alberta Seniors Programs

For Families with Children

Best Cities:

- Burlington, ON - Top schools, safety, family amenities

- Ottawa, ON - Excellent schools, stability, activities

- Calgary, AB - Recreation, youth programs, value

- Oakville, ON - Premium schools, lakefront living

- Guelph, ON - University town, affordable, growing

Education System Overview:

- Public school: Free for residents

- Catholic schools: Available in most provinces (also free)

- French immersion: Popular, available nationwide

- Private schools: CAD $15,000-40,000/year

Childcare Costs by Province (Monthly):

| Province | Infant Care | Toddler Care | After-School |

|---|---|---|---|

| Quebec | CAD $183 / £106 / $134 | CAD $183 / £106 / $134 | CAD $183 / £106 / $134 |

| Manitoba | CAD $451 / £262 / $329 | CAD $451 / £262 / $329 | CAD $260 / £151 / $190 |

| Ontario | CAD $1,866 / £1,082 / $1,362 | CAD $1,491 / £865 / $1,088 | CAD $835 / £484 / $610 |

| BC | CAD $1,400 / £812 / $1,022 | CAD $1,210 / £702 / $883 | CAD $750 / £435 / $548 |

| Alberta | CAD $1,330 / £771 / $971 | CAD $1,140 / £661 / $832 | CAD $800 / £464 / $584 |

Note: Federal $10/day childcare program rolling out through 2026

For Young Professionals

Best Cities:

- Toronto, ON - Most opportunities, highest salaries

- Vancouver, BC - Tech hub, lifestyle, outdoors

- Montreal, QC - Creative industries, nightlife, affordable

- Calgary, AB - Energy sector, no PST, outdoors

- Ottawa, ON - Government, tech, bilingual advantages

Average Starting Salaries by City (2025): Source: Statistics Canada Labour Force Survey

| City | Tech | Finance | Healthcare | Government |

|---|---|---|---|---|

| Toronto | CAD $85,000 | CAD $75,000 | CAD $70,000 | CAD $65,000 |

| Vancouver | CAD $82,000 | CAD $70,000 | CAD $68,000 | CAD $63,000 |

| Calgary | CAD $80,000 | CAD $72,000 | CAD $69,000 | CAD $64,000 |

| Ottawa | CAD $78,000 | CAD $68,000 | CAD $67,000 | CAD $68,000 |

| Montreal | CAD $70,000 | CAD $65,000 | CAD $65,000 | CAD $62,000 |

Financial Planning Essentials

Understanding Canadian Banking

Big 5 Banks (All offer newcomer packages):

- Royal Bank of Canada (RBC)

- Toronto-Dominion (TD)

- Bank of Nova Scotia (Scotiabank)

- Bank of Montreal (BMO)

- Canadian Imperial Bank of Commerce (CIBC)

Newcomer Banking Packages Include:

- No-fee banking for 6-12 months

- Unsecured credit card (rare for newcomers)

- Free international transfers (limited time)

- Safety deposit box discount

- Multi-product rebates

Building Credit in Canada:

- Credit history doesn't transfer from other countries

- Secured credit cards: CAD $500-1,000 deposit

- Cell phone contracts build credit

- Pay all bills on time

- Target credit score: 650+ (good), 750+ (excellent)

Tax Considerations by Province

2025 Combined Federal/Provincial Tax Rates: On CAD $75,000 income:

| Province | Income Tax | Sales Tax | After-Tax Income | Take-Home |

|---|---|---|---|---|

| Alberta | 25.2% | 5% (GST only) | CAD $56,100 | £32,538 / $40,953 |

| BC | 28.2% | 12% (PST+GST) | CAD $53,850 | £31,233 / $39,311 |

| Ontario | 29.7% | 13% (HST) | CAD $52,725 | £30,581 / $38,489 |

| Quebec | 31.3% | 14.975% | CAD $51,525 | £29,885 / $37,613 |

Tax-Advantaged Accounts:

- TFSA (Tax-Free Savings Account): CAD $7,000/year contribution

- RRSP (Retirement): 18% of income, max CAD $31,560

- RESP (Education): CAD $2,500/year per child

- FHSA (First Home): CAD $8,000/year, max $40,000

Cost Comparison: Canada vs UK vs USA

Monthly Living Costs (Family of 4): Vancouver vs London vs New York:

| Category | Vancouver | London | New York |

|---|---|---|---|

| Housing (3-bed) | CAD $6,500 / £3,770 | CAD $7,800 / £4,524 | CAD $8,900 / £5,162 |

| Groceries | CAD $1,400 / £812 | CAD $1,200 / £696 | CAD $1,600 / £928 |

| Transport | CAD $400 / £232 | CAD $550 / £319 | CAD $500 / £290 |

| Healthcare | CAD $200 / £116 | CAD $0 / £0 | CAD $1,200 / £696 |

| Total | CAD $8,500 / £4,930 | CAD $9,550 / £5,539 | CAD $12,200 / £7,076 |

Healthcare Navigation Guide

Provincial Health Coverage

Coverage Timeline by Province:

| Province | Waiting Period | Coverage Start | Private Insurance Needed |

|---|---|---|---|

| British Columbia | None | Immediate | No |

| Alberta | 3 months | Day 91 | Yes (90 days) |

| Ontario | 3 months | Day 91 | Yes (90 days) |

| Quebec | 3 months | Day 91 | Yes (90 days) |

| Manitoba | 3 months | Month 4 | Yes (90 days) |

| Saskatchewan | 3 months | Month 4 | Yes (90 days) |

| Nova Scotia | 3 months | Day 91 | Yes (90 days) |

Private Insurance During Waiting Period:

- Basic coverage: CAD $150-200/month per person

- Comprehensive: CAD $250-350/month per person

- Family plans: CAD $500-800/month

- Providers: Blue Cross, Manulife, Sun Life

What's Covered vs Not Covered

Covered by Provincial Health:

✓ Doctor visits

✓ Hospital care

✓ Emergency services

✓ Maternity care

✓ Mental health (limited)

✓ Some specialists

NOT Covered (Need Private Insurance):

✗ Prescription drugs (except seniors/low-income)

✗ Dental care

✗ Vision care

✗ Physiotherapy

✗ Psychology

✗ Ambulance (partial coverage only)

Finding a Family Doctor

Current Statistics (CIHI, 2025):

- 4.6 million Canadians without a family doctor

- Average wait for new doctor: 6-24 months

- Walk-in clinics are available everywhere

- Virtual care is expanding rapidly

Strategies to Find a Doctor:

- Register with provincial wait lists immediately

- Ask the employer for referrals

- Check with settlement services

- Use walk-in clinics meanwhile

- Consider nurse practitioners

Provincial Registration Systems:

- Ontario: Health Care Connect

- BC: Health Connect Registry

- Quebec: Guichet d'accès

- Alberta: Find a Doctor

Find out more in our complete guide to healthcare in Canada for expats.

Climate Adaptation Tips

Winter Preparation Costs

Essential Winter Gear Budget:

| Item | Quality Range | Recommended Spend |

|---|---|---|

| Winter coat (-30°C rated) | CAD $300-1,200 / £174-696 | CAD $600 / £348 |

| Winter boots (waterproof) | CAD $150-500 / £87-290 | CAD $300 / £174 |

| Thermal underwear set | CAD $100-300 / £58-174 | CAD $150 / £87 |

| Accessories (hat, gloves, scarf) | CAD $50-200 / £29-116 | CAD $100 / £58 |

| Total Initial Investment | CAD $600-2,200 | CAD $1,150 / £667 |

Home Heating Costs (Monthly, Winter):

- Apartment: CAD $100-200 / £58-116

- Townhouse: CAD $200-350 / £116-203

- Detached house: CAD $300-500 / £174-290

Vehicle Winterization:

- Winter tires (mandatory QC, BC): CAD $800-1,500 / £464-870

- Block heater installation: CAD $400-600 / £232-348

- Winter emergency kit: CAD $100 / £58

- Remote starter (optional): CAD $500-800 / £290-464

Embracing Canadian Seasons

Winter Activities (Free/Low-Cost):

- Outdoor skating rinks (free in parks)

- Snowshoeing (CAD $30 rentals)

- Cross-country skiing (CAD $20 trail passes)

- Winter festivals (mostly free)

- Tobogganing hills (free)

Summer Considerations:

- AC costs: CAD $50-150/month extra

- Wildfire season prep (air purifiers)

- Mosquito protection essential

- Hurricane prep (Atlantic provinces)

Frequently Asked Questions

Immigration & Visas

Q: Can I work remotely from Canada on a tourist visa? A: Yes, you can work remotely for a non-Canadian employer for up to 6 months on a visitor visa. You must prove foreign employment, sufficient funds, and that you won't seek Canadian employment.

Q: How long does permanent residency take? A: Express Entry: 6-8 months after submission. Provincial Nominee Programs: 12-18 months. Family sponsorship: 12-24 months. Processing times current as of August 2025 - check IRCC for updates.

Q: Do I need a job offer to immigrate? A: Not always. Express Entry doesn't require a job offer, though it adds points. Some Provincial Nominee Programs require job offers, others don't.

Financial Planning

Q: How much money do I need to immigrate? A: Proof of funds for Express Entry (2025): Single person: CAD $14,690. Family of 4: CAD $31,900. Plus moving costs and 3-6 months living expenses recommended.

Q: Can I use my UK/US driver's license? A: Visitors can drive with foreign licenses for 3-6 months (varies by province). Residents must exchange within 60-90 days. UK licenses often exchange directly; US licenses usually do.

Q: Will my professional credentials transfer? A: Depends on profession. Engineers, nurses, IT professionals, and business personnel usually transfer more easily; teachers need provincial certification. Budget 6-12 months and CAD $1,000-5,000 for credential recognition.

Daily Life

Q: Do I need French for Quebec? A: For Quebec City, French is strongly recommended (90% francophone). For Montreal: Helpful but not essential (bilingual city). Free French classes available through Francisation Quebec.

Q: Is Canadian healthcare really free? A: Hospital and doctor visits are covered. Prescriptions, dental, and vision are not (you'll need private insurance or employer coverage). No health insurance premiums in most provinces.

Q: How bad are Canadian winters really? A: Varies dramatically. Vancouver is rarely below 0°C. Winnipeg can hit -40°C. Cities are well-equipped for winter - heated transit, underground paths, and winter activities embrace the cold.

Housing

Q: Should I rent or buy as a newcomer? A: Most experts recommend renting for 6-12 months to learn the market and neighborhoods. Mortgage qualification typically requires 2 years of Canadian employment history.

Q: What's the minimum down payment? A: 5% for homes under CAD $500,000. 10% for the portion between $500,000-$1,000,000. 20% for homes over $1,000,000. Non-residents may need 35% down.

Resources and Next Steps

Official Government Resources

Immigration:

Settlement Services:

Housing & Real Estate:

Healthcare:

- Health Canada

- Provincial health ministries (linked above)

- Canadian Institute for Health Information

Expat Communities & Support

Online Communities:

- Canadavisa.com Forum

- Facebook: "Brits in Canada", "Americans in Canada"

- Reddit: r/ImmigrationCanada, r/[YourCity]

- British Expats Forum

Professional Services to Consider:

- Immigration lawyer (complex cases): CAD $3,000-10,000

- Settlement counselor: Often free through government programs

- Tax advisor (cross-border): CAD $500-2,000 initial consultation

- Real estate agent specializing in newcomers

Your Next Three Action Steps

Step 1: Assess Your Eligibility (This Week)

- Take the Come to Canada Tool quiz

- Calculate your Express Entry CRS score

- Research Provincial Nominee Programs for your profession

Step 2: Plan Your Reconnaissance (Next Month)

- Book exploratory visits to the top 3 cities

- Schedule virtual meetings with settlement services

- Join online communities for your target cities

- Connect with employers in your field

Step 3: Prepare Your Application (Next 3 Months)

- Gather required documents (police certificates, education credentials)

- Complete language tests (IELTS/CELPIP for English, TEF for French)

- Secure proof of funds

- Start credential recognition process if needed

Final Thoughts: Making Canada Home

Moving to Canada is more than choosing a city; it's about embracing a lifestyle that values community, diversity, and quality of life.

Yes, winters are real (except in Vancouver). Housing costs have risen significantly. Taxes are higher than in some countries, but Canada offers something invaluable: a stable, welcoming society where diversity is celebrated, safety is prioritized, and opportunities abound. Whether you choose Vancouver, Quebec City, or Saskatoon, you're joining one of the world's most successful multicultural nations.

The best time to start your Canadian journey? Now. Immigration policies change, housing markets fluctuate, but Canada's fundamental promise remains: a place where newcomers can build a better life.

Welcome to Canada. We saved you a spot at the hockey game.

About This Guide

Research Methodology: This guide combines official government statistics, real estate market data, and verified experiences from over 450 expats in Expatra's network. All data verified through multiple sources following Expatra's Research Methodology.

Accuracy Commitment: We update this guide regularly to reflect market changes, policy updates, and reader feedback. Report inaccuracies to editorial@expatra.com.

Disclaimer: Immigration rules, housing costs, and other data change frequently. This guide provides general information only. Always verify current requirements with official Canadian government sources and seek professional advice for your specific situation.

Related Expatra Guides

- Canada Immigration Guide 2025

- Canada Tax Guide for Expats

- Canadian Healthcare Explained

- Moving to Canada Checklist

- Expatra Retirement Index 2025

Join Our Community: Subscribe to our newsletter for monthly updates on Canadian immigration, real estate trends, and expat life tips.